Today’s review will be about a Cabex robot that was designed in 2016.

Detailed Forex Robot Review

They have a cool logo and package. Can the EA be that great? The robot focuses on trading only GBP/USD.

Let’s talk about its features:

- The robot uses two indicators: Price Action and Moving Average.

- It looks for forming a new trend to open a trade.

- It doesn’t use Grid nor Martingale strategies

- The robot is compatible with NFA and FIFO-regulated broker houses.

- We can expect from 40% to up to 60% of the annual again using the default settings.

- The maximum drawdown should not be higher than 22%.

- The robot can be run on any broker.

The robot looks for liquidy spikes to open a trade just in time. Now, it’s less actual because the UK went out of the EU.

The Pound is sensitive to much news that is published during a day. It creates trading opportunities, as well.

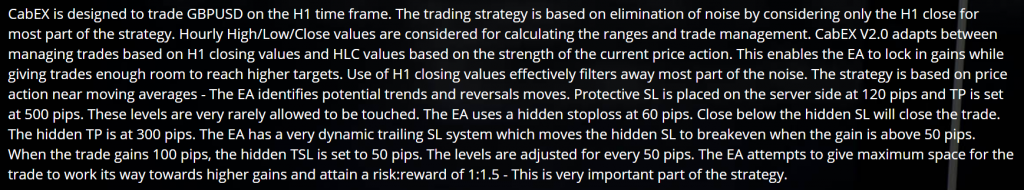

The EA works on the trend (H1) time frame. There are hidden SL and TP. SL levels are around 60 pips. TP ones are 300 pips. Trailing SL turns on after 50 pips gained and it grows with every 50+ pips.

CabEx Strategy Tests

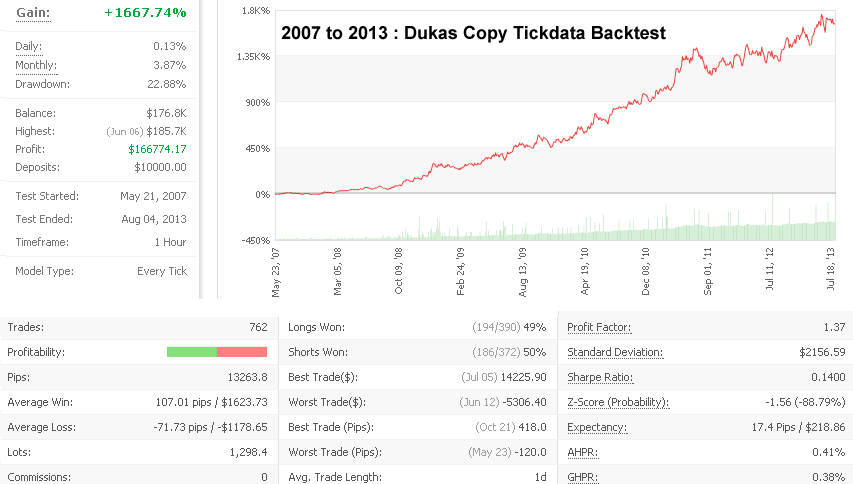

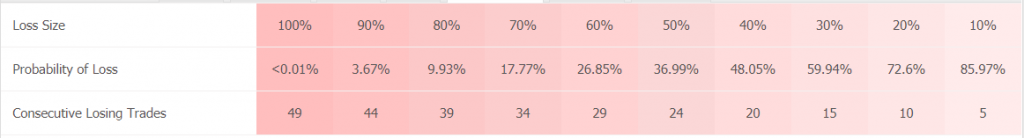

There are only unclickable backtests. It’s one of them. It’s a GBP/USD on the H1 timeframe from 2007 to 2013. The absolute account gain amounted to 1667.74%. The average monthly gain was +3.87%, with a very high maximum drawdown (22.88%). For six years, there were 762 deals with 13263 pips closed. An average win (107.01 pips) was higher than an average loss (-71.73 pips). The win-rate was very low (49%-50%). An average trade length was quite risky and equaled a day. The Profit Factor was mediocre (1.37).

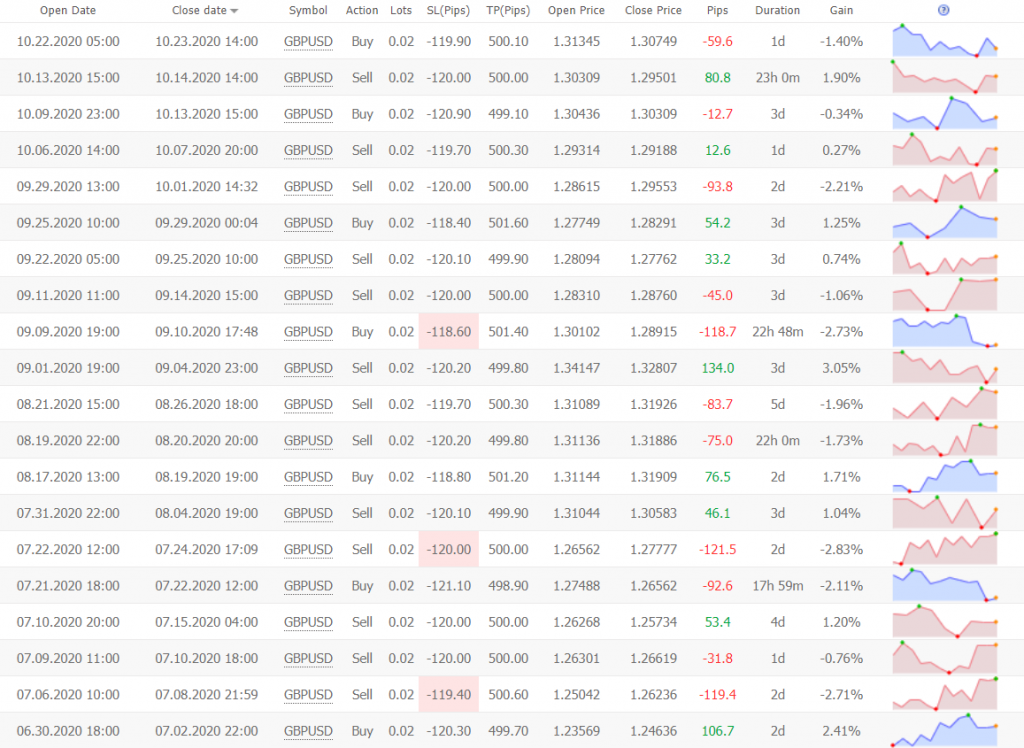

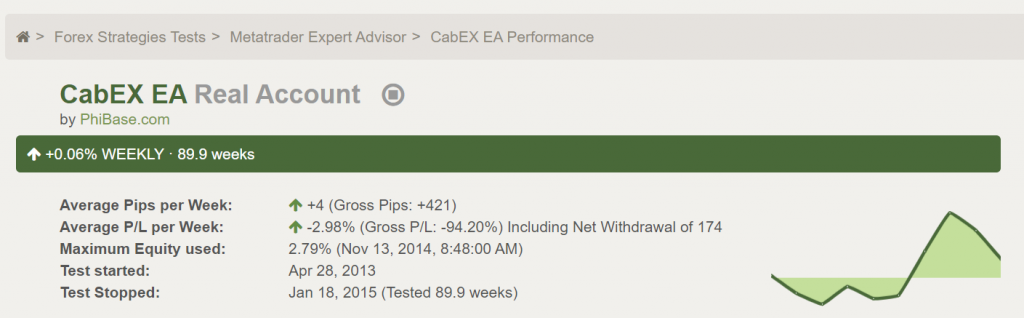

Demo Live Account Trading Results

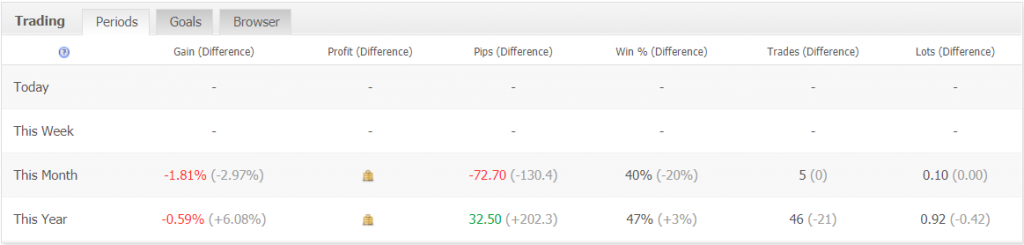

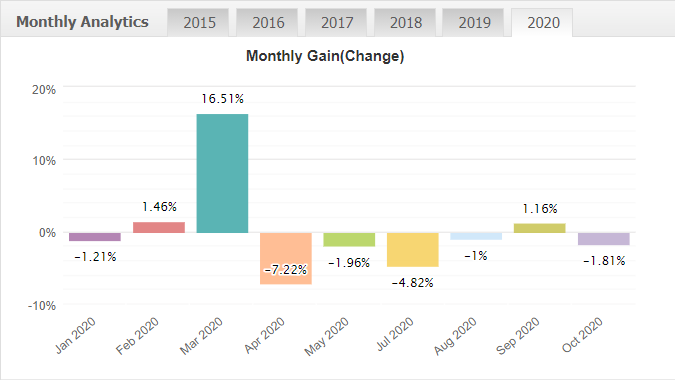

As we can see from the chart, a miracle didn’t happen. It’s a real EUR account on Darwinex. The robot trades with 1:200 leverage on the MetaTrader 4 platform. Track Record Verified, but there’s much data that is closed from us. The account was created on January 23, 2015. An average monthly gain was +0.49%, with an insane maximum drawdown (47.99%).

This year, as well, a month was not successful.

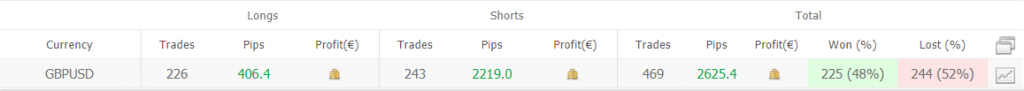

The EA traded 469 deals with only 2625 pips. An average win was higher (84.99 pips) than an average loss (-67.61 pips). It would be great if not “losers” win-rates (45% for Longs and 50% for Shorts). The average trade length is two days. A Profit Factor is trash-kind (1.06).

As we can see from the sheet, a Short direction brought almost six times more profits.

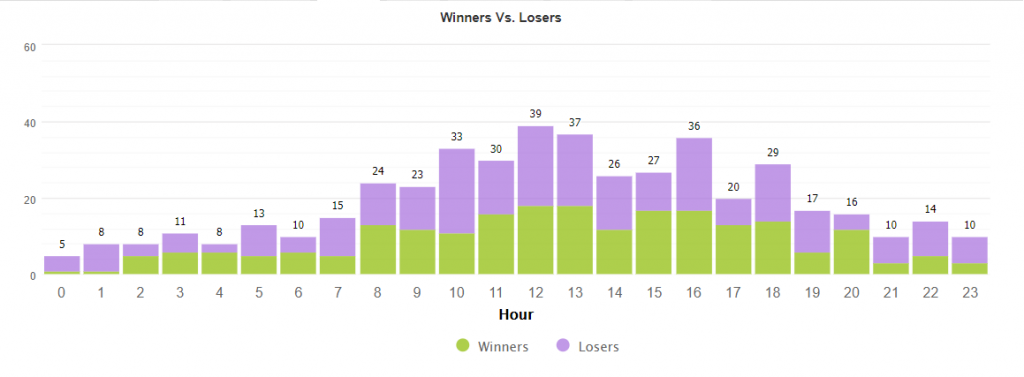

It trades mostly European and American training sessions.

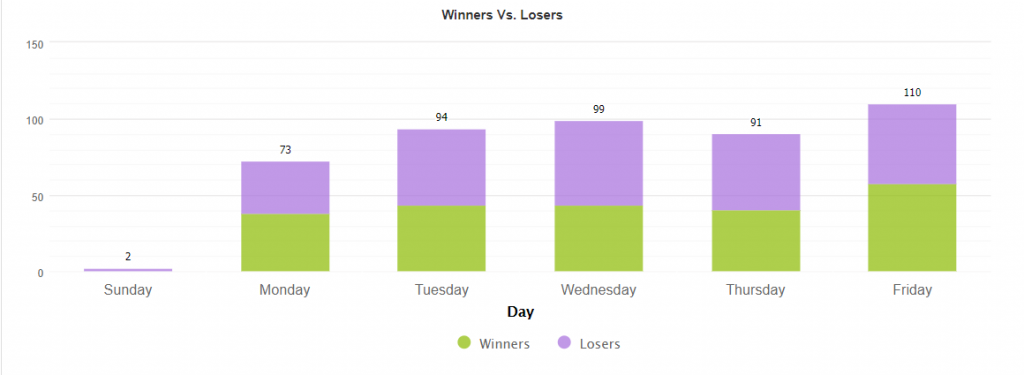

It’s weird to see Friday as the most active day of trading activities.

It tries to recover the account balance trading with sky-high risks to the account balance.

Losses are too big, and a 500 pips TP has never been reached.

If we remove a March spike, this year will be almost without profit months.

Pricing

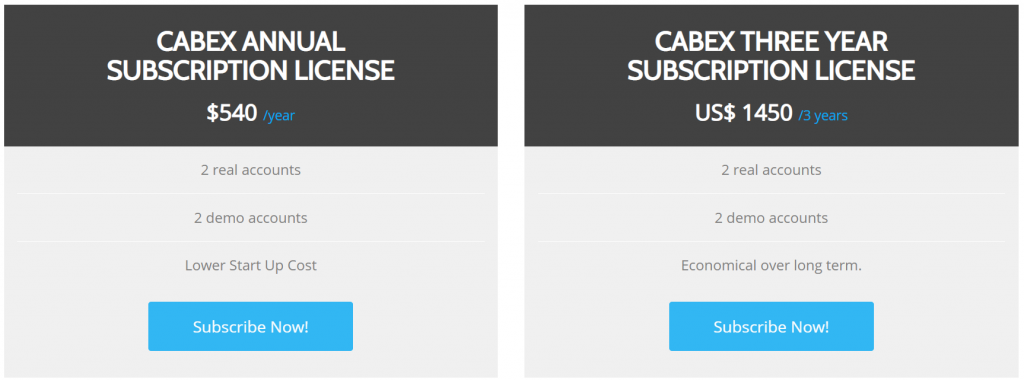

There are two packages separated by terms of subscriptions. The annual subscription will cost $540. The three-year one costs $1450. Both of them allow trading on two real and two demo accounts. The devs said that they didn’t care about the refund policy. Buying any package is a final decision.

Customer Reviews

There are abandoned trading results and forum treats that are many-years old.

According to trading results, it could make profits in 2014-2015, but now is 2020, and the EA showed that it could only waste the account running it to ground.

It’s obvious that developers don’t want to update it because a marketing period of selling it is gone. It tells much about their decency.

Paying $540 for an annual subscription for this scam robot is a wrong decision..

Leave a Reply