- BTCUSD rallies 15% above $40,000

- Western sanctions on Russia fuel Bitcoin demand

- Bitcoin equities direct correlation slowly ending

Bitcoin has bottomed out after trading below the $40,000 psychological level over the past ten days. The flagship cryptocurrency popped by more than 15% on Monday, fuelled by a number of factors that continue to elicit strong crypto demand.

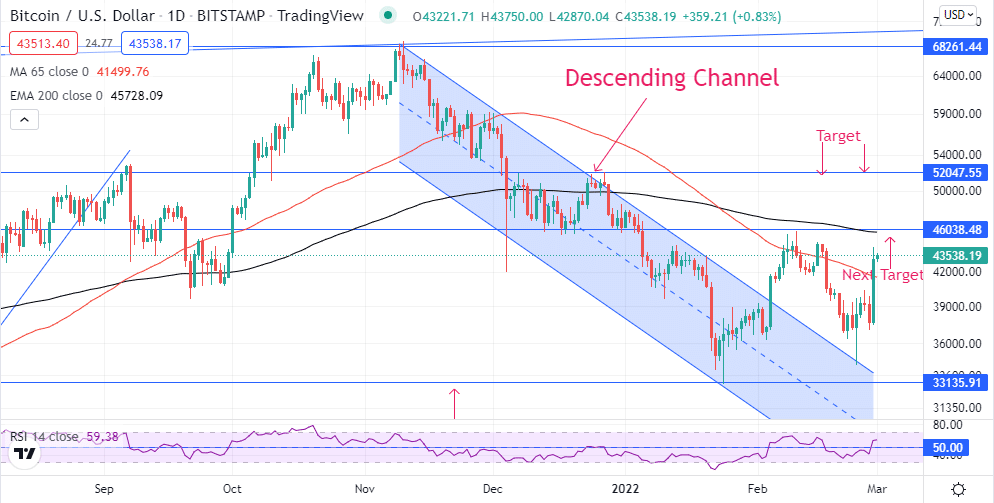

BTCUSD technical analysis

BTCUSD closing and finding support above the $40,000 level has reignited hope of a potential bounce after a recent sell-off to one-month lows of $34,387. Short seller’s failure to steer a drop below the $33,000 handle is once again fuelling suggestions of waning downside pressure.

In addition, the Relative Strength Indicator has risen above the 50 handle, signaling a buildup in buying pressure. Amid the renewed bids on the flagship crypto, bulls are staring at strong resistance near the $46,038 handle.

Failure to rally and close above the key resistance level could reignite sell-off or trigger consolidation in a range above the $40,000 handle. A rally past the $46,000 handle should fuel a rally to the $50,000 handle.

Why is Bitcoin rallying?

Bitcoin and other top cryptocurrencies have been boosted by Western sanctions on Russia, fuelling investor interest in alternative assets. It has emerged that the dropping of Russia from the SWIFT network is forcing Russian citizens to switch to other alternative systems such as crypto to complete cross-border transactions.

Cryptocurrencies have emerged as a safe haven during the challenging times triggered by the Russia-Ukraine standoff. The western sanctions intended to cripple the Russian economy have only left the country isolated, causing its national currency to plunge by more than 30%.

Faced with the rubble that is losing value against the major currencies, Russian citizens have flocked banks, withdrawing their money and putting them into other assets as a way of protecting their wealth. While most of the amounts have ended up being invested in the US dollar given its reserve currency status, some have also opted to convert their holdings into Bitcoin, consequently fuelling a rally on BTCUSD.

Russia strong crypto uptake

Immediate reports indicate that Russian citizens have up to 12 million cryptocurrency wallets. The wallets hold close to $23.9 billion in crypto. Russia being the third-largest country in the world on Bitcoin mining, might also explain why many are moving their wealth into cryptocurrencies as a store of value and hedge against uncertain times.

The recent uptick in Bitcoin demand follows a massive sell-off from record highs fuelled by a number of factors, key among them being the risk-off mood in the market. Bitcoin was one of the hardest-hit alternative assets, as investors started shunning riskier assets amid the Russia and Ukraine conflict escalation.

Bitcoin-equity correlation

US equities have come under pressure retreating from record highs amid concerns about the long-term impact of the ongoing conflict. While cryptocurrencies have been trading in tandem with the equity market, Bitcoin has ended up paying a hefty price amid broader sell-off in the capital markets.

However, it appears the direct correlation between equities and cryptocurrencies is slowly coming to an end. With equities still under pressure, cryptocurrencies have started bottoming out despite the risk-off mood being in play in the markets.

The rally from one-month lows also appears to be fuelled by dollar weakness fuelled by retreating treasury yields. Yields have started edging lower amid concerns that the Russia-Ukraine conflict could force the US Federal Reserve to go slow on aggressive monetary policy tightening.

As it stands, Bitcoin should remain on the front foot in the short term as Russian citizens turn to alternative assets to shrug off the impact of the western sanctions.

Leave a Reply