A grid trading strategy is a popular approach to participating in the financial market. It is popular among all asset classes, including cryptocurrencies, stocks, and forex. In this article, we will look at how the grid trading approach works and how it can be automated using robots.

What is a grid trading strategy?

A grid trading approach involves setting multiple limit buy and sell orders at certain points in an asset. When set at various places, the resulting figure has a close resemblance to a rectangle or triangle grid.

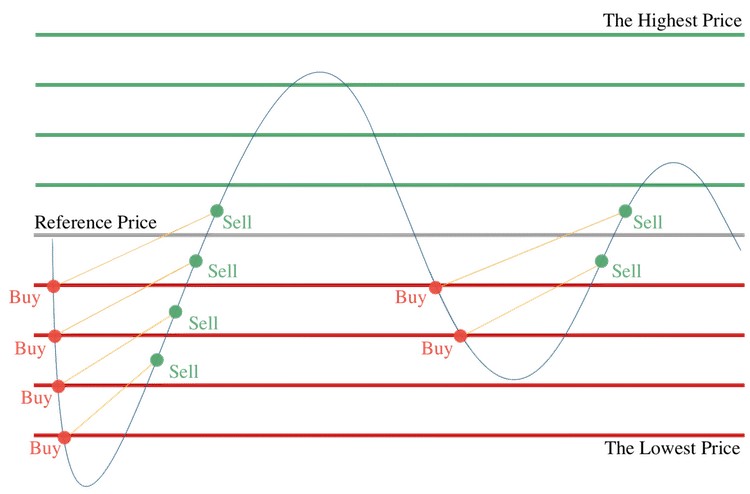

The idea behind the grid trading strategy is simple. A trader first identifies a reference level, which is usually the starting point of the trade. After this, they identify potential levels to buy the asset that is below the price. They also identify levels where potential sell orders can be placed. As such, in this grid, a sell order will be paired with a buy order. On the short side, every buy order is then paired with a sell order on the upper side.

Key concepts of a grid trading strategy

The grid approach is made up of several important concepts. First, there are pending orders. A pending order is where you direct an online broker to execute a trade at a pre-determined level. If the asset is trading at $10, you can place a buy-stop order that will be executed if the price moves to $11. In this case, the order will only be placed if this happens.

A sell-stop order, on the other hand, is where you direct the broker to short an asset when it reaches a certain level that is below the price. In this case, you could place a sell-stop order at $8.

There are other types of pending orders. A buy limit order is where you direct a broker to purchase an asset at a price that is lower than the present one. A sell limit, on the other hand, is where you direct the broker to place a short trade above the price. In a grid trading strategy, these four order types are very useful.

Other parts of the grid strategy

There are other parts that are important in a grid trading strategy. First, you need to select the reference price. Think of this as the pivot point of the financial asset that you are trading. This part is established by first identifying the overall performance of the asset. In most cases, the grid strategy works well in a period when an asset is going through substantial volatility. Then, select a potential middle point of the asset.

The next parts of the grid approach are the highest and lowest levels. You can identify these levels by looking at the asset prices and the highest and lowest points. Noting these points is so important because it will determine the number of grids that you will have in the trading approach.

It is important that you look at the fees charged by your broker. Ideally, you should not place the grids extremely close to one another. If these grids are very close, then the profit will not be able to cover the fees.

There is also a concept of take-profit and stop-loss. A stop-loss is a tool that will automatically stop the trade when it falls below a pre-determined level. A take-profit, on the other hand, stops the trade automatically when it moves to your profit level. The chart above shows an example of the grid trading logic.

Types of grid trading strategy

There are three types of grid trading strategies. First, there is one that is known as an arithmetic grid. This is where each grid in the asset generates the same amount of profit. In this case, you can set a grid that will generate a $20 profit when it works. In most cases, this works well in a period when the asset price is not extremely volatile. The second grid type is known as a geometric one. In it, the trader focuses on the percentages.

Grid trading strategy automation

The third type of grid trading strategy is known as automation. This is the approach of creating an algorithmic bot that implements the two strategies. There are three methods of using these bots. First, you can create a bot from scratch. This is where you sit down and use your coding experience to come up with a robot that works. While this is an ideal situation, it is challenging for many people who lack this knowledge.

Second, you can buy a grid robot that has already been created. You can buy this bot by paying a one-off fee. Some sellers offer it for free and then take a cut for every profit you generate.

Third, you can use grids that are provided by cryptocurrency brokers and exchanges. Many exchanges like Binance, KuCoin, and FTX have added grid features to their ecosystem.

Before you use the grid, it is always important to test it in the live market using a demo account. Doing that will help you estimate how successful the bot is.

Cons of using the grid trading strategy

There are several challenges you experience when you are using the grid trading strategy. First, it does not work well when the market is either ranging or when it is highly directional. Therefore, if the market suddenly moves from being highly volatile to ranging, you will not make a lot of money.

Second, in most cases, the grid trading strategy works well in short timeframes. If you use it in a daily or weekly chart, you will wait for a long time until results appear.

Summary

A grid trading strategy is a popular approach in the financial market. In this article, we have looked at how the strategy works and identifies an approach to optimize it. Most importantly, we have explained how you can automate it easily.

Leave a Reply