Source: Bloomberg

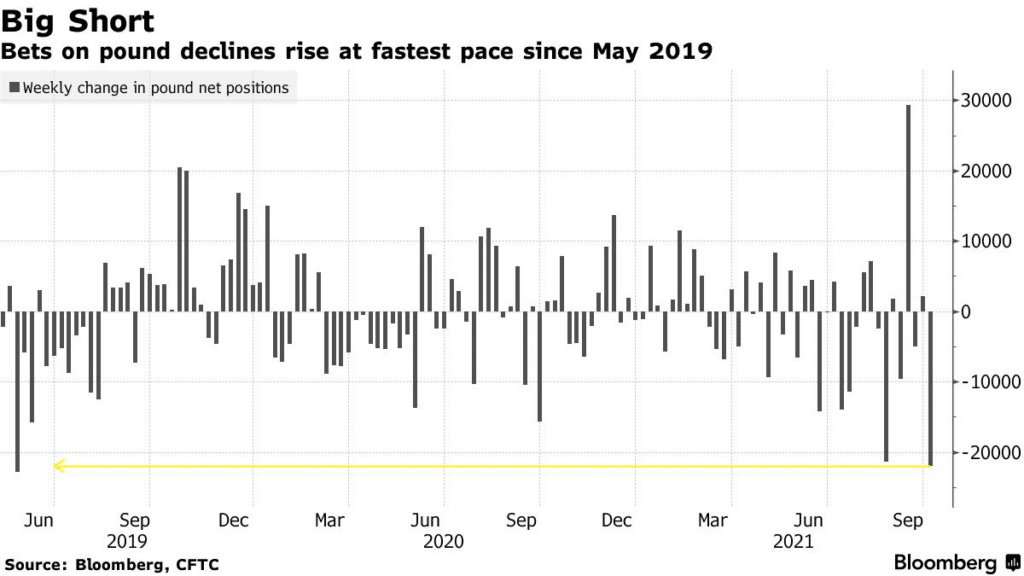

Investor bets against the British pound have risen at the fastest rate in at least two years in anticipation of Bank of England’s policy tightening this week. GBPUSD is up +0.13%.

- Currency traders are speculating that the Bank of England’s move to contain price pressures could crowd out growth and dampen consumer sentiment. The move is also expected to squeeze real incomes amid higher energy prices.

- Markets are expecting that BOE will increase the rate by 15-basis points in December before embarking on another 50-basis point increase by June to bring the rate to 0.75%.

- The option traders are also betting against the pound, with three-month risk reversals showing the most bearish sentiment in seven months.

- Now, strategists are projecting that the pound could fall back to levels witnessed in late 2020. Societe Generale strategist Kit Juckes sees the pound plunging to $1.32 in the next few weeks.

- Bank of America strategists say high inflation and low growth environment is hitting the UK harder, with any pound strengths opening an opportunity to sell.

Leave a Reply