Chinese officials have unveiled a full arsenal of measures to taper down consumer prices, but strategists expect this to fail, Bloomberg reported.

- China, in the last three weeks, hiked transaction fees, adjusted tax regulations, censored industry research, called on producers to unload inventories, and pushed trading firms to reduce wagers.

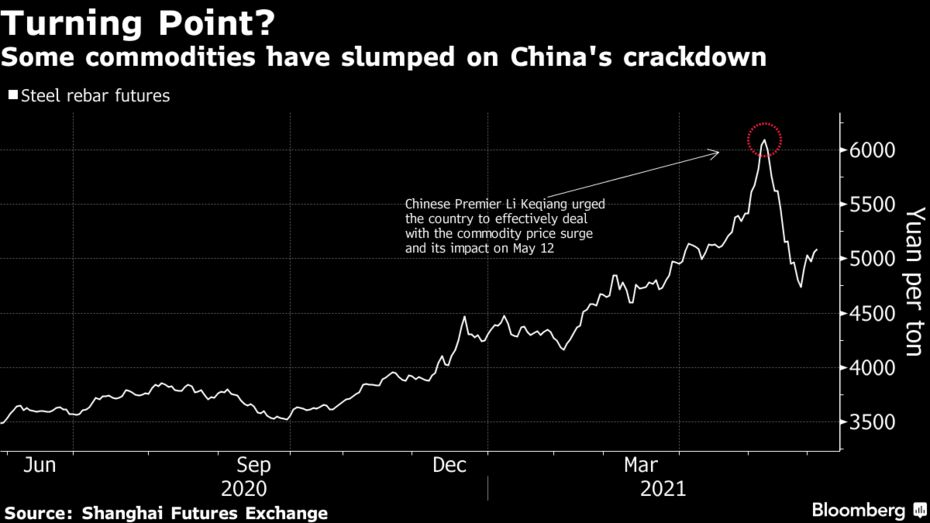

- The measures seek to address the surge in commodity prices covering coal, glass, and steel rebars which have soared to record highs.

- The high prices are affecting China’s export manufacturing and could likely impact economic recovery from the COVID-19 pandemic.

- Strategists at both Goldman Sachs Group Inc. and Citigroup Inc. believe the attempts will likely fail due to supply constraints and high global demand.

- Goldman strategists said China has lost its power to control key commodities prices, including oil and copper. It advised clients to “Buy the China-led dip.”

- China has since been successful in its efforts after rebar and coal prices have dropped 22% from their May highs.

Leave a Reply