Biases are inherent to human thinking, and traders are not immune to it. Not only can biases affect what trading decisions one makes but also how one analyzes the market conditions. In this article, we take a look at the importance of understanding biases, how they affect our judgment, and how one can use them when formulating trading decisions.

Biases and their role in trading

Trading bias is an inclination or outlook that a trader may have about the markets based on which s/he may believe that there is a higher probability of a specific outcome compared to any other possibilities. In forex trading, being bearish or bullish is a form of bias.

It is normal to have biases especially when technical and fundamental factors support them. However, what’s even more important is whether or not the market confirms those biases before you act on them. Predicting currencies blindly without taking into consideration the dynamic market environment and the changing market behavior can be devastating for one’s trading.

But, biases are required for a trader to develop trading decisions that align with his/her trading strategies. The ultimate goal is to make sound decisions with actual money. Sifting through the innumerable sources of information to make decisions can become overwhelming, which may lead to errors without a healthy bias.

However, coupled with this should be the ability to recognize the market environment and trading signals to keep trades from making a loss and grab the opportunities to further the profits. At the same time, there is no particular strategy or set of trading signals that are always effective; if that were so, everyone would be a successful trader.

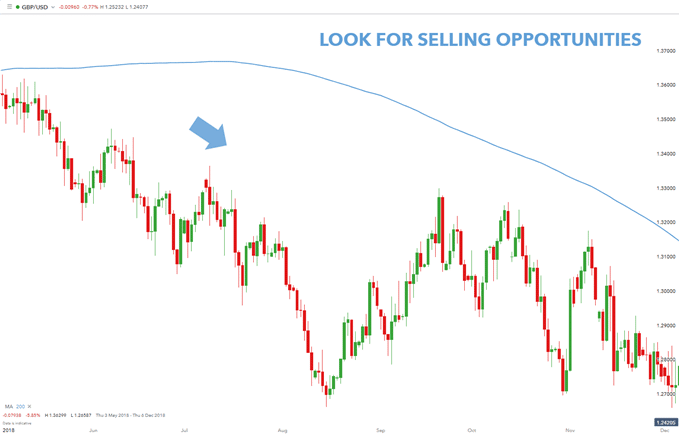

For instance, a bearish trading bias may look like this:

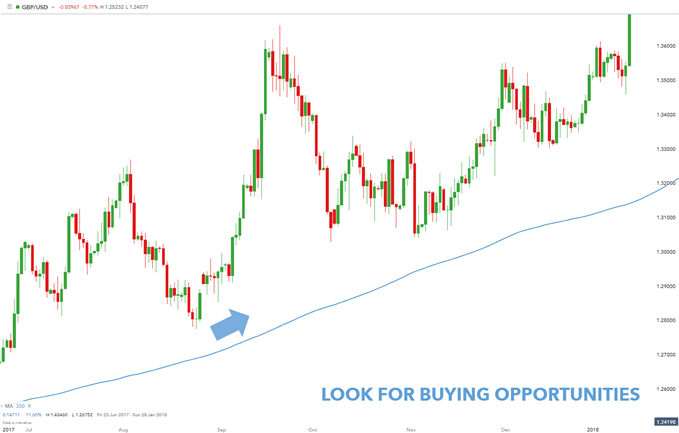

And, a bullish trading bias may look like this:

Note that in both these cases, we are making use of technical indicators and only then interpreting it through our bias.

Trading system biases

Personal interpretation of economic data is essential to develop a trading system. Without shunning the potential effectiveness of automated trading and trading signals, the intuition of a trader and the ability to look ‘beyond the numbers’ will mark the difference between a successful and an unsuccessful forex trader.

New traders don’t have the experience, confidence, or ability to control positive outcomes and end up frozen with indecision. As such, they let other things guide their emotions that can lead to devastating results.

In order to develop their perceptions, many new traders tend to rely only on outcomes. The chief problem with outcomes is that though they may have been profitable, they do not cut down on the long-term risk. That is why traders should determine their trading bias depending on the following components:

- What market to trade

- The size of the trade

- What direction to trade

- When to get in

- When to get out

But, sometimes, biases end up negatively, thus impacting how one trades. This can affect how a trader develops, tests, and trades his/her system. Some of the biases that expose a trader to losses include the following:

- Overconfidence bias – ‘I know where the market will go’

- Anchoring bias – ‘If this, then that’

- Confirmation bias – ‘This proves that I was right’

- Loss aversion bias – ‘I hope that the price will revert’

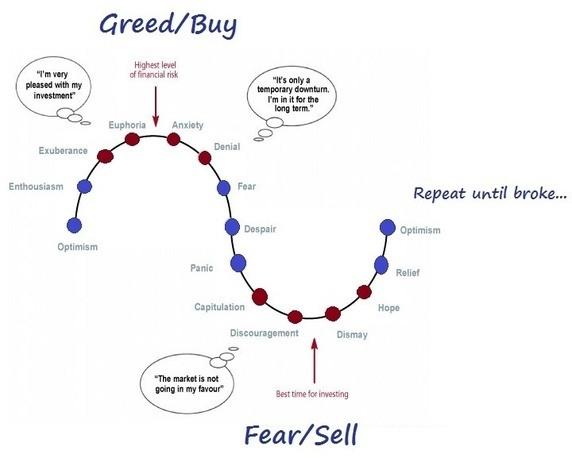

All these biases have a few things in common – fear, greed, and excitement. Traders who give in to these feelings end up creating psychological barriers for themselves that keep them from seeing the real picture. No one wants to lose but it is a part of forex trades and no amount of biases or predictions are ever going to influence how the markets change.

Dealing with your biases

All traders have biases, for that is a human trait. But, when one is in the field of forex trading, it is important to identify what biases one is guilty of and how to avoid them from interfering with the decisions one takes. While you are identifying which one of these biases applies to you, it is essential to consider that biases in themselves aren’t inherently bad. They have their utility as well. That is why how one goes about correcting one’s fundamental biases is also an important skill.

Let’s take a look at some of the most widespread biases amongst forex traders.

Recency Bias

This bias involves placing too much importance on events that happened recently and in turn losing sight of the bigger picture. It isn’t only involved in making trading decisions but also in how one analyzes the markets.

In order to correct this bias, give yourself time to take a step back and observe the long-term situation of the trade. Do not let the big picture get lost in the welter of information that you are dealing with.

Herding Bias

Traders, especially novice traders, have a tendency to make the trade that is being backed by other traders. This bias keeps one from being confident in one’s own analysis and instead forces one to follow the majority.

Though it may keep one from making utterly disastrous trades at times, it can also keep one from making potentially profitable trades, especially when one has assessed the market to a T. If you have enough reason to believe that the markets are headed for a turn, there is no need to go with the flow.

Attribution Bias

This bias occurs when people are determining what or who was responsible for a particular outcome. People tend to attribute their success to their skills and failures to external factors, such as the market’s unpredictability or a slow internet connection.

According to psychologists and veteran traders, this bias can only be corrected by keeping a trade journal. A trade journal allows traders to list their trades, the things that went right or wrong, what one expected, and what one got. Through such an assessment, traders can understand their strengths and weaknesses and become mindful of their trading practices.

Conclusion

Though biases are seen as psychological barriers that come in the way of good decision making, in reality, they only actually allow one to interpret the data in a certain way. One cannot only use biases to make trading decisions, no more than one can use only technical indicators.

One has to be fully aware of the biases that one utilizes in making such interpretations. Only a careful mixture of the two, one’s biases and an objective interpretation of market signals, can allow a trader to become successful in the long run.

Leave a Reply