- BTCUSD Powers through $43,000.

- ETHUSD turns bullish above $3,000.

- Cathie Wood touts Ethereum and Bitcoin.

- KPMG makes crypto investments.

Bitcoin and Ethereum are on to a good start in the market, helped by a spike in risk-on trade. Bullish sentiments from the likes of Ark Investment CEO Cathie Wood and KPMG Canada also continue to support a bounce back after the recent deep pullback.

BTCUSD technical analysis

BTCUSD is one of the pairs flying high after bottoming out of 7-month lows. The pair has already powered through the $40,000 handle, which has emerged as short-term support, above which the flagship cryptocurrency remains bullish.

Short-term resistance likely to curtail upside action is at the $44,400 area. A break above the level could pave the way for bulls to steer a rally to highs of $48,300 on its way to the $50,000 handle. Failure to find support above the $45,000 level could leave Bitcoin susceptible to a pullback to the $40,000 area.

Factors driving BTCUSD

The uptick from lows of $33,500 has been fuelled by a number of factors, key among them being the confirmation that Tesla did not sell all its BTC holdings last year. The electric vehicle giant says it held nearly $2 billion in Bitcoin as of the end of last year.

Accelerating the upside action on Bitcoin is recent positive rhetoric by Ark Invest CEO Cathie Wood. In the latest episode of the firm’s “In the Know” Podcast, the CEO reiterated that Bitcoin and Ethereum are great assets for portfolio diversification following the correction from record highs. According to Cathie Wood, the low correlation between cryptocurrencies and other assets makes them ideal for diversification purposes.

A build-up in institutional investors taking a strong interest in cryptocurrencies also fuels the recent uptick in price after the steep pullback. KPMG Canada, a member of KPMG International Ltd, is the latest to add Bitcoin into its portfolio.

With the addition, the firm says it is committed to emerging technologies and asset classes. In addition to investing in Bitcoin, the firm has also reiterated its commitment to other digital asset classes as part of a diversification spree.

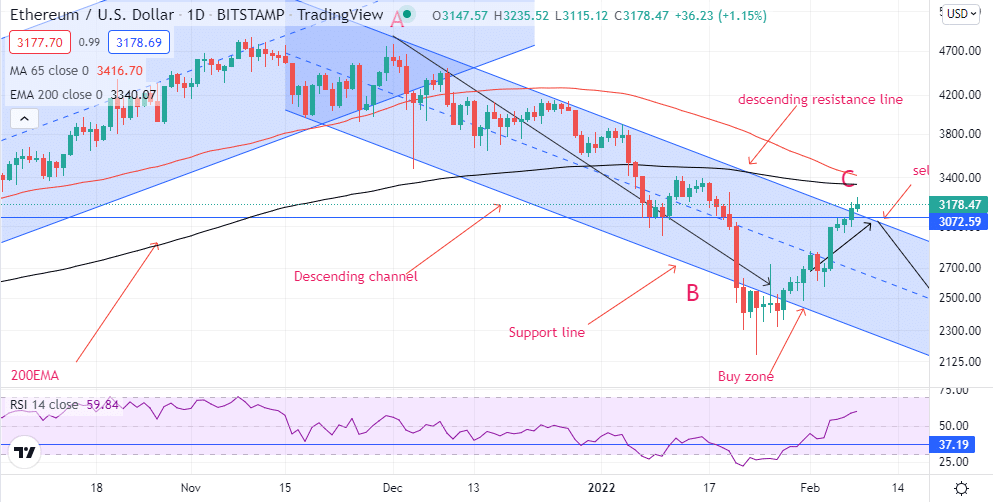

Ethereum price analysis

Meanwhile, Ethereum has also followed Bitcoin in powering high as bulls flock to the second-largest cryptocurrency. ETHUSD has already found support above the $3,000 level after rallying to highs of $3,180.

Over the past week, BTCUSD is up by more than 20% after bottoming out of 7-month lows near the $2,200 area. BTCUSD finding support above the $3,000 level should reignite hopes of further price gains to highs of $3,800. On the flip side, a drop below the psychological level could trigger renewed sell-off

Ethereum, just like Bitcoin, has also benefited from positive rhetoric around cryptocurrencies. Cathie Wood, seeing it as a great asset for diversification, continues to affirm the crypto sentiments, especially after the recent deep pullback. KPMG Canada investing in the coin has also strengthened its sentiments, helping attract more retail traders following the recent deep pullback.

Bitcoin and Ethereum Outlook

Looking ahead, regulatory uncertainty could curtail Ethereum and Bitcoin price moves. China and Russia resorting to a tough stance against crypto trading and mining is one factor that could trigger pullbacks following recent bounce backs.

Additionally, the dollar strengthening across the board with the imminent rate hikes in March could also come to bite the two cryptocurrencies. In addition, the two have had a direct correlation with stocks, rallying with the stock market posting strong moves to the upside. It is unclear whether the correlation is still in play and whether it will hold for long.

Leave a Reply