The Chainlink price tumbled to the lowest level since February 3rd as investors reacted to the latest warnings on Ukraine. LINK, the platform’s native token, is trading at $15.40, which is about 21.55% from last week’s high.

Chainlink and other coins tumble

LINK and other cryptocurrencies sold off on Monday morning after they attempted to stabilize during the weekend. Data compiled by CoinGecko shows that the total market capitalization of all cryptocurrencies has crashed from over $2 trillion last week to about $1.855 trillion.

The main reason for the sell-off is the ongoing risk-off sentiment in the market as worries about a Russian invasion of Ukraine jumped. The situation escalated on Friday after the US warned that Russia was prepared to launch an attack in the coming days.

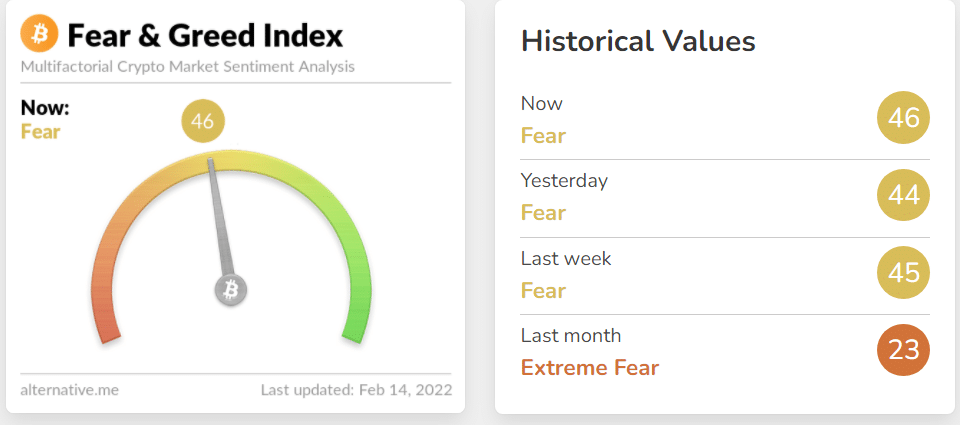

As a result, most risk assets have declined, with the Dow Jones and Nasdaq 100 futures slipping. At the same time, the yields of the 10-year and 30-year government bonds have risen to 1.96% and 2.27%. Other cryptocurrency prices have also declined sharply in the past few days while the Bitcoin fear and greed index moved to the fear level of 46.

Still, some analysts believe that the sell-off that happens because of geopolitical risks tends to be a buying opportunity. Besides, it is unlikely that the crisis between Ukraine and Russia will have a major implication in the world economy. The only risk is that the price of crude oil and natural gas will keep rising.

Chainlink expansion continues

Chainlink is a useful blockchain project that uses hybrid oracles to link off-chain data to the blockchain. For example, using the network, it is possible for developers to integrate weather data into the blockchain. They are also able to add data like school performance and the stock market to on-chain networks.

Therefore, Chainlink is one of the most important platform in the industry. Indeed, LINK has a market cap of over $7.2 billion, making it the 22nd biggest coin in the world.

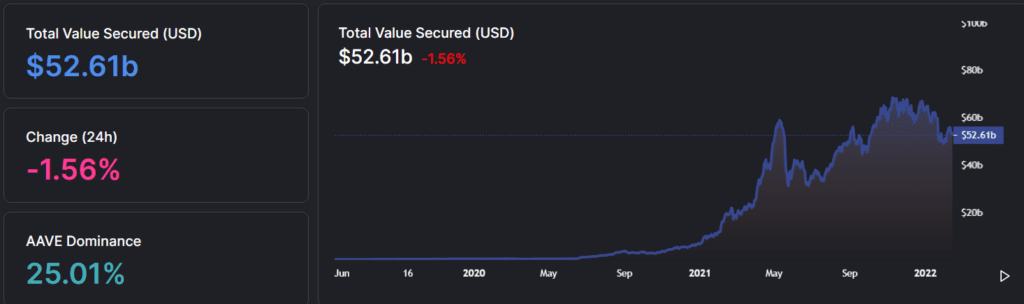

Data compiled by DeFi Llams shows that the network has a total value secured (TVS) of $52.61 billion. This price is lower than its all-time high of over $66 billion. The biggest users of Chainlink are Aave, Anchor, Compound, Abracadabra, and Frax.

There is a likelihood that the network will continue expanding as more people embrace the blockchain industry and as the DeFi industry grows.

There are other reasons why the Chainlink price will likely rebound from a fundamental perspective. First, it has little competition. While it has a TVS of over $52 billion, its second-biggest competitor is Maker, that has a TVS of about $10 billion.

Second, Chainlink recently recruited Eric Schmidt to join its board. Eric was the former CEO and Chairman of Google, meaning that he has a lot of experience scaling technology products. Finally, the number of blockchain networks embracing the platform are expected to keep growing.

Chainlink price prediction

The four-hour chart shows that the LINK price rose to a key resistance level at $19.57 last week. Since then, it has erased some of the gains and dropped by over 20%. It has moved below the 25-day and 50-day moving averages, while the MACD has moved below the neutral level.

Therefore, there is a likelihood that the Chainlink price will continue falling as bears target the next key support level at $14.

Leave a Reply