DISCLAIMER: This article presents no direct guidance on specific actions regarding your investment and personal funds management. We may recommend certain assets at a certain time, but you are responsible for your investment.

Bitcoin blockchain project and BTC

Bitcoin explained

Bitcoin is a decentralized virtual currency that can be bought, sold, and exchanged without the help of an intermediary such as a bank. As described in a 2008 whitepaper by a developer or group of developers dubbed Satoshi Nakamoto, it also operates as an electronic payment system powered by blockchain technology.

Commonly referred to as digital money, Bitcoin enables secure peer-to-peer transactions on the internet. Every transaction carried out by the network is recorded on a digital ledger that every connected computer can view but cannot change its content. Furthermore, the ledger is distributed throughout the entire network. Therefore, even if one computer goes off, the ledger’s contents can be viewed through other computers.

While anyone can edit the content of a block on the Bitcoin blockchain, any changes must be approved by the entire network. For any transaction to go through, it must be approved by a majority of all Bitcoin holders. This makes Bitcoin secure and trustworthy.

Bitcoin mining is the process that leads to the addition of new transactions on the Bitcoin blockchain. The process entails the use of powerful computers that compute complex cryptographic puzzles. In addition, there is a reward system to entice people to engage in mining to add more transactions on the blockchain.

The reward system works by rewarding miners who get correct answers to the puzzles with new bitcoins. In addition generation of correct answers results in the creation of Bitcoin.

BTC whitepaper and tokenomics

BTC is the native token that powers the Bitcoin network. It acts as a mode of payment that enables the sending and receiving of money on the network. In addition, it is used to settle transaction fees on the network.

The total number of BTC tokens that will ever be in circulation is limited by the software and will never exceed 21 million coins. The limited supply has been one of the factors that has continued to fuel an uptick in price gain, given the strong demand in the market.

Currently, there are about 19 million BTC coins in circulation with a market cap of $579.1 billion. However, as one of the most expensive cryptocurrencies, buying a fraction of a BTC coin is still possible.

BTC coin price analysis

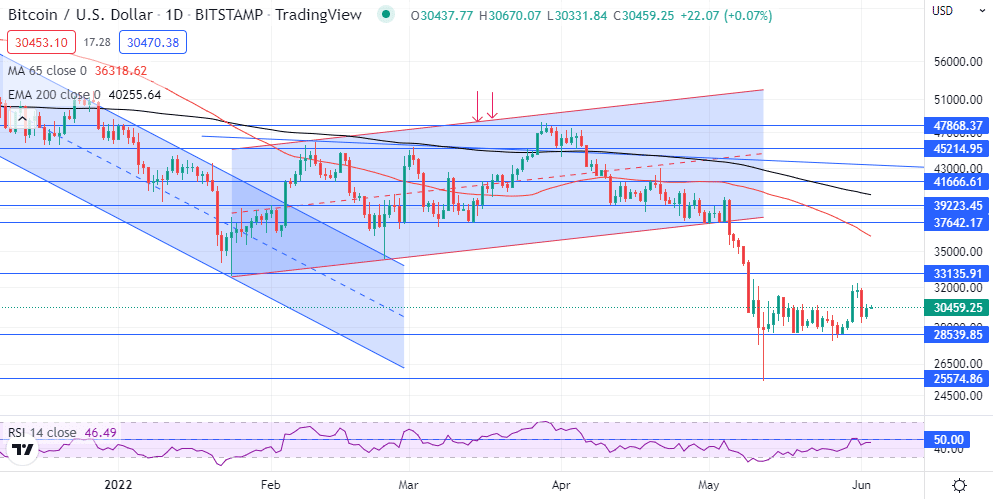

BTC coin is down by more than 50% from its all-time highs of about $68,000 highs. The flagship cryptocurrency has been under pressure for the better part of the year after the 2021 crypto boom. The 30% plus sell-off this year comes at the backdrop of investors shunning riskier assets amid the uncertainty about the global economy.

Inflationary pressure has also forced investors to use their capital on other pressing needs rather than bet on speculative assets such as Bitcoin. In recent weeks, Bitcoin has resorted to trading sideways near the $30,000 psychological level.

While the coin did tank to lows of $28,500 last month, the deep pullback appears to have attracted strong accumulation. Conversely, the coin has bounced back and trying to find support above the key $30,000 level. Above this level, BTC remains well-positioned to bounce back to the $38,000 level.

Failure to find support above the $30,000 level could expose BTC to further losses. Consequently, the token could tank to lows of $28,500, seen as the next pivotal support level.

BTC price prediction for a year

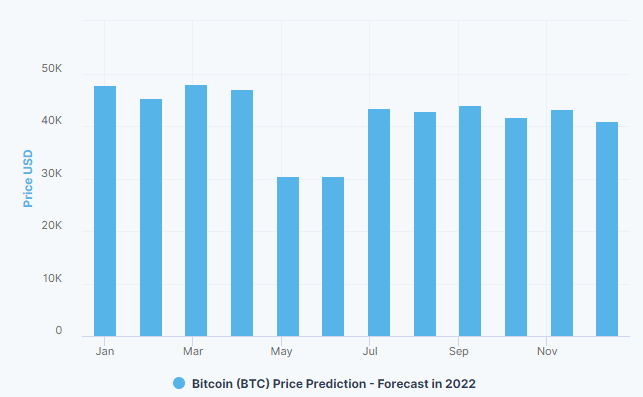

A 50% plus pull back from all-time highs has left Bitcoin flirting with oversold conditions. With the coin trading near the $30,000 level, it continues to attract strong accumulation from traders who missed out on the initial leg to all-time highs.

The prospect of Bitcoin bouncing from current levels is high. Estimates on Digitalcoinprice.com indicate that the flagship cryptocurrency could bounce back and rally to highs of $42,591 before year-end, representing a 40% plus gain from current levels.

Analysts at Walletinvestor.com, on the other hand, expect Bitcoin to explode to highs of $48,997 over the next year.

BTC price prediction for 2025

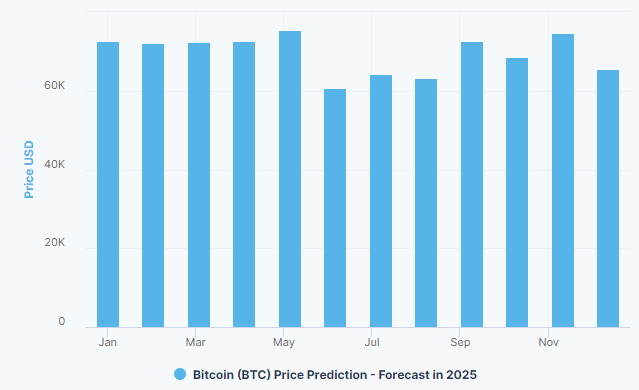

While Bitcoin remains engulfed in a strong sell-off wave in the short term, things are expected to change in the long run. With the broader sector expected to bounce back from the recent crash, Bitcoin is one of the coins expected to explode.

Consequently, Bitcoin is expected to rally to all-time highs of $69,898 over the next three years, according to estimates at Digitalcoinprice.com.

BTC price prediction for 2030

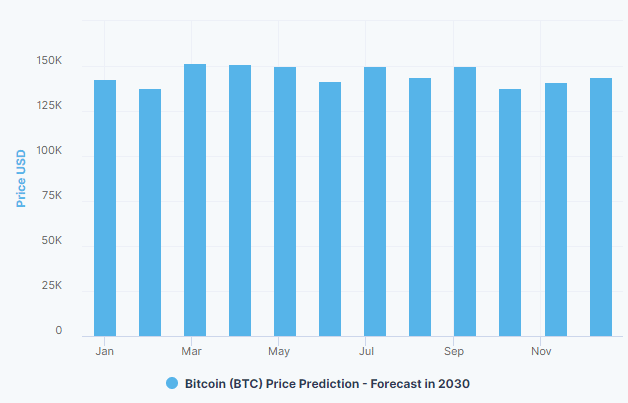

There is no doubt about Bitcoin’s long-term prospects as one of the most speculative assets in the cryptocurrency sector. Increased crypto adoption in the mainstream sector is one factor that should steer the coin to all-time highs over the next few years.

Consequently, Bitcoin is expected to be worth $145,850 a coin by 2030, according to price prediction on digitalcoinprice.com. Estimates on Walletinvestor.com, on the other hand, indicate BTC could hit highs of $123,063 over the next five years.

Leave a Reply