Introduction

Would you mind wandering back to your first income? Do you remember how many Whoppers the money could buy?

It may not be easy to remember because not all of our shops at Burger King. Depending on how far back we are talking about, your income has probably grown. Hence it can buy more Whoppers. Still, let us, for a moment, think of someone who just earned his first income, which is perhaps higher than what you earned. Even then, there is a big chance that a person’s income cannot buy as many Whoppers as yours could.

The example above is a simplistic explanation of inflation, which is the price growth of goods and services over time. Inflation is all around us, and consumers understand it better than any other economic concept. We are all at peace with the fact that hamburgers will get more expensive as we grow older.

Nevertheless, that is not always true. Though rare, certain conditions in the economy lead to negative growth of prices, often called deflation.

Defining and Explaining Deflation

Deflation is an economic phenomenon where prices of goods and services fall, also called negative inflation. Economists consider negative inflation more dangerous than positive inflation because falling prices can quickly become self-sustaining, making it impossibly difficult for any intervention to work.

Although deflation leads to an increase in the purchasing power of a currency, this increased purchasing power may not help the economy if the aggregate demand/aggregate supply is low. Interesting, right? Let us consider the illustration below for a better understanding.

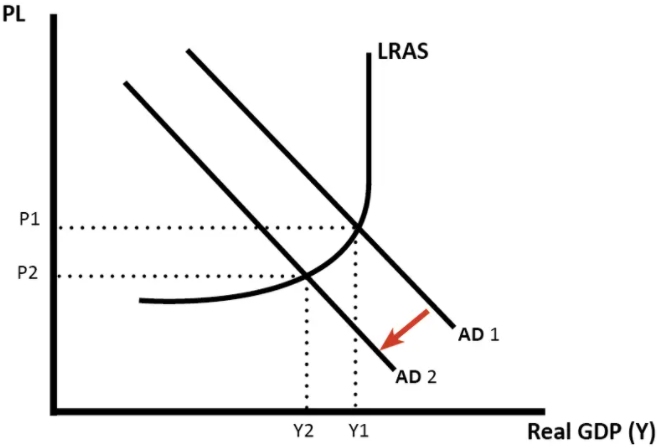

According to Economics 101, the aggregate demand (AD) curve and the aggregate supply (AS) curves meet at the point of equilibrium. At this point, there is a balance in the economy’s forces of demand and supply. In Figure 1, price P1 and Output Y1 result from balanced AD and AS.

Suddenly, a phenomenon such as the COVID-19 pandemic sets in. Governments encourage people to stay indoors and avoid physical contact, suddenly stopping economic activity. In the short term, the economy’s supply-side remains active as producers deplete their inventory (represented by the long-run aggregate supply (LRAS) curve.

Figure 1: Illustrating Deflation using AS-AD curve

But the sudden stop hits the demand side hard, leading to a shift from AD1 to AD2. The equilibrium point also shifts along the LRAS and settles at price P2 and output Y2. P2 is lower than P1, meaning the money’s purchasing power in the consumers’ pockets is higher. However, the consumers are not willing to spend their money and instead deposit it into a savings account.

The resulting lower demand disincentivizes supply, leading to a drop in real GDP from Y1 to Y2. This Y1 – Y2 difference is the quantity of deflation. In other words, we use the difference to quantify the impact of deflation on the economy.

How Deflation Affects the Economy

Anything that causes a drop in the output level of the economy is problematic. Deflation is not as expected as inflation, but its effects on the economy are more adverse, including:

- High unemployment rates. Lower prices are an integral feature of deflation. Producers will do everything possible to compensate for the decreased prices, including cutting wages and downsizing the workforce. As a result, aggregate demand declines further hence setting off a deflation spiral.

- Changes in consumer spending behavior: to combat deflation, governments are likely to cut interest rates to spur consumption. In effect, the economy will end up engorged with money in the long-run, setting off higher interest rates to control inflation. In a sense, combating deflation often increases debt’s real value. For this reason, consumers may defer spending to avoid punishing rates in the future.

- Lower investment rates. In deflation, cash is a significant asset because of the growing purchasing power of money. Declining economic activity lowers interest rates. Investors can earn from an investment, even declining lower than the growth rate of cash. Some investments turn volatile in a recession as central banks lower interest rates to jump-start demand. Eventually, investors withdraw their money from assets such as stocks, leading to a massive drop in the stock market.

Can you trade during Deflation?

Yes. Before we get into the details of how trading during deflation, let us see how to track it. As earlier discussed, deflation is a diametric opposite of inflation, meaning one can track this phenomenon the same way one tracks inflation. The consumer price index (CPI) provides a good view of the economy regarding deflation. CPI signifies the onset of deflation when it slides below 0%.

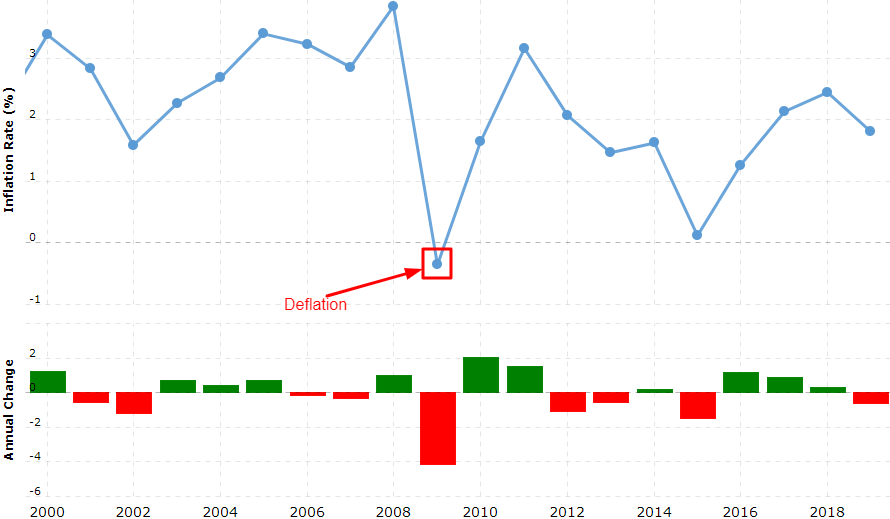

Deflations often happen during periods of great economic crises such as the Great Recession about a decade ago. During the period, US inflation raced past the zero-line to -0.36% in 2009 (marked in Figure 2).

Figure 2: US Inflation Rates (2000 – 2019)

Let say the US Federal Reserve deploys massive bond-buying programs and cuts interest rates to control the economic effects of COIVID-19. As a result, the Forex market experiences sharp increases in currency volatility due to a flood of greenbacks.

Monetary policies that aim to increase credit flow in an economy are expansionary. Such policies stimulate the growth of prices in the economy and weaken the purchasing power of the currency.

A longer-term consequence of the Fed’s actions is the decline of USD against major rivals, who are also vital trading partners. However, the Forex market volatility will become more violent if other major economies implement policies similar to the Fed. Major currency pairs will experience violent gyrations in value.

Conclusion

While you can trade during the deflation period, you must be aware of the intense volatility. Deflation often descends into a spiral because tanking prices touch off a chain reaction of production cuts, wage cuts, falling demand, and even more decreased prices. The spiral a significant challenge that might make forex trading untenable. However, expert traders adept at de-risking trading strategies have the best opportunity to generate income in this period.

Leave a Reply