- Japan has witnessed an improvement in exports and industrial output with a steady increase in fixed business investments.

- The BoJ is set to maintain the purchase of 12-trillion-yen worth of ETFs and 180-billion-yen worth of Japanese real estate investment trust (J-REIT).

- Non-resident investors reduced their Canadian equities in June 2021 by CA$3.3 billion (the first since June 2020).

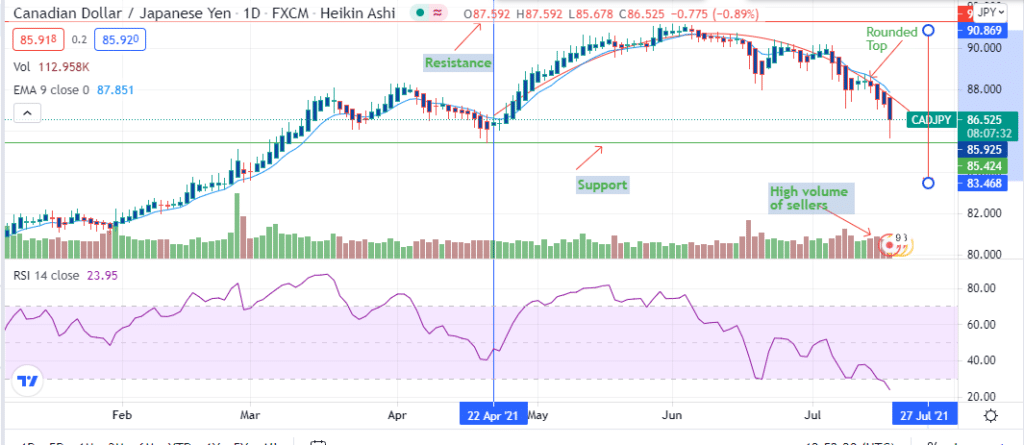

The CADJPY pair fell 1.42% as of 5:36 am GMT on July 19, 2021, from the previous day’s close. It opened at 87.28 and traded to a low of 86.17. The Canadian dollar held on to maintain a 1-year change of 10.41% despite declining from the 52-week high of 91.21. Japan has witnessed an improvement in exports and industrial output with a steady increase in fixed business investments.

The Bank of Japan (BoJ) is scheduled to release the core CPI data for June 2021 (YoY) on July 19, 2021. The rate of the CPI change (less the price of fresh food) is expected to remain around 0.0%, supported by the rise in energy prices. A reduction in the charges of mobile phones offset the increase in energy prices.

With the price stability target set at 2%, the Bank of Japan aimed to continue with its quantitative easing (QE) program. The BoJ is expected to perpetuate the expansion of the monetary base until the CPI rate (less fresh food-YoY) stabilizes above 2%. The three core competencies chosen by the bank to support Japan’s financial stability include:

- Initiate special financing of firms to help respond to Covid-19 emergencies

- Removing the upper limit when providing the yen or foreign currencies (the Canadian dollar included). This move will consider the purchase of Japanese Government Bonds (JGBs) and maintain operations that actualize the supply of the dollar.

- Purchase of 12-trillion-yen worth of ETFs and 180-billion-yen worth of Japanese real estate investment trust (J-REIT).

Olympics

In a move that could affect the Japanese yen, Tokyo Olympics sponsor Toyota pulled out its TV commercials from the event.

Japan’s Tokyo 2020 Athletes

The giant automaker cited poor public support for the global competition amid doubts of the games’ safety in the wake of the Covid-19 scare.

Canada’s lifting of the cruise ban

Canada announced that it would lift its cruise ship ban in November 2021 following an easing of Covid-19 rules. The industry rakes in annual revenue of $4 billion to the Canadian economy and is responsible for 30,000 jobs.

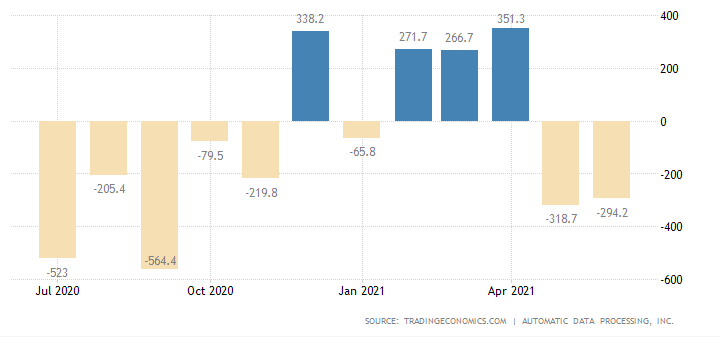

A total of 294,200 Canadians lost their jobs in June 2021 as compared to 318,700 in May 2021.

Nonfarm Employment change in Canada

While this loss is an improvement in the Nonfarm (payroll) Employment change, it still shows a job deficit in Canada. In the goods-producing sector, employment was reduced by 4,600 in the natural resources and mining segment. The service sector was the worst hit, with leisure and hospitality recording an employment decline of 97,440 in June 2021.

Canada lowered its purchases of foreign securities by 42.83% from CA$ 18.63 billion in May 2021 to CA$10.65 billion in June 2021. The acquisitions consisted mainly of US shares. Non-resident investors also reduced their Canadian equities in June 2021 by CA$3.3 billion. This reduction was the first since June 2020. However, foreign investments (such as securities of government debt) surged to CA$20.8 billion in May 2021.

Technical analysis

The CADJPY formed a rounded top pattern, with the latest uptrend’s swing beginning on April 22, 2021. At the time, the pair’s support was at 85.925. It rose and met resistance at 90.869, where the downtrend took shape.

In response to the rounded top pattern, the price may decline in the short term. The pair may test the prior support zone at 85.925, and if the market manages to break down lower, move towards 83.468. There is a high volume of sellers, along with the oversold 14-day RSI at 23.95.

Leave a Reply