The Idea of Cross Market Correlation?

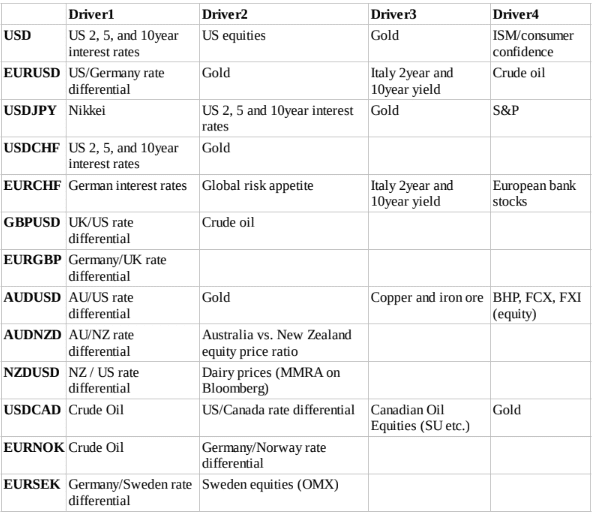

There’s a simple theory behind the idea of correlation trading. There is often one or more than one underlying factor that drives markets simultaneously. This means the markets are interconnected giving traders an improved chance forecasting forex. Correlation trading uses both macroeconomic and microeconomic factors that explain the relationships between different markets.

The relationship between one currency pair and another is the simplest association possible in Forex. For example, EURUSD is the most important currency pair in the world with the highest liquidity and it is used by countless speculators to convey their view on the dollar. This basically implies that if EURUSD moves notably, it is most plausible that the other USD pairs such as GBPUSD and AUDUSD will move in accord.

Currency vs. Currency

Earlier people could trade AUDUSD to earn money just by surveillance of EURUSD and carrying out trades with the hope that AUDUSD will reach or catch up to the move in EURUSD. That is no more the case presently since algorithms are capable of apprehending the tiny deviations in one currency pair and adequately arbitrage the gains away prior to a human being capitalizing on them. But it is still critical to grasp the fact that USD-based currencies have a substantial inclination to move together.

In a situation where EURUSD, NZDUSD, and GBPUSD move together while the other pairs stay put, there is a higher possibility that the next short term move in AUDUSD is up and USDCAD is down as the overall momentum of the dollar leads. Understand the general direction of the dollar and make out which currencies are dictating and which are lagging behind. If there is a lack of activity and USDCAD suddenly moves 30 points higher, you can rest assured that the short term weak side in AUDUSD will be lower as the move of USDCAD indicates dollar strength. The power of USDCAD to foretell the rest of the dollar pairs is so major and is highly believed in by many traders that it has earned itself a nickname “The Truth”.

Currency Vs. Interest Rates

Between the span of 1995 to today, even the most convenient drivers of currencies have been through changes in relative interest rates. This happens because investors tend to favour currencies that pay a higher rate of interest, that is high-yielders, and dodge currencies that pay negative or low-interest rates. Besides, a large portion of the reasons that the interest rates rise in a country (higher inflation, higher growth, confidence) supports the currency. If things are going just right somewhere you will notice both the currency as well as the interest rates (yields) going up.

Therefore a move higher in interest rates is time and again a good forecaster of an upcoming move higher in the currency. This is a critical aspect to grasp as it is the reason responsible for currencies reacting so violently to unforeseen moves in interest rates. If a central bank signals a greater intention to raise interest rates or to lower interests, the currency of that country will react in an expected manner.

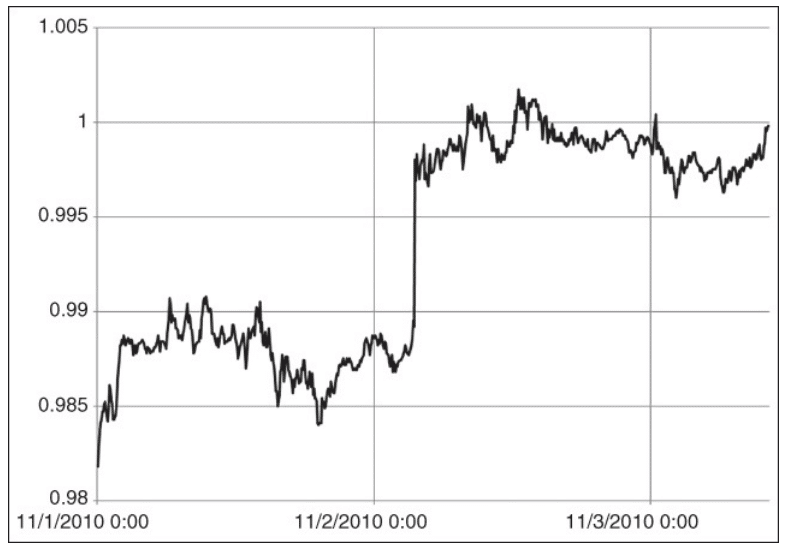

Following is an example of how currency reacts when there is an unanticipated move in rates:

On the 1st of November 2010, the market expected the Reserve Bank of Australia (RBA) to hold rates steady at its board meeting. But something of the opposite sort occurred. RBA decides to hike its cash rate by 0.25% (25 basis points).

The following chart depicts 5 minutes of AUDUSD around the announcement.

Currency vs. Commodities

This correlation of one currency pair versus commodities comes because commodities are mostly priced in USD and there happens to be a tough and unrelenting connection between USD and commodity prices. Commodities instantaneously become cheaper for foreigners when the US dollar is crippled because a weaker dollar tends to equate to higher commodity prices. Similarly, if the US dollar is stronger it makes commodities more expensive for foreigners and ends up reducing the global demand at the margin which drives prices lower.

Currency vs. Indices

In the late 1990s the correlation of one currency pair versus an equity index, the US internet bubble was in full swing and when equities rallied, it was identified as a sign of strength for the dollar since it indicated money flowing into the US technology stocks. The correlation was effectively positive between the US dollar and the US equities. In the simplest words, equities up = dollar up. Later on, from 2003 to 2010, the correlation diverted the other way. It showed a quality relationship between risky high yielding currencies and equity performance which was called the “RiskOn, RiskOff” or the RORO regime.

This regime is where a large group of highly correlated risky assets moved together in harmony and in sync. When the equities went up, the USD sold off and commodities and risk currencies like CAD, AUD and NZD rallied. Nevertheless, the US economy began to go one better than its global peers around the year 2012 causing the correlation to toss again.

Currency Vs. Equities and ETFs

While trading currencies, traders can look at individual stocks and ETFs related to the particular currency. For instance, In Australia, investors can watch Freeport, BHP, or China AShares ETF (FXI). Traders can use ETFs as they help them focus on what’s happening in specific sectors that are relevant to the particular currencies. They should keep in mind that the equities will be correlated to related commodities.

So, how to trade correlations?

Traders can start by creating a group of overlay charts provided they have the necessary software. They can do this using high-quality software such as Bloomberg or Reuters Eikon. They can use 15 or 20 overlay charts of forex versus correlated assets and scan for divergence.

Traders have to flip over the overlays to look for any major dislocations, with most of the charts showing a market somewhat close to equilibrium. The objective is to find large divergences between correlated assets and currencies, and then trade the currency as it catches up to a certain level.

Leave a Reply