Climbing Scalper is programmed to deal with large spreads while working on multiple currencies. It uses various techniques to find the most precise entry and exit points for each trade. The developer provides extensive backtesting records and has optimized the algorithm to provide the best set files. We will go through all its features in our review to check if the algorithm can benefit us in the long term.

Detailed Forex robot review

Liudmyla Bochkarova is a robot author who resides in Ukraine. She is the developer of multiple Forex robots such as Golden Future, Golden Cash, etc., and has a rating of 4.8 based on 11 feedback from the MQL5 website. Liudmyla is not transparent about her portfolio and provides no details on her market experience. There is also no evidence of the seller’s profile on social media platforms such as Facebook, LinkedIn, etc.

Features

The algorithm comes with the following key characteristics:

- The algorithm trades on the MT4/MT5 platforms.

- It contains a set of smart SL and TP.

- The system comes with easy installation setup.

- Traders can access a free demo account.

- Purchasing and renting options are available.

How it works

To make the system ready, take the following steps:

- Click on the ‘buy’ option available on the MQL 5 website

- Sign in to MetaTrader 4/5 platform using credentials

- Bring the algorithm to the expert directory and refresh the panel

- Link the robot with the chart, and you are good to go

Climbing Scalper strategy tests

The algorithm has a slippage/spread filter and is designed for the M5 time frame to trade on AUDUSD, EURUSD, EURGBP, GBPUSD, and USDCAD. It does not use martingale and grid strategies and uses stop loss on every trade to protect funds. Unfortunately, there are no live records that could help us define its strategy.

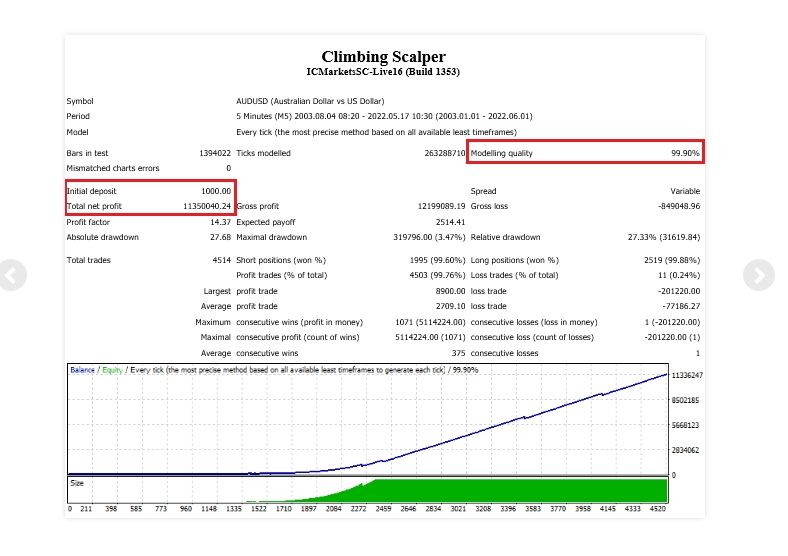

The algorithms backtest available in the image form, which risks its authenticity. The account showed that it traded on the AUDUSD symbol and followed the M5 timeframe. It can be seen the test started in August 2003 and ended in May 2022, which resulted in a total net profit of $11350040.24. The initial deposit was $1000, and the portfolio managed 4514 trades, where the profitability stands at 99.76.

Live account trading results

The algorithm has no live results, making it impossible for us to monitor the current win rate and live trades. We have gone through several performance-tracking websites, such as Myfxbook and FXStat but could not find any trace of current stats.

Pricing

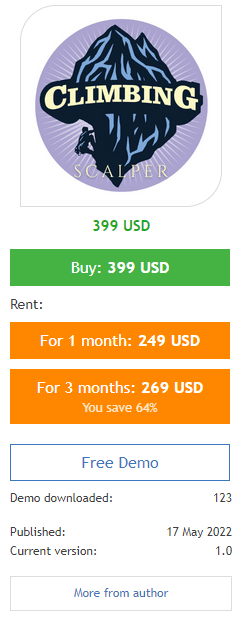

The bot has both purchasing and renting options available. The one-time payment costs $399, whereas users can lease the algorithm for $249 and $269 for 1 and 3 months.

Customer reviews

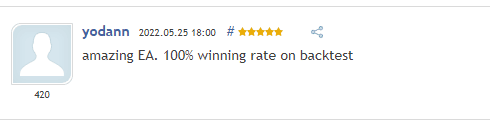

The algorithm has a rating of 5 based on five testimonials seen on the MQL5 marketplace. One of the traders comments that the EA finds profitable and has good performance.

Another trader states that the algorithm shows a 100% winning rate on backtesting.

The lack of customer feedback points out that the system has not been tested by the general community. It is not satisfactory to take the current reviews for real.

Leave a Reply