- Canada’s vaccination rate against Covid-19 reached 65.7% after 24.7 million people were fully vaccinated.

- Canada’s retail sales increased 4.2% in June 2021 (MoM) to C$56.2 billion.

- Factory activity in Japan weakened in August 2021 to 52.4% in August 2021 from 53.0% realized in July 2021.

The CADJPY pair added 0.61% as of 3:23 am GMT on August 23, 2021, from the previous day’s close. It traded to a high of 86.23 as the five biggest banks of Canada announced mandatory vaccination for their employees to enable a full return to work.

Canada’s vaccination rate against Covid-19 reached 65.7% after 24.7 million people were fully vaccinated. The country has administered a total of 52.3 million doses as the first week of the election campaign comes to an end.

With the next snap election slated for September 20, 2021: the vaccination mandate continues to take center stage in campaign pledges among aspirants including PM Justin Trudeau. Strategies such as testing and screening were recommended for citizens that would oppose vaccination.

The use of vaccination passports has been viewed as a way to incentivize and increase uptake of the Covid-19 vaccines.

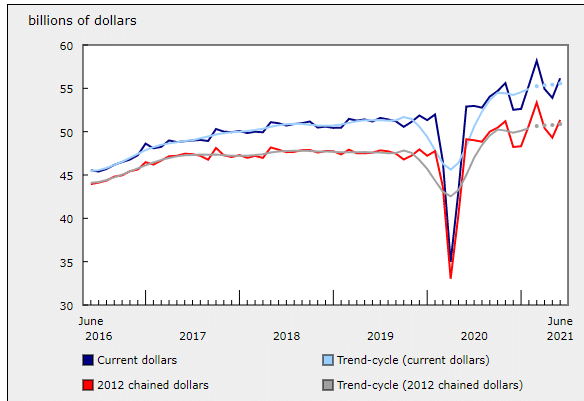

Retail sales

Canada’s retail sales increased 4.2% in June 2021 (MoM) to C$56.2 billion. The increase was buoyed by higher clothing sales as the ease of restrictions took control of public health institutions.

Core retail sales (that exclude the sale of gasoline and motor vehicle accessories) rose 4.6%. The volume of retail sales surged 4.1% in June 2021 but decreased 0.9% in the second quarter.

June 2021 saw motor vehicle sales soar 2.7% with a 3.3% increase in new car sales in dealerships. A 3.9% decrease was reported for second-hand motor-vehicle dealerships.

Food and beverage store sales declined 2.6%. Supermarket and grocery store sales led to the decline of food sales at -3.5% in June 2021.

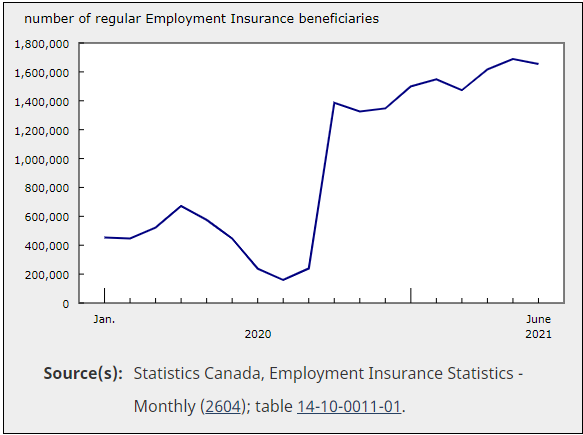

Canada’s employment rate

The Canadian dollar was boosted by a 2.0% drop in the enrolled population of those seeking benefits of employment insurance (EI) in June 2021 to 1.7 million (-34,000). The improvement in labor market conditions was marked by low national unemployment rates in the cities of Ontario, Quebec, and Alberta.

June 2021 saw employment gain by 231,000. Unemployment levels dropped to 1.6 million. Of this number, 1.4 million were in search of new jobs while the rest (200,000) were set to begin new engagements in the future.

There was a 2.0% decline in the monthly unemployment change and a 270.1% increase in employment numbers (YoY).

Japan’s slow manufacturing process

Factory activity in Japan weakened in August 2021 but still maintained its place in the expansionary zone. The manufacturing PMI flash estimates measured by the au Jibun Bank dropped to 52.4% in August 2021 from 53.0% realized in July 2021.

On seasonal adjustments, the au Jibun Bank Flash Services PMI decreased to 43.5% in August 2021 from 47.4% realized in July 2021. It was the lowest contraction since Japan was hit by the pandemic.

As of 6:53 am GMT on August 23, 2021, the Japanese yen had lost 0.79% against the New Zealand dollar and 0.35% against the Swiss franc.

Technical analysis

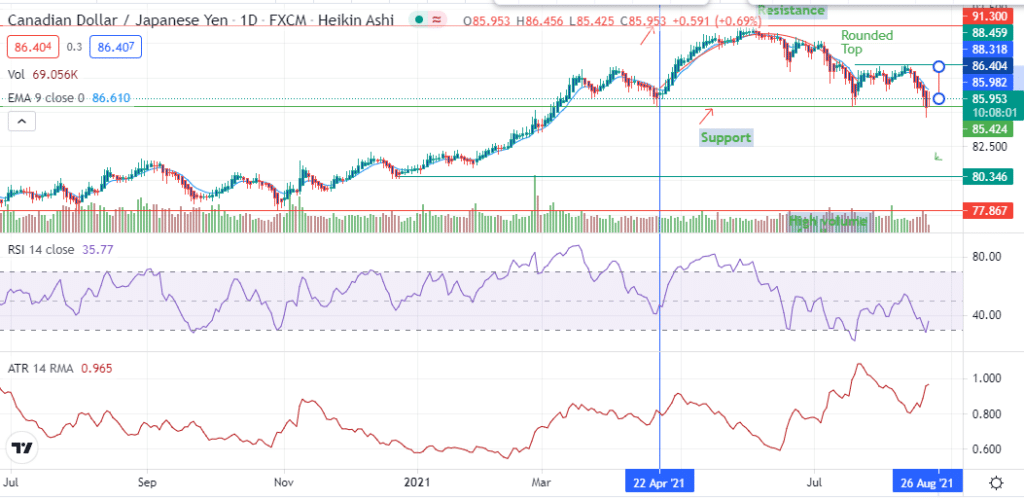

The CADJPY began a short-term bullish continuation after the rounded top pattern formation from April 22, 2021.

The bullish continuation above 86.4 is likely to give way to a price move towards 88.32, 88.46, and the resistance point at 91.30. However, the price is still below the 9-day EMA that may pave way for the bearish reversal in the short term.

The price decline may push down prices towards 86.40, 85.95, and 85.42.

Leave a Reply