Decisions by world powers decades ago continue to shape the modern finance and economics industry. Some of the accords’ impacts are being felt and should be felt for many years to come. The Bretton Wood Agreement is one such momentous agreement that has shaped the two industries a great deal.

Before World War 1 gold was the preferred standard of exchange for international trade, as the war progressed, most countries ended their ties with the standard as they opted to print more money to finance war costs.

The result was severe hyperinflation. While the nations did return to the yellow metal standard after the war, there were calls for a new structure that would offer more flexibility than contending with the bullion standard at the time.

New standard

The watershed moment came into being after World War II as economic powerhouses were faced with a standard exchange structure challenge. As the war came to an end, the financial policies had to change.

Conversely, some of the biggest economies at the time assembled in Bretton Woods, New Hampshire, in 1944. The goal was to work on a new model that would standardize exchange rates. Participants agreed to replace the precious metal as part of the changes.

Besides, countries came together with the sole aim of doing away with the rigidity of previous monetary systems. The idea was to develop a new model that would address a lack of cooperation among nations. Similarly, they sought to replace the precious metal, which had been abandoned after World War 1.

Likewise, the nation’s sought to develop an international monetary system that would ensure stability in exchange rates. The new arrangement was also to address competitive devaluations that had clobbered the global financial ecosystem at the time.

Reaching a consensus on the goals of the new monetary system was no easy task. Preparation had begun two years before the main conference, with financial experts from the 44 countries holding countless bilateral and multilateral meetings.

The Bretton Wood Agreement

Finally, an agreement was reached. The new system, comprising a set of rules, enabled the creation of a fixed conversion mechanism. Similarly, the IMF established a fixed rate of fiats. Every participating nation had to uphold the prevailing rate with narrow margins up and below.

Countries that struggled to maintain the fixed rate could petition the institution to adjust it, which the other states would have to follow.

The US dollar was propelled and became the base for international transactions. Its value was set at 1/35 an ounce for gold as the North American nation accounted for a good chunk of the precious metal reserves.

Participating nations came to a consensus and agreed to redeem their legal tenders for the greenback and not gold henceforth. The result was strong demand for the buck even as its value with the precious metal remained the same. As the new system came into being, all currency conversion had to emanate from the greenback.

Also, the International Monetary Fund came into being set up to oversee exchange rates and offer loans. The World Bank came into, as well, tasked with providing the loaning funds that were to be used to rebuild some of the most affected areas of the war.

The collapse

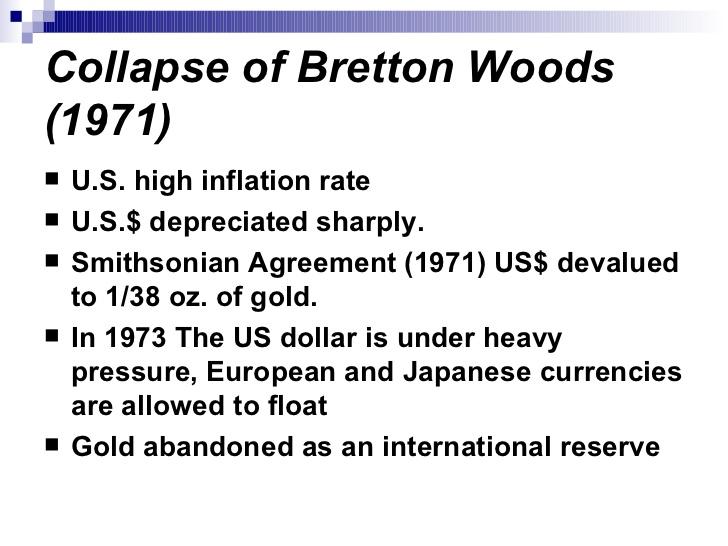

The collapse of the Bretton Wood System was mainly triggered by a US financial crisis between 1971 and 1973. During this period, the supply of the US dollar overseas increased significantly, exceeding the total gold reserves that the economic powerhouse held.

With dollar supply exceeding the bullion reserves, the system became untenable as other powers started questioning its value as a global currency. Under President Richard Nixon’s leadership, the US tried to mend the situation by cutting the buck value by 1/38 of an ounce of bullion.

That did not work. The President went forth and cut the dollar value to 1/42 of an ounce of gold, but it still did not help calm the situation. As the buck value started declining, people began converting their holdings into gold, awaiting further devaluation.

Nixon was forced to end the convertibility between the bullion and the buck. The breakdown of the connection between the two marked the end of the Brentwood Woods Accord. With the collapse of the currency, conversion resorted to free-market exchange rates.

The last nail on the coffin was that most of the currencies had already started to float freely as part of the system. While some countries did try to revive it, it eventually collapsed as nations resorted to allowing forces of supply and demand to determine the conversion rates.

However, the IMF and the World Bank remained intact and continued to perform their role as mandated at inception.

The aftermath

Countries no longer peg the exchange rates of their native currencies to the dollar. Likewise, gold is no longer relied upon as the standard of exchange. The collapse meant the IMF had to assume a much bigger role in stabilizing the global financial ecosystem.

The institution was tasked with designating reserve currencies on which most international trades and transactions take place. On the other hand, the World Bank plays a pivotal role in providing the much-needed financing that helps accelerate growth in member states.

Conclusion

Amid the collapse, the Bretton Woods Accord served a much bigger role. For starters, it helped unify 44 countries at a time when there was great division emanating from World War II. In addition, it helped solve a financial crisis that threatened the global economy at the time, given the lack of a standard currency conversion mechanism.

However, the biggest role was helping strengthen the global economy, fuelling an expansion from a recession. Besides, it helped maximize international trade as different countries with varying currencies could participate, given the availability of a fixed exchange rate.

Leave a Reply