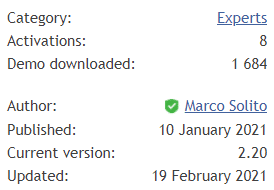

Blueshift was designed by Marco Solito and released on the MQL5 site on January 10, 2021. The last version (2.20) was published a month and a half ago.

Detailed Blueshift Robot Review

There are many features and settings explanations published. Let’s figure out what can be useful for us:

- The robot can open and close deals automatically for us.

- The system is designed around a trend strategy that just simply follows the market, making little profits.

- It works with trading metals such as Gold and Silver.

- The main time frame to work on is M15.

- It works with “Wpr and Ma Indicators” to trade trends and get ready for counter-trend opportunities.

- The robot runs intraday orders.

- It performs trades with approximately 90% accuracy. It’s proven by verified trading results.

- The robot was tested on the M15 time frame as well.

- It places Take Profits and Stop Losses for each open trade to cover it from the periods when the market goes wild, especially during the high-impact news during the European and American sessions.

- The system is free to go with any broker house.

- An ECN account is a good option to increase system stability and profitability.

- The minimum leverage can be set at 1:10.

- We should have at least $100 on our trading account.

- There are not so many settings to customize the system according to our trading style.

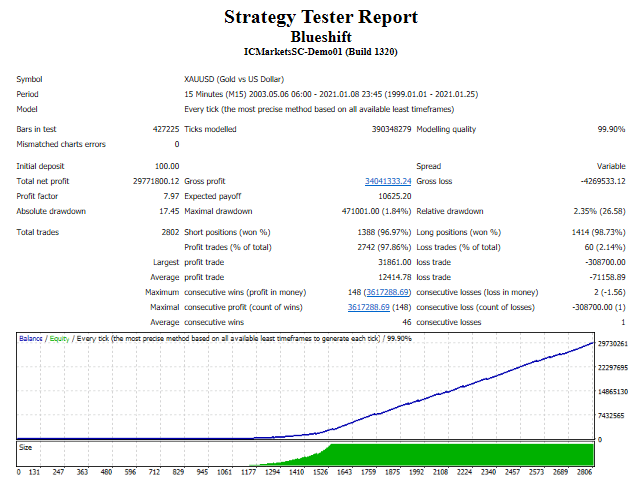

Blueshift Strategy Tests

There’s an XAU/USD (Gold vs. US Dollar) backtest provided. The time frame was set M15. The data was chosen from 2003 to 2021. The modeling quality was 99.90%. The spreads were varied (real ones). An initial deposit was $100.00. It has amounted to $29,771,800.12 of the total net profit. The Profit Factor was 7.97. It’s a solid number for any backtest. The maximum drawdown was insanely low, and that’s great – 1.84% ($471,001.00). Blueshift has traded 2802 deals with a 96.97% win-rate for Short and 98.73% for Long trading positions. The win-streak was huge – 46 deals.

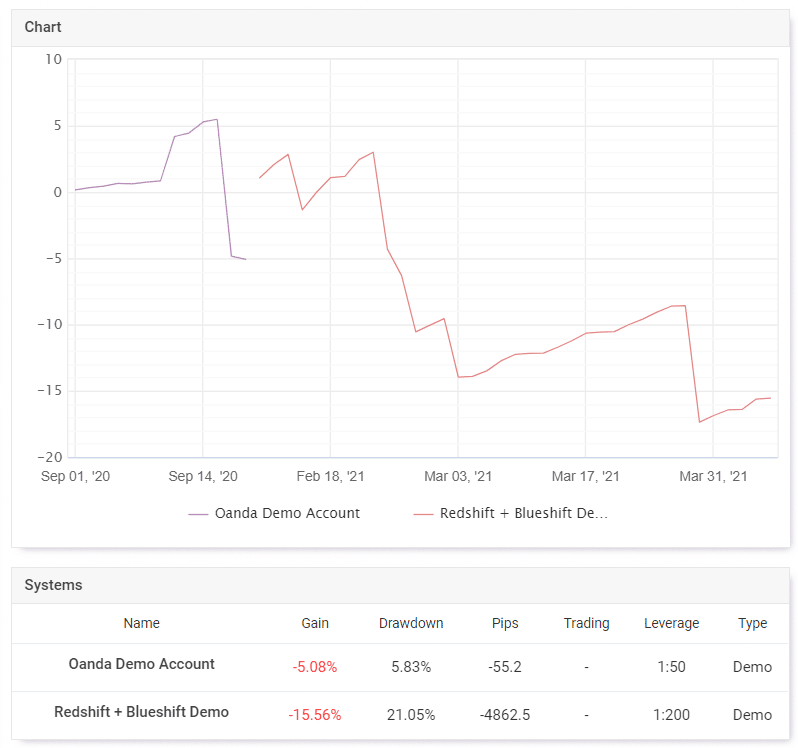

Real Account Trading Results

After March 2021 losses, the Blueshift account has been removed from listing on myfxbook.

We have only a mix of Redshift and Blueshift left with horrible results.

The robots run a demo USD account on IC Markets automatically with 1:200 leverage on MT4. The account has a verified track record and verified trading privileges. It was created on February 10, 2021. Since then, the absolute gain has become -15.56%. An average monthly gain is -8.75%. The maximum drawdown is 21.05%.

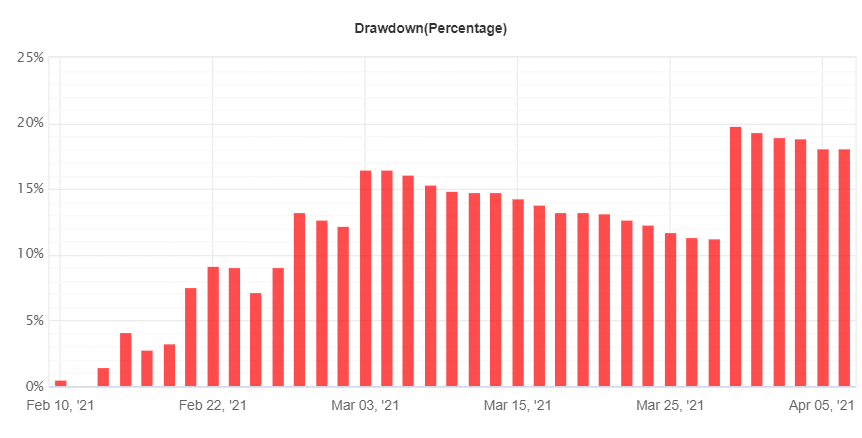

The drawdowns are high and consistent.

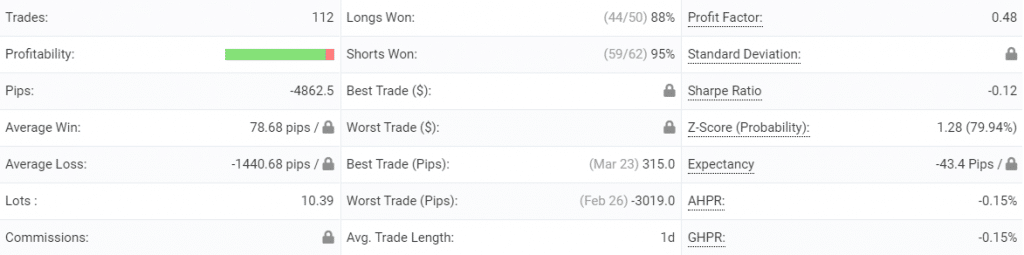

There were 112 deals with -4862.5 pips traded. An average win in pips is 78.68 when an average loss is -1440.68. The Long position’s win-rate is 88% when the Short position’s win-rate is 95%. An average trade length is one day. The Profit Factor is horrible – 0.48.

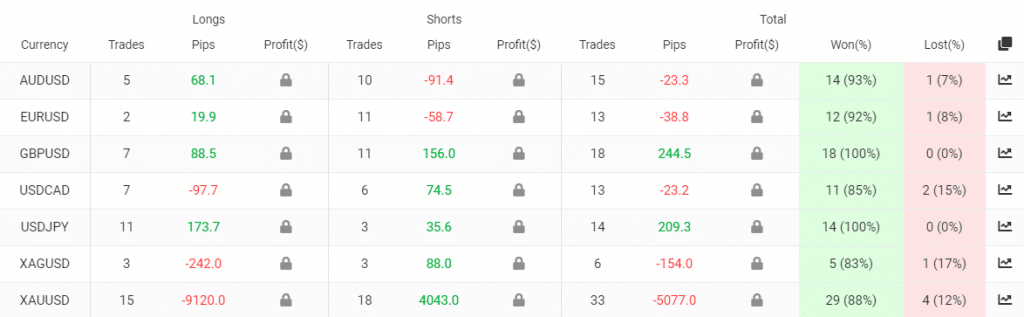

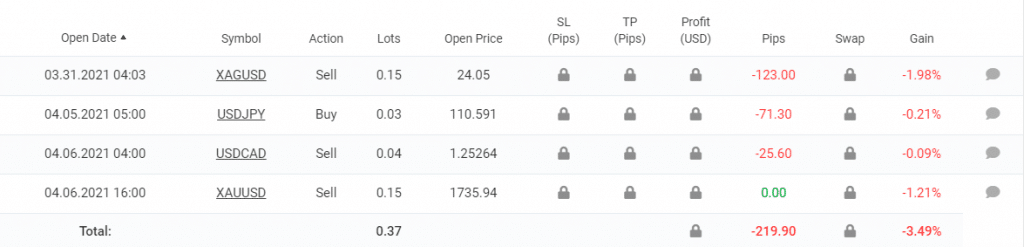

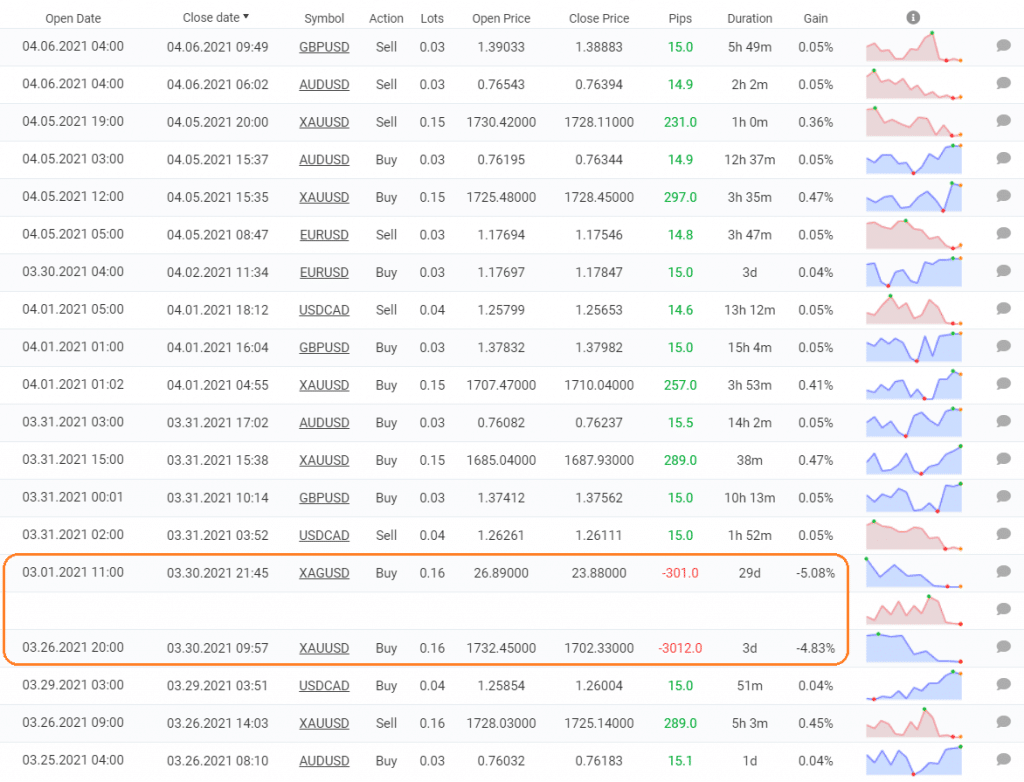

XAG/USD and XAU/USD are Blueshift symbols. As we can see, both of them have brought significant losses (-154 pips and -5077 pips).

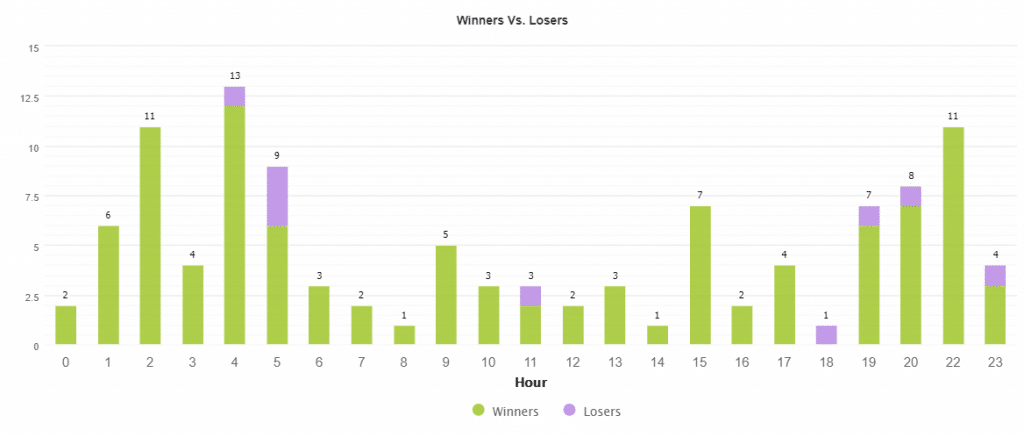

The robots focus on trading during American and Asia trading sessions.

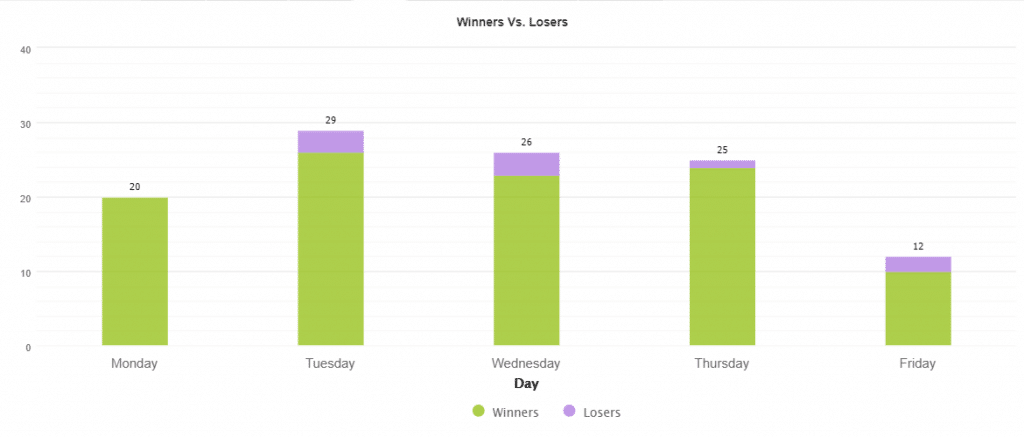

Tuesday is the most traded day with 29 deals closed.

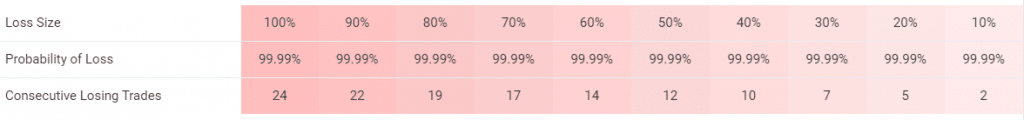

The system trades with insanely high risks to the balance. To lose 10% of the account, the system has to lose only two deals in a row.

There are some deals sitting in the drawdowns.

The last two significant losses were obtained on Gold and Silver that are under Blueshift management.

Pricing

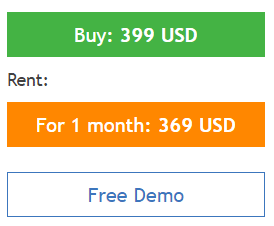

The system can be bought for $399. We’re not sure this offer is fair. There’s a single scam-like rental option for $369. Why scam-like? Usually, a one-month subscription costs from 10% to 30% of the lifetime price. One-month subscription with 8% OFF is a scam. It means the developer isn’t interested in providing investors with an opportunity to try it. The system can be Demo downloaded for free.

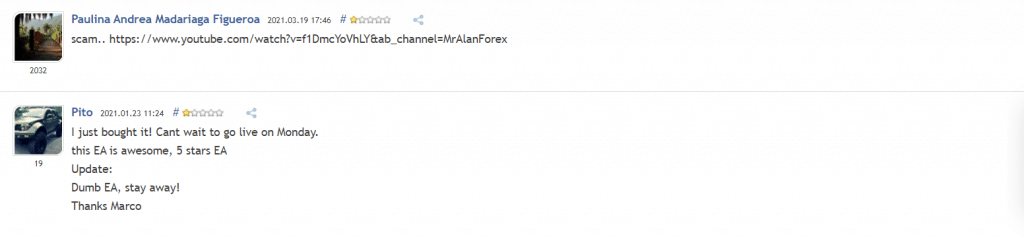

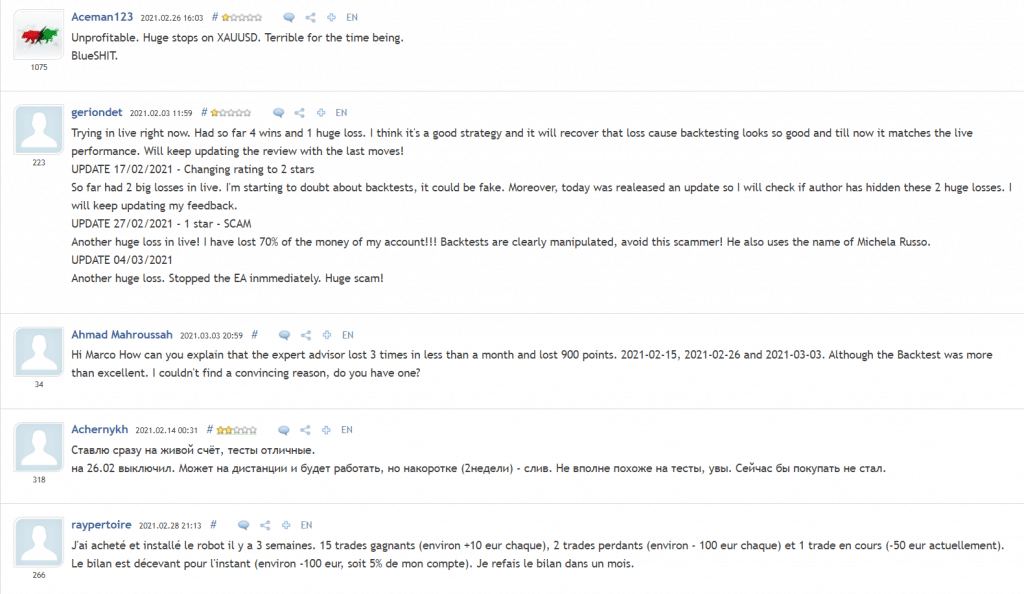

Customer Reviews

There’s an endless wall of comments that the system is a scam and we have to stay aside from it.

Blueshift is a scam trading solution that triggered many lost trades on the account. It was removed several weeks ago. There’s an account that is under Blueshift and Redshift management. Its trading results are horrible as well.

The offer is scam-like because of an overpriced subscription. We’d like you to stay aside from this trading solution.

Leave a Reply