People all over the world have been yearning to trade cryptos since the beginning of the cryptocurrency boom in early 2017. The crypto market is open 24 hours a day, seven days a week, and traders cannot monitor the charts at all times. Because the market is so volatile, cryptocurrency trading is particularly addictive. While long-term investors may not be concerned about taking advantage of such movements, other traders can profit handsomely from such volatility. Using trading bots is the solution to this issue. They aid in the automation of the process, thus reducing the burden on traders.

How do trading bots work?

Crypto trading bots are computer programs that buy and sell various cryptocurrencies at the appropriate times in order to make a profit. The top crypto trading bots gather data from a variety of sources, including social media, news sites, crypto market makers, and more. This is why they use AI and machine learning to figure out what news has a social impact and will likely have a significant impact on market pricing. Bots can be purchased as standalone software or integrated into cryptocurrency exchanges.

How to build and customize a trading bot

You may create a crypto trading bot in a variety of ways. Finding an open-source crypto bot that you can download and use right away is the cheapest and easiest option. This requires only a basic knowledge of technological concepts and helps to keep costs and development time down. However, you’ll need to add your own features, maintain development, and repair any bugs/security issues, among other things.

Using Bitsgap as an example

Bitsgap is a complete crypto trading platform that allows you to trade, maintain portfolios, use trading bots, send signals, and much more. The sign-up process will just take you two minutes because it simply requires you to verify your email address. Users can also use their Google or Facebook accounts to connect. Furthermore, Bitsgap offers a 7-day free trial during which the trader can test a number of features.

Steps

Choose the bot strategy

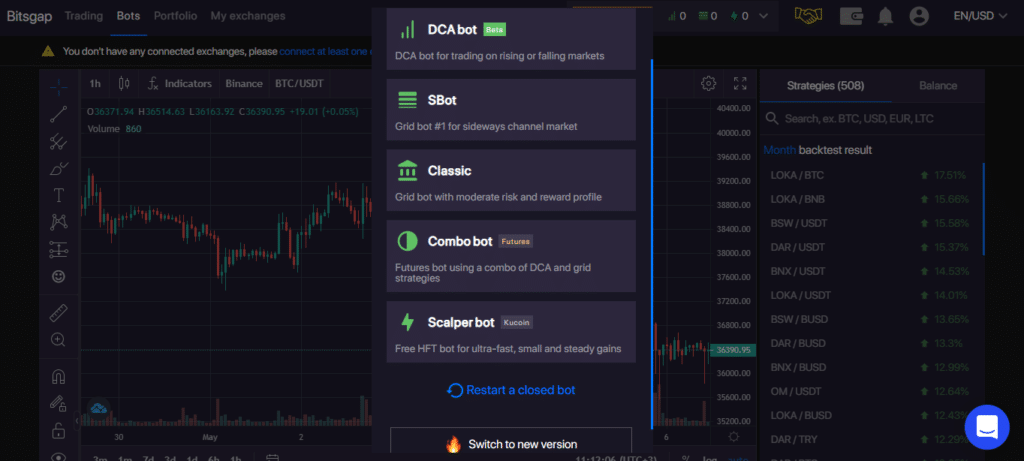

BitsGap’s bot comes with three alternative trading strategies, each with a slightly different algorithm dependent on market conditions and what you think will happen in the market.

When you sign up and log in to Bitsgap, it will redirect you to their homepage, which contains a bots option at the top right. Click the orange ‘Start new bot’ button at the top of the screen. This will bring up a drop-down menu with all of the bots that can be created. They include the Sbot, DCA bot, Combo bot, Classic, and Scalper bot.

Choose a crypto pair and link your account with one of the supported exchanges

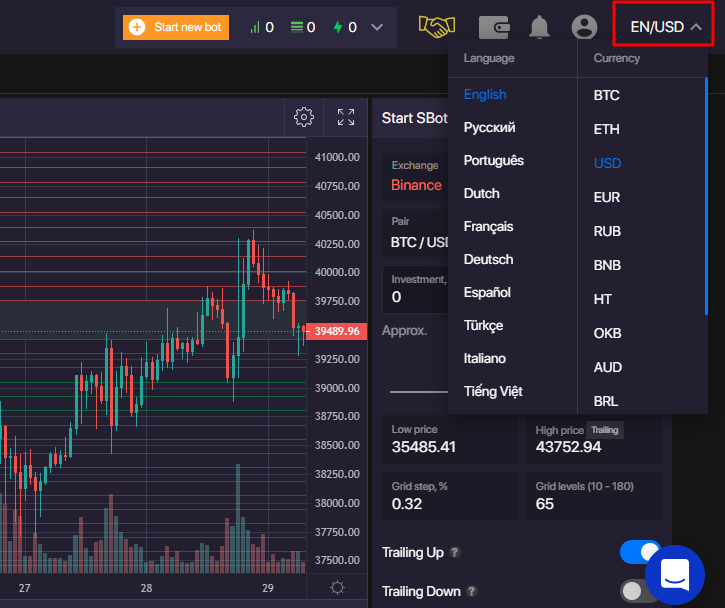

Bitsgap has over 25 major exchanges integrated, including Coinbase Pro, Binance, Poloniex, Kraken, Bitfinex, and others. You choose the exchange and link it with your API keys. You’ll also need to pick a crypto pair to trade.

Select the investment value and frequency of trading

The investment value is expressed in the system currency, which can be changed by selecting it from the drop-down menu in the top right corner of the page.

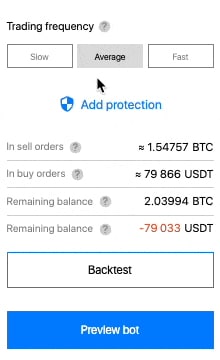

You can control how frequently the bot trades by setting the frequency of trading. There are three alternatives: slow, average, and fast.

Apply the risk management strategy

It is very important when trading crypto to have a risk management strategy. In Bitsgap, it is done by selecting ‘Add protection’, which brings up a menu with options such as take profit and stop bot.

A take-profit order is a form of limit order that specifies the precise price at which an open trade should be closed for a profit. The take-profit order is not filled if the security’s price does not exceed the limit price. In Bitsgap, you choose a percentage profit at which you want to exit the trade. The bot closes all open positions whenever the current funds reach this level. It is then assigned the Take Profit status and moved to the Spot History.

When using the stop bot option, you must provide a price below which the bot will cancel your orders.

The stop bot feature follows the price until it hits your limit, at which point it closes all active positions. The bot is then moved to Spot History and given the status of Stop Loss.

Backtesting

The Bitsgap backtesting tool actively optimizes pre-configured trading bots for bull (rising) and bear (falling) markets.

To enhance revenue and avoid risks, the team employs machine learning by examining and analyzing past data. Traders can select any trading pair based on their trading history and bot results.

Steps of building a crypto bot from scratch

- Step 1: Choose a programming language to work with

The most popular languages for crypto bot development are Python, Javascript, Perl, and C.

- Step 2: Obtain your APIs and create accounts with all of the exchanges you intend to use.

APIs provide your bot access to any exchanges you want it to trade on. APIs for accessing cryptocurrency data are available from the major cryptocurrency exchanges.

- Step 3: Choose a trading bot model, such as an Arbitrage bot.

- Step 4: Establish the bot’s architecture.

The mathematical model on which every algorithm is built must be sound. Clearly defining the type of data you want your algorithm to interpret is an important part of the process. For more complex trading models, your bot will need to be able to spot market inefficiencies and other anomalies. This implies that one of its functions will be to study historical trends.

- Step 5: Creation

You can begin coding after you’ve outlined the architecture of your bot. Naturally, this is the most time-consuming aspect of the procedure.

- Step 6: Testing

Testing has two purposes. The first one is to ensure that your bot works properly and can handle the kind of data variations that will be thrown at it. The second one is performance fine-tuning. This is accomplished by optimizing the type of behavior you want your bot to display.

- Step 7: Live deployment

At least for the first few months, constant monitoring of your bot’s performance is highly suggested. After that, you should be able to trust your bot to work on its own without much oversight.

Summary

Assessing markets in search of trading opportunities is time-consuming and very involving. A trader’s ability to pay attention during trading time is practically impossible, which is why the majority of them choose to use bots. You can customize a bot using an open-source tool like Bitsgap, or you can create one from scratch using the steps we’ve discussed.

Leave a Reply