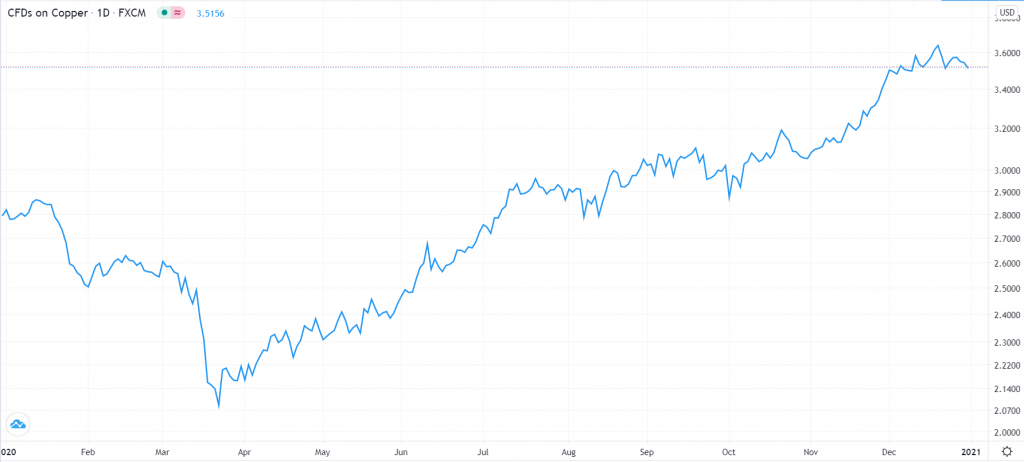

Copper price declined for the third consecutive day as investors reacted to the relatively weak manufacturing PMI data from China. It is trading at $3.5156, which is slightly lower than the 2020 high of $3.6415.

Copper 2020 performance

China manufacturing PMI

Copper prices rallied by about 77% from the March 2020 low of $1.9732 to a yearly high of $3.615. This performance was mostly due to the relatively weaker US dollar, limited supply, and rising demand from China.

The Chinese economy was the first major country to emerge from the coronavirus pandemic. It rose by 3.2% in the second quarter, followed by a 5.6% increase in the third quarter. Economists expect that it rose by 5.8% in the fourth quarter of the year and by 8.4% in 2021.

China is an important player in the copper market because it is the biggest buyer. It buys about 50% of the total global production.

Yesterday’s decline was possible because of the disappointing economic data from China. Data by China Logistics showed that the manufacturing sector cooled slightly in December. The Purchasing’ Managers Index (PMI) declined from 52.1 in November to 51.9 in December. This reading was slightly below the median analysts’ estimates of 52.0.

US stimulus

Copper prices also declined because of the stimulus situation in the US. Last week, Donald Trump signed the recently-passed $900 billion stimulus package. Some of these funds will go directly to individuals, while others will go to companies, states, and local governments.

This stimulus was below the previous proposal by Democrats, who wanted a $2.2 trillion package. It was also below the $1.8 trillion the White House wanted and the $4.5 trillion that some economists were calling for.

Further, Senate Majority Leader Mitch McConnel rejected calls for an additional stimulus. Democrats and Trump had called for direct checks to increase to $2,0000.

Stimulus and copper have a close relationship. In most cases, a higher stimulus leads to a weaker dollar, which is positive for copper prices.

Copper prices are also struggling because of the slow roll-out of the US vaccinations. The latest data showed that the country had vaccinated only 2.3 million people. This is sharply lower than Trump’s administration target of 20 million people.

Copper price faces risks in 2021

Copper had an excellent year in 2020. However, this could change this year as the world economy recovers. For once, while supply declined in 2020, there is a possibility that it will keep rising in 2021. Total supply declined by 1.6% in 2020, but analysts expect it to rise by 3.1% in 2021. This could have a negative impact on the prices.

Also, the dollar could strengthen in 2021 as investors shift from the 2020s risk-on sentiment to risk-off. This is partly due to the rising global debt and potential risks of higher interest rates. In total, global debt soared by more than $20 trillion in 2020.

A substantial amount of this debt went to poorly-rated companies and countries. Investors could start worrying about this debt if central banks start being hawkish.

Copper technical analysis

On the weekly chart, we see that copper price has been on a strong upward trend since March 2020. Along the way, it managed to move past the important resistance levels at $3.00 and $3.20, signaling that bulls were in total control.

However, it has found some resistance recently. It has dropped for the past two consecutive weeks. The last time it did this was in September 2020.

The price is still above the 25-week and 50-week exponential moving averages. But the Relative Strength Index (RSI) has moved from the extreme overbought level of 79.9 to the current 69.

Therefore, I predict that the price will continue dropping as bears aim for the important support at $3.32. On the flip side, a move above the 2020 high of $3.6468 will invalidate this thesis because it will send a signal that there are still buyers in the market.

Leave a Reply