The Forex market remains open 24/7, and there are such a huge number of financial instruments and currencies you can trade in that it can feel quite overwhelming for a beginner. There is no ‘one suits all’ approach when it comes to trading in pairs, and you need to assess each pair based on your trading strategy in order to decide on its efficiency. For example, the EUR/USD pair is extremely popular among new traders, but it has a high number of false breakdowns and cannot be traded with the aid of indicators.

So, the characteristics of each pair must complement the trading strategy since each one of them has a distinct market movement and trajectory. Let’s take a look at some of the factors you need to consider while choosing a currency pair.

Determine the trend as per your strategy

Determining the trend is the first thing you need to do when you select a pair to trade in. To determine the trend, you can use the help of moving averages or trend lines. Next, you need to be certain the pairs suit your trading scheme.

For example, if you are using a trending strategy, you should choose a trending pair because using this strategy on a sideways pair can be disastrous. Combining a trending strategy with trending pairs enhances your chances of making profits. Conversely, if you come across a pair that is showing sideways movement, you must go with a sideways or range trading strategy suitable for that particular kind of pair.

There exist several schemes applicable to various pair types, but you should carefully study the behavioral pattern of a pair before you start investing. The incorrect combination of a strategy and pair can lead to huge losses, so you should always consider this factor carefully.

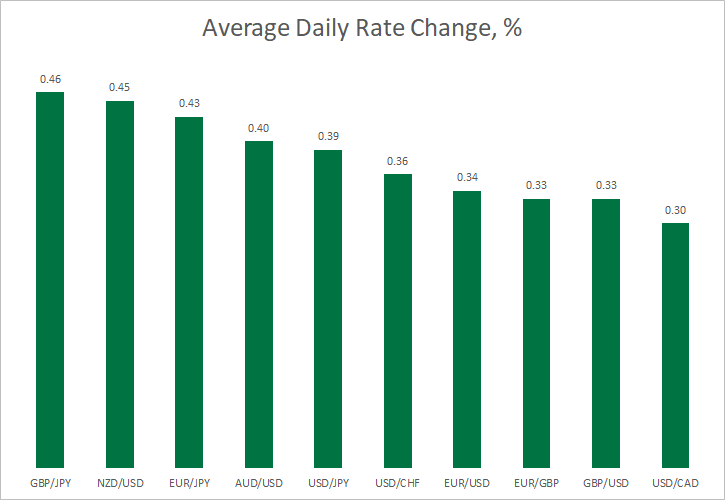

Volatility

Those currency pairs that are traded in lower volumes are likely to be highly volatile. Volatility is generally higher for minor volumes that are not traded much or belong to countries with political and economic unrest.

Some currencies like NZD, CAD, and AUD are closely related to price changes of resources like wood, iron ore, and oil, which are among the chief exports from these countries. For these reasons, these currencies are characterized by frequent price changes.

Other factors impacting volatility include major world events and the release of financial information, and even major pairs are not immune to such unpredictable events. According to a mathematical theory, if a pair starts displaying higher volatility than average for a certain amount of time, a short-term reversal is bound to take place.

Many traders employ the breakout trading strategy for this purpose, which involves monitoring the quieter pairs until the price of one of them starts showing a sudden fluctuation and opening trades based on the movement before the trend slows down.

In this regard, you should keep in mind that the probability of negative movement is always there, and you cannot execute the trade at the price of your choice. This makes it imperative that you have risk-management measures in place while you’re dealing with volatile currency pairs.

Liquidity

In the foreign exchange market, liquidity is defined as the ease by which a currency pair can be traded on demand. The liquidity is particularly high for the major currency pairs, but you have to trade on the basis of banks, which let you trade in a specific currency pair.

The liquidity is not the same for all the pairs, and minor and exotic pairs generally tend to have low liquidity. If a currency pair has high liquidity, it means that you can buy or sell large chunks of it without causing any notable change in its exchange rate. This holds true for major pairs like:

- GBP/USD

- USD/JPY

- USD/CAD

When the liquidity is low, you cannot buy or sell a substantial amount of that currency pair without causing its exchange rate to shift by a large margin.

Trading time

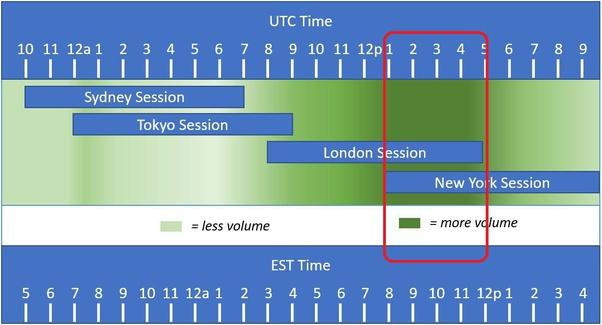

A good time to trade in currency pairs is when high volumes are being traded in the Forex market. For example, Tokyo opens during EST hours, and if you wish to trade in this market, the best time to do it is between 7 PM EST and 10 PM EST. In the meantime, you can start buying and selling the AUD/USD pair since it opens during this period of time.

By the time the London market is active, you can access most of the currency pairs. Depending on whether the pair is trending or not, you can trade in the window of 3 AM EST to 6 AM EST. Between 8 AM EST to 12 PM EST, the market often sees highly volatile movements due to the markets in both the USA and London being open simultaneously.

Trading costs

This is the overall cost that you have to bear to transact in currencies. It consists of expenses that are not mandatory, like technical analysis reports and news bulletins, as well as compulsory expenses that all traders need to pay.

If you take the help of a broker while trading in currencies, you need to pay them a commission for every transaction. Normally, this is the only mandatory cost you need to bear while transacting in currency pairs. Several merchants will agree on the point that making gains is not entirely dependent on the trading performance and underestimating the costs is not a wise thing to do.

Summary

Thus, you now know the various factors you need to consider while choosing a currency pair for yourself. You should keep a close eye on important global events and use risk management measures for the best results.

Leave a Reply