The primary focus of DDMarkets is to offer trade signals for trading Forex, indices, commodities, cryptocurrencies and stocks. It is said that all the signals integrate an entry price, take profit, protective stop loss order, risk ratio and approximated duration based on the time frame the assessment was conducted. The vendor also provides other trading services including market research, trading analysis, and trading courses.

Detailed Forex signal provider review

DDMarkets normally generates the trading signals manually. A majority of these signals are based on a technical analysis. The professionals particularly find the instruments they want to focus on and then start analyzing many time frames to solidify prospective entries. After that, they highlight the trading strategy.

The next process is to reaffirm the entries and start computing risk ratio, estimated duration of potential drawdown and the probable basic triggers. The trade alert is instigated after the strategy is provided. The last step is to send daily updates to the trader through email indicating how the trade signal is performing till its closure.

The features of DDMarkets are:

- Support multiple currencies

- Easy to follow

- Compatible with all brokers

- Full email support

- Professional alerts

- Daily reports and updates on all open trades and on the market

- Uses longer time frames such as daily, weekly or monthly charts

- Focuses on leading cryptocurrencies like Bitcoin, Tether, Ripple, Ethereum, Dogecoin etc

This vendor is not transparent. The only thing they tell us is that they have been serving online traders since 2014 and their goal is to offer legitimate trading signals with extensive market analysis and strategies. They withhold information about their team, qualifications, achievements, contact details, address, physical location, history, etc.

DDMarkets strategy tests

The DDMarkets team states that it offers intraday and swing strategies. The former approach highlights the main price levels that may be utilized for many techniques like breakout or buy/sell on dips. These enable the trader to generate signals from the chart presented in the analysis.

However, the team does not take time to explain the swing method thoroughly. This greatly disadvantages potential traders. For this reason, they may experience challenges as they try to figure out what indicators this vendor looks out for and whether this method is effective or not. This may even lead them to lose interest and trust in this vendor and opt for dealers who have more transparent strategies.

There is no backtest data. We do not know why the professionals have not supplied the FX community with this data considering how important it is. They have reiterated severally on their site that they strive to be transparent and yet have failed to showcase results that highlight the workability of their strategies. This hypocritical behavior makes us doubt their credibility.

Live account trading results

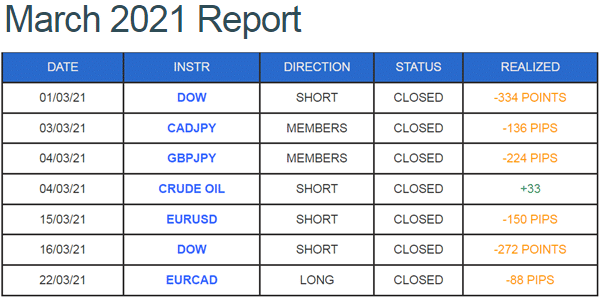

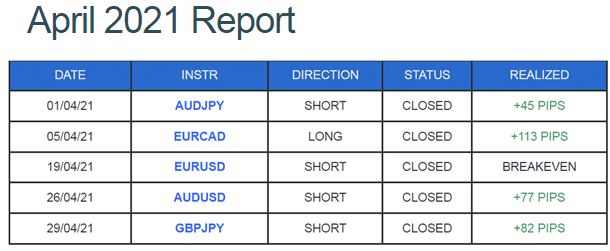

DDMarkets has provided various trading statistics highlighting the performance of their trading signals since 2014. Regrettably, this data has not been verified by third party sites like FXBlue, FXStat or Myfxbook.com. Therefore, its trustworthiness can easily be put into question. Nonetheless, we have decided to share and analyze some of the 2021 data.

A closer look at March statistics reveals that the account made a series of losses with all the trading instruments it worked with except one. Crude oil was the only profitable one. DOW (a stock index) made the most losses as it lost 334 points.

April was a winning month because all the currencies recorded significant profits. The EURCAD currency pair had the highest profits as evidenced by the 113 pips made.

Pricing

DDMarkets provides a variety of packages. We have noted that there is an assortment of distinct offers on the table. The initial option is the global trades alerts package which costs $59.90, $87.40, and $230.60 for the 14-day, 30-day and 90-day plans respectively. The second package is for intraday strategies. The 14-day and 30-day plans are priced at $49.70 and $74.40 respectively.

The third offer which is termed “Advanced Integration” is a combination of global trade alerts and intraday strategies. The vendor provides a 30-day plan at $138.70/month and a 90-day plan at $392.40 per quarter. Notably, a cryptocurrency investment plan is available as well. This is a 30-day offer that will cost the trader $71.50.

No money-back guarantee is mentioned. So, we believe it is non-existent.

Customer reviews

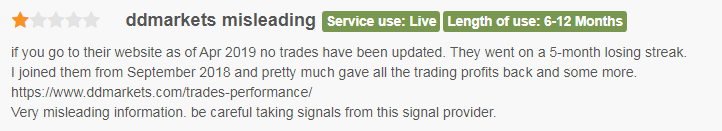

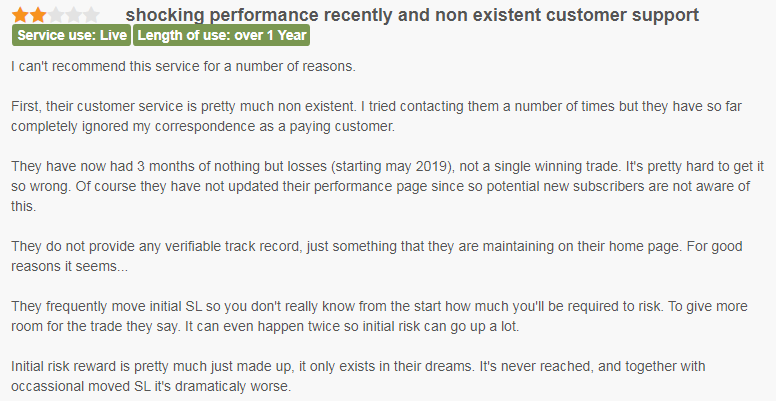

There are 4 mixed reviews for DDMarkets on the Forex Peace Army site. The vendor has been given a rating of 2.538 out of 5. The 2 disgruntled traders mainly complain about the losses they have incurred since subscribing to this vendor’s services. One of these clients also highlights the dealer’s poor customer service as his attempts to contact the support team yielded no fruits.

Traders should not trust DDMarkets. The developers have failed to disclose their real identities and, therefore, it would be risky and foolish to entrust your money to anonymous people.

Moreover, the trading results available are non-verified. Worse still, they are published in a table format. There is no way an analytical trader can confirm this data.

Leave a Reply