Source: Bloomberg

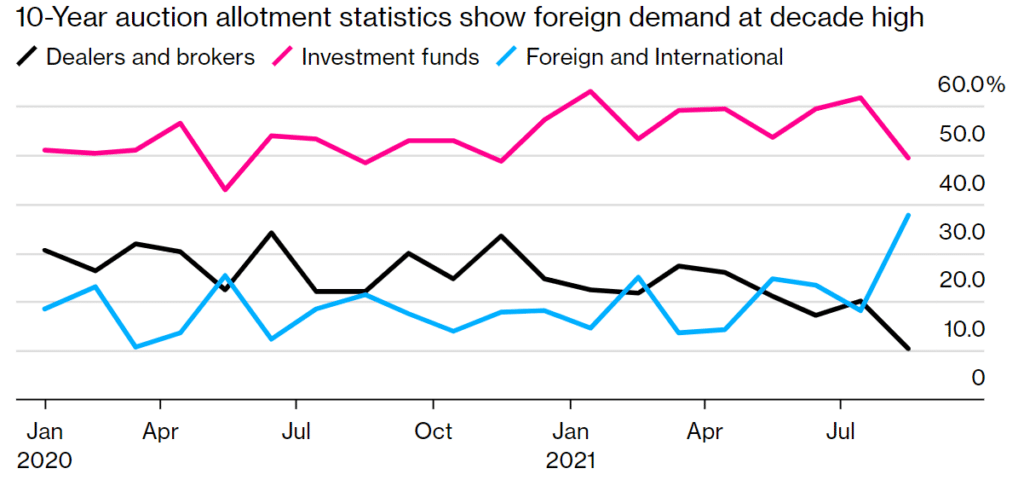

Global funds received $15.4 billion of the total $41 billion 10-year Treasury notes sold in August, representing a more than a decade record 38% share. US 10 Year Treasury Yield is currently 1.292%.

- The increased sales of treasury notes have been linked to central banks’ persistent bidding as they reallocated their forex reserves as Treasury bills fell short of supply.

- Analysts also link the sales to Chinese demand as its currency reserves rose to the highest in over five years in July.

- Fed’s repo facility has also been viewed as a possible driver of the uptick in Treasury note sales.

- Market participants are now keen on a similar pattern of foreign central bank demand via the indirect auction allotment.

- The 10-year Treasury sales were offered at a 1.34% rate, at least three basis points below the prevailing yields, the biggest premium in 9 years.

Leave a Reply