Bonanza EA is a Forex trading system that was launched on 14th August 2021. The seller claims that the system is perfect for long-term traders. However, in order to determine the true profitability of this robot, we must conduct an in-depth analysis of its performance factors and analyze the trading results.

Detailed Forex robot review

Since there is no official website for this expert advisor, we need to consult the MQL5 website to get all the information on it. On the product page, the vendor has given us a short introduction to the robot, followed by a list of vendor recommendations and features. We also have the link to a live signal for this EA, and another list outlining the EA settings. The presentation does not look very professional and some important information is missing.

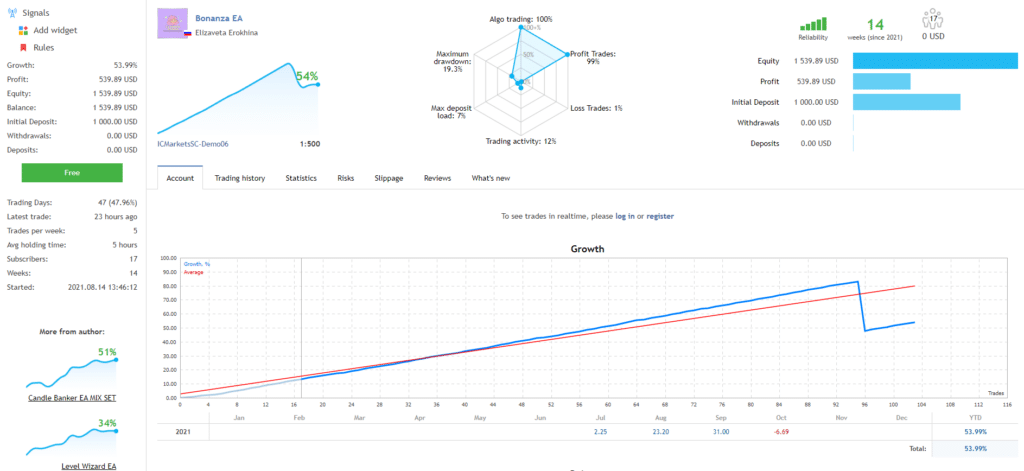

Bonanza EA is a product from Elizaveta Erokhina, a developer who is based in Russia. There is virtually no information available on this person, so we don’t know whether we are dealing with a reliable seller. The vendor has shared their email address but we don’t know anything about their service history. Other EAs sold by this person include Tiburon EA Level Wizard EA, and Candle Banker.

Bonanza EA trades exclusively in XAU/USD. It uses filtering techniques to find entry and exit points. Since the vendor has not explained the techniques, we don’t know how accurate the entries and exits are. With each trade, it uses take profit (TP) and stop loss (SL).

The minimum deposit for this EA is $300. The vendor recommends using it on H1 charts. Also, you should sign up with an ECN broker. Bonanza EA does not use trading strategies like grid and martingale. You have the option of trading with a fixed lot size or enabling the AutoLot feature to let the EA calculate the lot size.

There are several parameters in the EA settings that you can modify to suit your trading style. You can set the period and the timeframe for the moving average and select the applicable price. It is also possible to set the start time and the stop time.

Bonanza EA strategy tests

Bonanza EA uses price action algorithms in combination with an indicator created by the author. Since they haven’t explained how this indicator works, we cannot determine how effective the strategy really is. Information related to the trading scheme is important since it reveals how the robot analyzes the trend and how it looks for profitable opportunities. The lack of strategy insight is a major red flag and it will cause most traders to shy away from this system.

Unfortunately, we don’t have the backtesting results for this expert advisor. Backtests are conducted over a long time period, thus revealing the ability of the robot to deal with different market scenarios. Although historical performance does not always translate into live results, many traders look for backtests before investing in a system.

The vendor hasn’t shared any links to verified trading accounts for Bonanza EA. Seasoned traders always look for trading statistics verified by third-party sources like Myfxbook, FXBlue, and FXStat. While we have the trading results presented on MQL5, we cannot consider them authentic.

This account has a short trading history of 47 days. During this time, the EA has conducted 103 trades, winning 102 out of them. This means it has a win rate of 99.02%. To date, the total profit generated through this account stands at $539.89. The maximum drawdown is 19.3% while the profit factor is 2.53.

Pricing

Currently, you can purchase Bonanza EA for $600. This is quite expensive for a newly-launched EA and not any people will be willing to spend this much. There are two rental options available for this system. The first one lets you use the EA for 1-month in exchange for $399 and for the 3-months rental plan, you need to pay $499. Although a free demo version of the system is available for download, there is no money-back guarantee.

Customer reviews

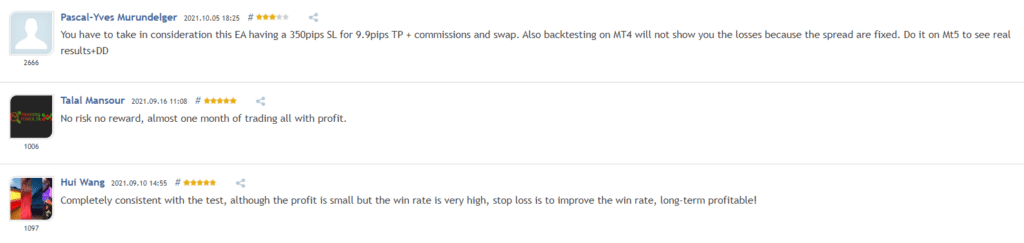

There are no user reviews for this EA on third-party websites. We cannot trust the reviews posted on the MQL5 product page.

There is no way you should invest in an unproven system like Bonanza EA. It has no verified trading accounts and the vendor has not shared the results for the backtest. We don’t know what trading strategy this EA uses, and it is highly likely to be a scam.

Leave a Reply