Botsfolio auto trades multiple cryptocurrencies without the need for active monitoring. The bots are best suited for traders with limited coding skills because users do not need to customize their algorithms. It currently supports Binance, Coinbase Pro, and FTX. This review will discuss how the platform works, its profitability, and its security so you can make an idea on the investment.

First Botsfolio quick summary

Botsfolio does not have any access to traders’ funds. It employs risk management analysis to ensure traders do not lose their funds in a single trade. This table will point out the pros and cons of using this algorithm.

| Upsides | Downsides |

| Botsfolio is fully automatic | It supports only three cryptocurrency exchanges (Binance, Coinbase pro, FTX) |

| It is beginner-friendly and requires no coding skills | Payment is possible only in cryptocurrency |

| The platform charges a 15% fee on profits quarterly |

| Platform Reliability: | 3/5 |

| Pricing: | 2/5 |

| Ease of Investment: | 3/5 |

| Customer Support: | 2/5 |

| Exchanges Supported: | 2/5 |

What is Botsfolio?

Botsfolio is developed for 24/7 crypto trading without the need to actively configure the bot. It will automatically recommend the best trading strategy according to the trader’s needs. As mentioned before the algorithms are incorporated with risk management intelligence.

How does Botsfolio generate profits?

Traders can use one of the four strategies from the platform according to their requirements: value investing, hedged trading, futures trading, and fixed income. The bot will automatically select the best investment policy based on the investors’ financial goals, which are determined from a previous Q/A survey. The developer does not provide any guarantee of profits.

Safety and security

Botsfolio is a safe bot, as it has no control over traders’ withdrawals or deposits. The bot does not transfer any funds, and the account or assets are only in the investor’s control. Exchanges can be connected via encrypted API keys, ensuring that your investments are safe.

How Botsfolio’s pricing works

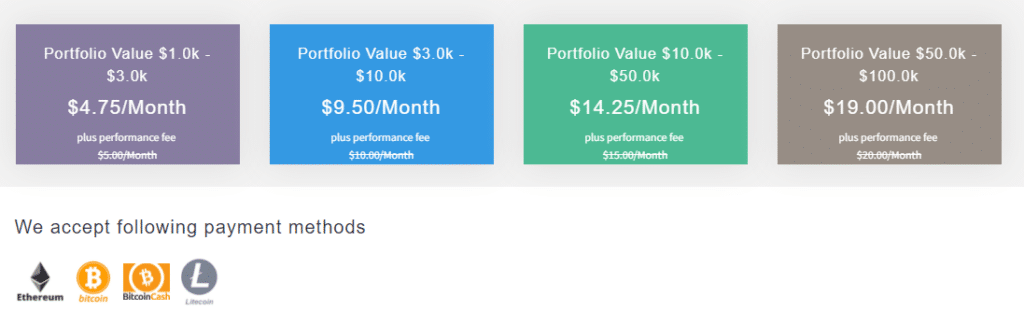

Botsfolio offers four pricing plans which can be paid per month and it is based on the user portfolio. They deduct a performance fee of 15% quarterly on profits. The cheapest subscription is for $4.75/month+ performance fee, and the maximum is $19/month.

Botsfolio only accepts payments in cryptocurrency and currently supports Bitcoin, Ethereum, and Litecoin.

Available exchanges

Botsfolio supports a few cryptocurrency exchanges listed below:

- Binance

- Coinbase Pro

- FTX

How long has Botsfolio been in business?

There is no information about the foundation of Botsfolio, its developer, or current team members. The only info given is that it is under KribX Inc, based in the USA. The lack of transparency raises concerns about the platform.

How to get started with Botsfolio?

To get started with Botsfolio, register on the platform by setting up a password and account. After signing up, decide on investment goals and answer a few questions to get an idea about investing in cryptocurrency. Link the API keys with the exchange and start trading in the market.

Customer support

Botsfolio offers minimal customer service with only an email for support and marketing queries. The platform lacks a live chat option and a phone number.

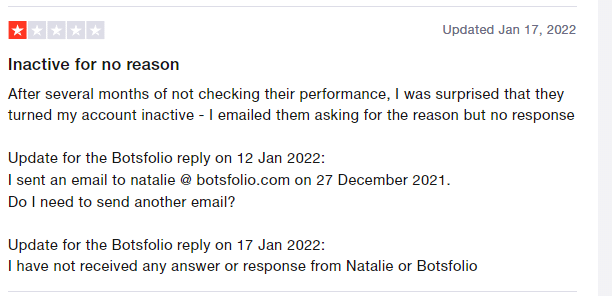

Client feedback is present on TrustPilot, where a trader states that the bot was inactive and the developer did not respond to his queries.

Botsfolio does not provide live tracking for their robots through reputable performance tracking platforms. The pricing plans are costly, and payments are accepted only in BTC, LTC, and ETH. Also, there is no information on the vendors, and there is less information about the company's whereabouts.

Leave a Reply