On July 4, 2019, Reuters ran the following headline, “Sliding government bond yields keep dollar and euro under pressure.” A few paragraphs under the headline, the publication explained that increasing bond prices were pressuring the world’s most valuable currencies toward lower prices.

If you were keen enough while reading the above paragraph, you must have noticed some kind of relationship between bond prices and currency movements. But there is more to it. The paragraph also mentions bond yields, and it seems they relate differently with bond prices. We can therefore deduce that bond yields and bond prices affect currency pairs differently.

Well, the two paragraphs you have just read might read like complex financial jargon, especially if your understanding of forex and bond markets is at beginner-level. Thankfully, we shall spend the rest of this piece cutting through the complexity for your benefit. Read on!

Bond prices and yields

A bond is a tradable financial instrument that an obligor uses to raise funds from financial markets. Both public and private institutions can issue bonds, in which case you will find public bonds and private bonds (usually referred to as corporate bonds).

Although one might view a bond simply as a debt, it is a special kind of debt. The issuer takes money from holders and promises to pay it back in full at an agreed date – usually more than one year. In the meantime, the obligor will pay the bondholder a percentage of the bond’s face value at certain regular intervals.

Bonds take years to mature, and some holders might not want to sit on them for that long. The investors can sell the bonds on secondary markets, which implies that bond prices fluctuate often. Therefore, the price of a bond is the amount an investor on the secondary market is willing to pay to acquire the debt.

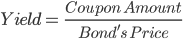

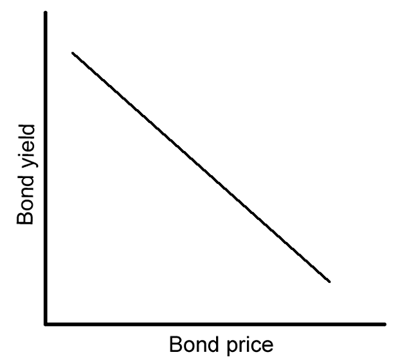

Yields, on the other hand, is the ratio of the bond’s interest amount (also called coupon amount) and the prevailing price. We can represent a bond’s yield using the following formula:

Looking at the formula, several things become clear. A higher bond price reduces the bond’s yield. When the denominator grows bigger, and the numerator (coupon amount) remains constant, the quotient (yield) becomes smaller. In technical terms, we can describe the relationship between bond prices and bond yields as inversely related.

Bond prices and yields vs. interest rates

The prevailing interest rates affect the bond’s price and, by extension, its yield. Let us see how interest rates affect prices first.

Recall that bonds are long-term assets, but investors have the option of selling on the secondary market. The interest rates in an economy play a pivotal role in pricing a bond. Issuers take the prevailing interest rates into account when determining the bond’s par value.

Say interest rates climb higher compared to the prevailing interest rates when the issuer floated the bond. In such a case, it means issuers who float new bonds will set the coupon rates a little higher than the existing bonds’ coupon rates. Therefore, buyers would rather wait for the new bonds than buy the existing ones, which drives down their prices.

Let us see an illustration for a better understanding.

A company is offering a corporate bond that pays 7% in coupon rate at face value of $30,000. You buy the bond, and after a short while, the central bank adjusts interest rates higher to 9%. For this illustration, we shall assume that the coupon rate is equal to the prevailing interest rate.

In this scenario, buyers find your bond unattractive because new bonds offer a higher coupon rate of 9%. For you to sell, you will have to accept a loss, say 92% of the face value. This means you will have to sell at $27,600 (30,000 x 0.96 = 27,600).

What if the interest rates fall to 5%? Here, your bond’s coupon rate will be higher than new bonds that issuers might float. Therefore, many buyers will want to buy your bond at a premium, meaning you gain some profit from the sale.

Say the bond’s price rises to 105% of face value. Here, the bond’s selling price will be $31,500 (30,000 x 1.05 = 31,500).

How yields impact currency movements

Many governments rely on bonds to fund critical functions and projects. Each country’s bonds have different yields because of different interest rate regimes. The difference between bond yields of different countries is what investors call bond spreads. Higher spreads mean one country’s bond yields are far higher than the other.

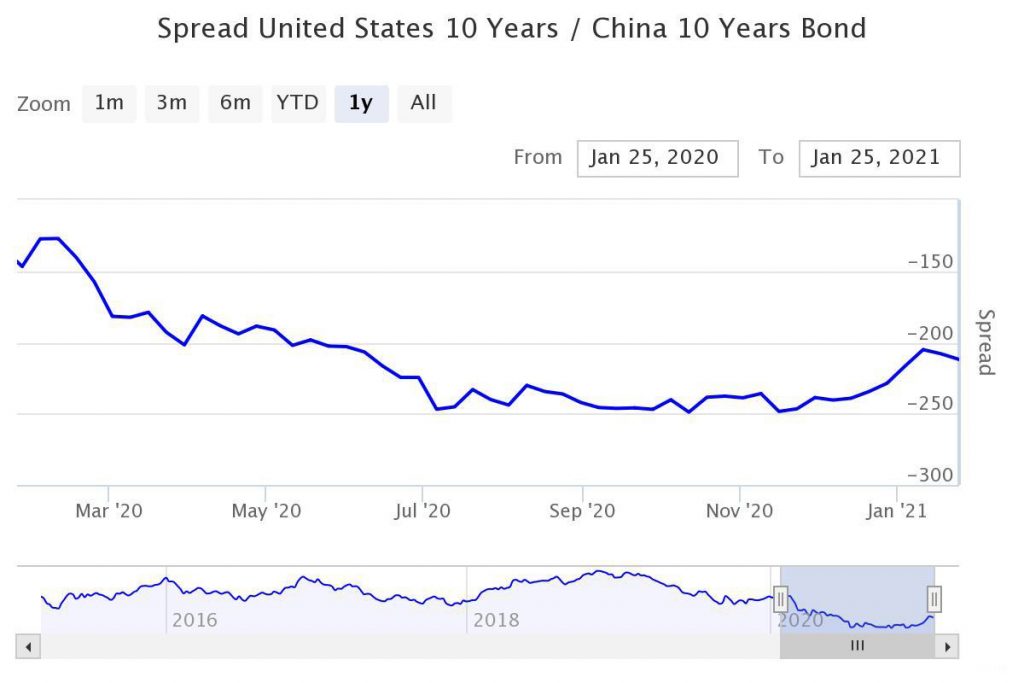

Let us illustrate this relationship with the help of the USA and China. Over the past year, the spread between the United States’ 10-year bonds and China’s 10-year bonds has been shrinking, specifically during the thick of the coronavirus pandemic. The thinning of the spread flattened and started to rise at the tail-end of 2020.

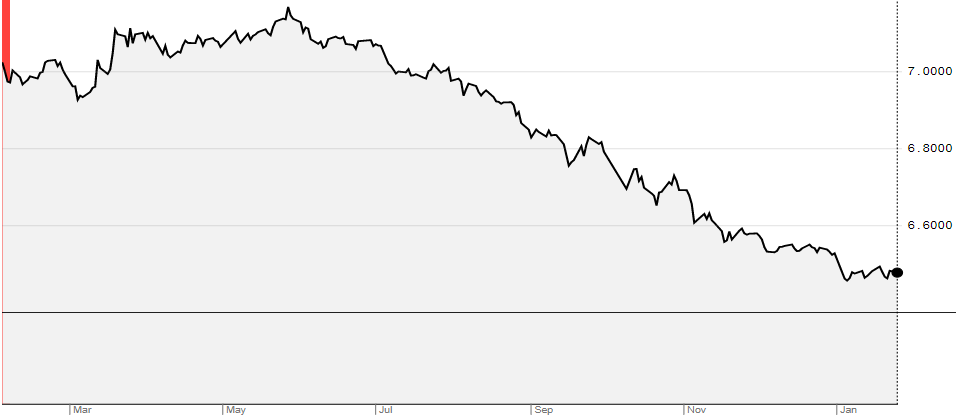

Meanwhile, the Chinese yuan firmed up against the US dollar for much of the period. How does this relate to the bond spreads?

The US 10 years bonds and China 10 years bonds yields behaved differently during the past year. On the one hand, the US 10 years bonds’ yields fell for most of the period while the opposite happened for the China 10 years bonds yields.

The higher bond yields in China attracted hot money flows, pushing up the CNY’s value against the USD. China reopened its economy early, and it is the only country that registered economic growth in 2020. Perhaps, the influx of capital into the country’s bond market was a vote of confidence in the economy. At the same time, the US was on edge following a disputed Presidential election and escalating coronavirus deaths.

Conclusion

There is a close connection between the global bond market and the global forex market. Events in one market generate strong waves that upset prices in the other market. For instance, high bond yields in China versus the US attract investors who are hunting for better returns. As a result, the higher demand for the Chinese yuan tilts the scales in its favor against the US dollar.

Leave a Reply