The price activity in forex trading always moves in a sequence of tops and bottoms. If you’ve been trying to analyze these trends of tops and bottoms, you can very well determine how the market is going to react under a given condition. Strategies are designed in trying to identify tops or bottoms to invest suitably. However, a majority of traders are taught as a rule to buy the bottom and sell the top but there is no guarantee that this kind of strategy would always work. Some seasoned traders do exactly the opposite and actually go ahead and buy the tops and sell the bottoms. Read on to understand more about this concept.

Why do Market Tops and Bottoms Draw Attention?

Forex traders use different strategies to identify the tops and bottoms with precision. New sophisticated tools and skills are discovered to study and identify these trends. The main aim is to identify the tops and bottoms as accurately as possible. All these strategies are based on a simple approach that the market trend is going to reoccur. A lot of attention is drawn by experts in predicting the market. Unfortunately, it is a known fact that the market cannot be anticipated to behave in a particular manner in the same given situation. However, to minimize the losses, it is highly recommended, one should always use these methods with caution.

The most significant forex tops and bottoms

There are a few remarkable and significant cases of tops and bottoms:

- The 1929-1933 bear market crash. Here the stakeholders expected the market to recover, presuming the era of bear has ended. However, the bear came back and the price fell down further.

- Let us take another case of the bottom in stocks in March 2009. All indicators showed that this was going for a nosedive since it was an oversold situation. However, against all odds, a few die-hard stakeholders were confident of recovery and it did prove to be an excellent recovery.

- On the other hand, in the crash of 1987, the stocks dropped by 30% in one day and it could recover only in 1990.

Why is it Dangerous to Pick Tops and Bottoms?

As the majority of traders are taught to “buy the low and sell the top”, investors are tuned to sell when the indicators show overbought and buy when the indicators show oversell. However, there is no guarantee that this kind of strategy is always going to work. Consider the following scenarios:

- Indicators show a steep decline and there has been a huge oversold. You have never seen them at such a lowest level before. So you go ahead and buy thinking it is now going to bounce back and you can make some profit. Unfortunately, the trend continues to decline. You decide to buy again thinking that the situation might improve soon. However, the trend continues and as a result, you accumulate a huge loss.

- On the other hand, when indicators show a rise and there has been a significant overbought, you go ahead and sell, thinking you can make a profit. Now you wait for the market to fall but the market behaves exactly the opposite way. It peaks again and goes further into an overbought area. So you sell some more thinking that now it would surely fall. But this time it really peaks up significantly and you end up with huge losses.

So you start thinking where did you go wrong in both the cases when you did exactly as was expected?

Who is on the Other Side of the Boldness?

As mentioned, traders tend to sell as soon as the indicators show overbought and buy when the indicators show oversell. But before entering the trade it should be clearly understood that there is nothing called overbought or oversold. It is a myth that needs to be busted because nobody has actually any control on these indicators.

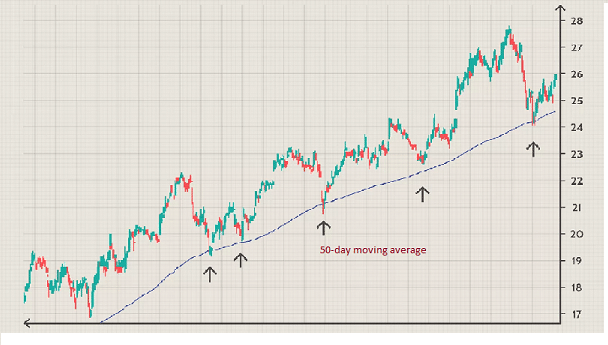

Under the circumstances, it is highly recommended that one should follow the buy/sell 50-day moving average, which is a very good and dependable trend indicator. First, you need to find where the price is in relation to the buy/sell 50-day moving average. The moving average shows a level that price is not likely to breach on a mere temporary backtrack giving a false market indication.

If the price is above the buy/sell 50-day moving average you should not be selling. You can only be the buyer. It is like going with the flow of the current instead of trying to go against the speeding truck. The opposite is true when the price is below the buy/sell 50-day moving average.

The 50-day moving average is an effective trend indicator tool in a steady market. However, it is not so effective in an erratic market. But you can cut down your losses by tweaking the time frame.

Investors who follow this method for trading definitely have an edge over the traders who stick to the “buy the bottom and sell the top” strategy. Also, the traders who have consistently been unsuccessful following other methods switch over to this method where you go with the flow of the market.

Conclusion

There is no single foolproof method in forex trading. Every method has its drawbacks and advantages. There is no one-size-fits-all answer. You will not be able to call the shots every time you enter the market. But at every entry point one should ask the following very useful questions:

- What is the one adverse news item which is going to influence the market in the near future and how long is it going to last?

- Where are the losers and the winners in trade placed?

At the end of the day, you must remember that you are in charge of your investment and your decision is going to be final. There is no need for you to always believe and depend on any sort of ‘method’. There is no such master plan which will result in success all the time. However, the buy/sell 50-day moving average has shown more consistency than other methods and it can be used for trading if you want to go with the flow.

Leave a Reply