- Canada’s employment rate rose 0.5% to 94,000, while the annual tally increased to 1,081,000 between July 2020 to July 2021.

- Switzerland has seen a sharp increase in new Covid-19 numbers from 0 on June 27, 2021, to 3,145 new cases on August 9, 2021.

- Canada’s trade balance is +C$3.2 billion, representing a surplus.

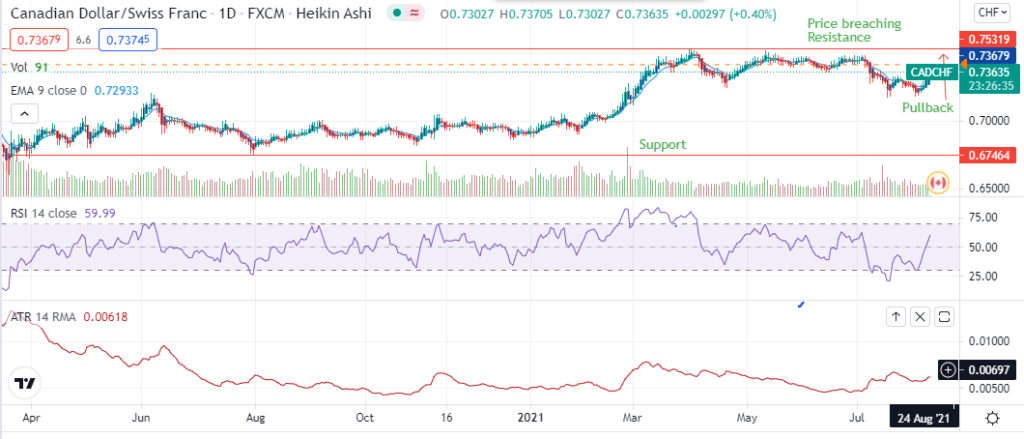

The CADCHF pair gained 0.74% as of 1:30 pm GMT on August 10, 2021, from the previous day’s close. It hit a high of 0.7374 from a low of 0.7308, indicating an increase of 0.90% on the trading day.

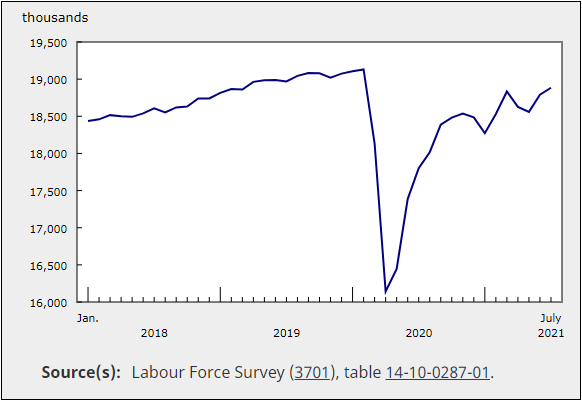

Employment data

The Swiss franc lost against the Canadian dollar after Switzerland’s unemployment rate for July 2021 (seasonally adjusted- s.a) fell 3.0% from 3.1%. When not seasonally adjusted, the Swiss unemployment rate for the month stood unchanged at 2.8%.

In Canada, the employment rate rose 0.5% to 94,000, after it had risen 1.2% to 231,000 in June 2021. In the two months, employment had declined 1.3% to 246,000, from the level attained in February 2020 (pre-pandemic).

The easing of health restrictions saw employment rebound, with 18,789,000 added in June 2021 and 18,883,000 added in July 2021 (+94,000). On an annual basis, a total of 1,081,000 employment positions were created between July 2020 to July 2021 in Canada.

Despite the decrease, investors noted that the bulk of the June-July 2021 gains in employment was from the youth aged 15-24 years. Women aged 25-54 years also accounted for this rise. Also notable was the fact that full-time workers in July 2021 increased 0.5% (+83,000). This increase was the first since March (Q1) 2021.

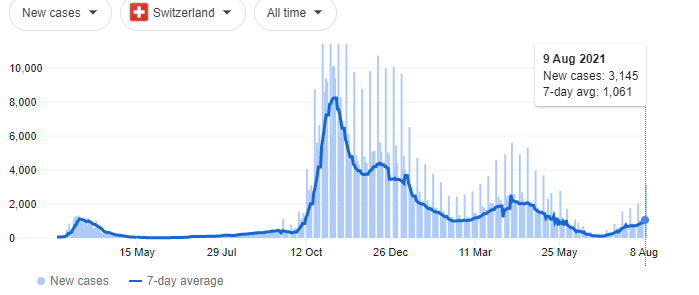

Coronavirus cases and deaths

Coronavirus cases have risen exponentially in Switzerland from 0 new cases recorded on June 27, 2021, to 3,145 new cases on August 9, 2021.

Overall, Switzerland has recorded 10,921 deaths from a total of 727,000 Covid-19 cases. While this country has had fewer cases, the recent rise in new cases has pushed back investment options due to the surge in the two months leading to August 9, 2021.

Approximately 4.23 million Swiss citizens have been vaccinated, representing 49.5% of the total population.

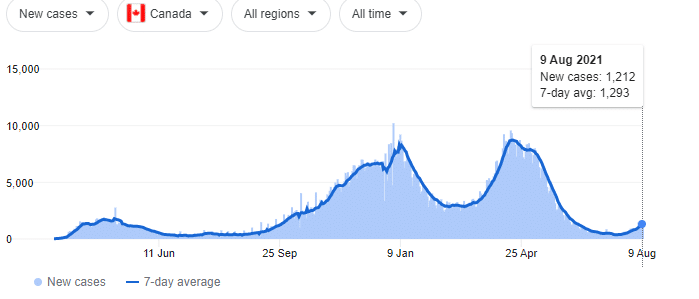

Canada recorded fewer cases of Covid-19 as of August 9, 2021, standing at 1,212. The total number of cases stood at 553,000, with deaths at 9,409 at the time. The country has stepped up its vaccination rate at 62.5%. About 23.5 million people have been vaccinated out of 50.7 million doses issued.

Merchandise trade

This high vaccination rate has acted as an investment booster.

June 2021 saw a strong increase in exports at C$53.8 billion (+8.7%). Imports declined by 1.0% to C$50.5 billion. With high exports against imports, the trade balance was +3.2 billion, representing a surplus in Canada’s merchandise trade.

There was a sharp rise in exports of energy merchandise at 22.9% to C$11.3 billion. Crude oil took the highest share in the energy sector, increasing by 25.7% or C$2.1 billion. Export volumes increased in June 2021 as compared to April and May due to supply disruptions.

Technical analysis

After the CADCHF pair formed a pullback, the price has been recovering, approaching the resistance line at 0.7532. At 0.7376, the price has risen above the 9-day EMA at 0.7293.

The 14-day ATR indicates an increase in volatility at 0.00618 during the formation of the pullback. We expect the volatility to keep rising. Additionally, the 14-day RSI is at 59.99, showing a rise in the buying momentum.

Leave a Reply