The prediction that takes place in the currency markets comes down to several things. For starters, people analyze economic releases and monetary policies to try and predict price action. Besides, some traders base their decisions on the interrelationship that exists between commodities and currencies.

Time-tested connections are standard among these two instruments. In some cases, currency price action would behave in a manner that shows a connection to some commodities. Mastering these tie-ups is a sure way of staying on top of the buying and selling game.

While some of the connections are strong, some are not. Besides, some hold for long, while others are short-lived and often trigger unexpected price changes. Therefore, being aware and watchful of these changes is essential when trying to squeeze some profit based on these small interrelations.

Top correlations to watch out for

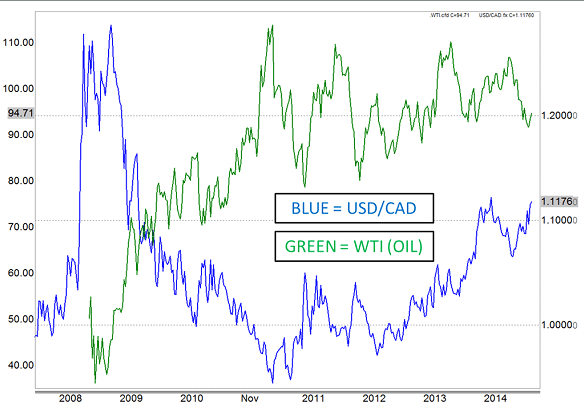

The Canadian dollar has, over the years, depicted a strong connection to the oil prices. Conversely, its pair with the buck is often susceptible to developments in the oil markets. Whenever oil prices rise significantly, the Canadian dollar tends to strengthen against the majors. This is partly because traders expect the country to receive more money from the oil business.

Likewise, whenever oil prices tank, the fiat often comes under pressure as the country is always at risk of making less money. Conversely, it is crucial to pay close watch to developments in the oil market when trading the loonie.

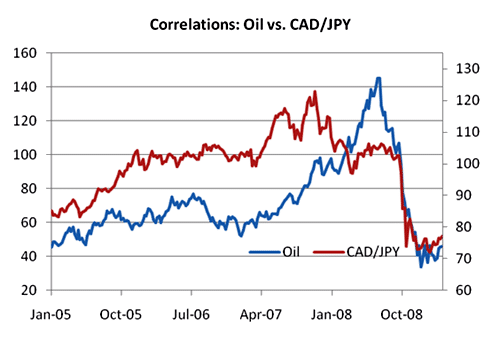

The Japanese yen also depicts a strong interrelation with the black gold prices. Whenever there is a significant increase in the black gold prices, the yen often struggles against the greenback. It also tends to strengthen whenever there is a considerable decline in oil prices.

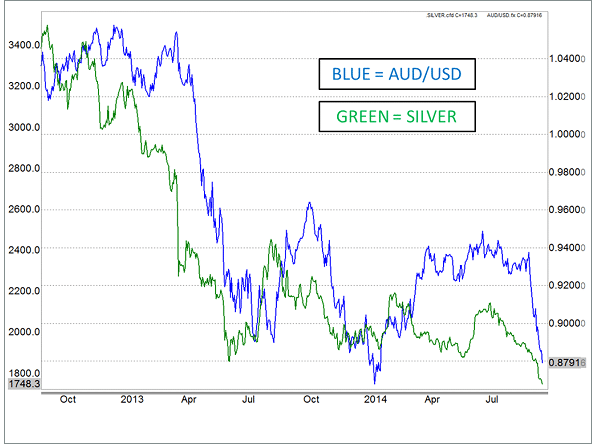

The Australian dollar is also susceptible to price changes that engulf gold and silver as they are some of the country’s biggest exports. Whenever gold prices edge higher, it often strengthens across the board. The AUD also struggles whenever there is a significant decline in precious metal prices.

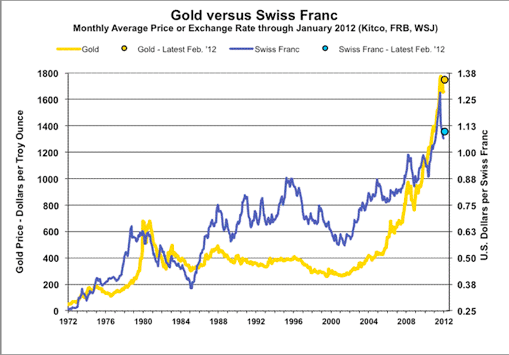

The Swiss franc’s value also depends on the yellow metal prices. Switzerland has a good chunk of its money guaranteed by gold reserves. The value of the franc tends to fluctuate in response to the precious metal prices as it also acts as a safe-haven currency and region.

How to trade connections

Not all correlations are worth trying to profit from. This is partly because some are not as strong and reliable as they ought to be. Besides, people need to consider some of the factors that affect price action before leveraging the interrelations.

Commissions spread, and liquidity is a thing to consider when trying to profit from the two financial securities’ relationships. The best instruments to consider in these cases are the easiest to find information on. These will come with tight spreads and liquidity, making it possible to profit from the smallest price changes.

The CAD and the yen are among the best for anyone looking to profit from developments in the oil business. The two give rise to a powerful pair in CAD/JPY, whose price action is always subject to oil price changes.

However, the CAD/JPY tends to come with wider spreads and can be less liquid. The fact that oil is usually priced in dollars is why most people trade the USD/CAD when looking to leverage oil prices and price action in their trading decisions.

USD/JPY is also an ideal pick given the connection between the yen and the greenback and oil. Also, it comes with a tight spread and high liquidity, which makes it easier to profit from small price movements.

AUD/USD should also come into consideration when looking to profit from gold prices. Australia being a net exporter of precious metals leaves the AUD susceptible to the yellow metal price.

The US is a net buyer of precious metal, which also brings the dollar to the mix. Conversely, the AUD/USD would be a perfect mix given the AUD and the US dollar relation with gold.

Timing

Timing is an essential aspect for anyone looking to profit from some of the strong relations between commodities and currencies. While trying to profit from connections, it is important to ascertain the kind of tie-up at a given time. If it is a positive connection, then similar trades would be ideal. In case of negative tie-ups, going long and short would have to come into play.

Defining whether a positive or negative correlation exists at a given time is essential. It is also important to determine the one asset that leads the other. We would advise any trader to monitor the degree of correlation at any given time before triggering trade.

Correlation cracks

Despite the great connections that exist, divergence does occur at times. The relationships don’t last all the time. There will always be times when the relations don’t exist, resulting in unexpected reverse outcomes.

Conversely, a currency and a commodity whose price actions are directly connected often diverge and behave unusually after a period of time and depending on underlying factors influencing people’s sentiments. Therefore, it is important to monitor such cracks as they can lead to disastrous outcomes.

Monitoring is pretty easy as several trading platforms offer indicators that make it easy to monitor real-time connections. The indicators make it easy to capture small divergence even when instruments under consideration are highly correlated.

Bottom line

Strong links exist between commodities and currencies in the financial markets. Similarly, one can use the tie-ups to determine the right time to trigger trades depending on how the two instruments behave in the market.

However, such connections do break down and tend to reverse at times. Conversely, it is essential to remain vigilant to identify a divergence from an expected norm. It is also important to consider spreads, liquidity, and fees while trying to profit from a given correlation.

Leave a Reply