Never before has hedging gained prominence than at a time when the coronavirus pandemic appears to be triggering extreme levels of volatility in the capital markets. Retail traders, as well as institutional traders, have had to engage hedging strategies in a bid to protect their portfolios, given the wild swings in the markets. Whether in automated trading or manual trading, currency hedging has proved to be a reliable strategy of mitigating risks associated with wild forex currency exchange rate fluctuations.

What is Currency Hedging?

In its purest form, currency hedging is the opening of an additional position either manually or with the help of forex robots to protect against adverse movements in the forex market. The process involves buying and selling various forex products to offset or balance an already running position. In opening additional positions, traders or forex expert advisors reduce the risk of exposure.

Hedging is one of the strategies used by traders to limit the potential risks associated with various currency pairs, whether in position trading, swing trading, or news trading. The strategy finds great use when a trader or an FX Expert Advisor wants to protect a given investment portfolio from exchange rate fluctuations.

Forex Hedging Strategies

Simple Currency Hedging Strategy

The simple currency hedging strategy sees traders open additional positions whenever they think a forex pair is about to change course, in the short term, on a given trend due to an adverse event. For example, if a trader is long the EUR/USD and there is a significant news event on the way that could cause the pair to tank in price, a trader might opt to open a short position on the same currency pair to mitigate against any losses.

The new profit from such a strategy is usually zero. However, by opening a trade in the opposite direction, a trader would be able to protect their original position until the adverse event ends, triggering a trend reversal to the previous long-term trend.

By opening a second trade in the opposite direction, a trader would be able to profit on closing the opposite trade before the trend reverses once again.

Multiple Currency Hedging Strategy

Multiple Currency hedging is an advanced currency trading strategy leveraged by traders with vast experience in the financial markets. The strategy is especially popular with currency pairs that are positively correlated. In such a case, a trader would be able to take a position in both pairs but in the opposite direction in case of an adverse event in the forex market.

Assume you are long the EUR/USD currency pair on the belief that the Euro will continue to strengthen against the U.S dollar in the end. However, an adverse market event such as an economic release in the U.S causes the dollar to strengthen relative to the Euro.

In such a case, a trader might opt to enter a short position on the GBP/USD to benefit on the U.S dollar strengthening against the pound. Similarly, a trader would be able to protect the portfolio from losses incurred on the EUR/USD pair by profits gained on the GBP currency pair.

However, it is essential to note that hedging more than one currency pair exacerbates the risk that a portfolio is exposed to. If the hedging works as expected, then one stands to benefit. However, should the hedge fail to generate the desired results, the risk of incurring more losses on two positions is always high.

Forex Options Hedging

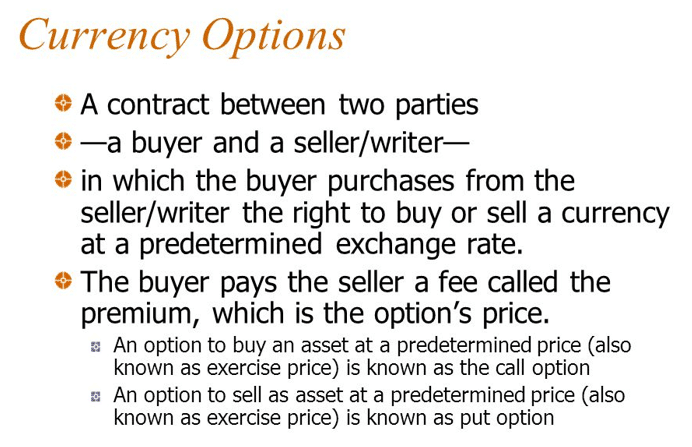

Options are important forex trading instruments used in hedging to mitigate against losses. Unlike, other securities, Options accords holders the right but no obligation to exchange currency pairs at a given price before expiry.

Assume you are long; EUR/USD has opened the position at $1.25. However, given developments in the U.S and Eurozone, it becomes clear that the pair is about to register a sharp decline. To protect your already opened position, you can trigger a hedge using options.

In this case, you can opt to hedge your risk by placing a put option at $1.20 with a one-month expiry. Should the price fall below the $1.20 level before expiry, you would have made a loss on your long position. However, your option would balance your exposure. Conversely, should the price rise above the $1.20 level, you could let the option expire, generate a profit on it, and only pay a premium.

Conclusion

Currency hedging is a popular trading strategy for limiting losses on already opened positions. The strategy is common with experienced traders, given the in-depth knowledge of financial markets required for a positive outcome. However, any trader can hedge a trader as long as they know the ideal entry and exit points to benefit from an added position.

Hedging in the forex market works best with major currency pairs given the correlation associated with such currencies. Similarly, major currencies offer more options for hedging strategies compared to minor currencies.

Leave a Reply