Table of Contents

Since social networking has grown so much in the past few years, it has become much more popular. As a result of these changes, more and more brokers are offering social trading systems and platforms.

There are so many forex brokers out there. This review has gathered some of the best available options for social trading. However, how does social trading work, and what does it involve? To give you as much information as possible, we’ve highlighted the most important parts of each broker, such as fees, pros and cons, and requirements for deposits and withdrawals.

Top 10 best social trading platforms

Here are our top 10 choices for the best social trading platforms.

1. TechBerry

Within its seven years, TechBerry has become one of the most successful automated trading systems in the forex market, managing to transform social trading. For those interested in a comprehensive analysis, a Techberry video review is available.

Fees

Those who subscribe to this broker’s “Green” annual plan must pay $19. An “Infinite” pack costs $499. The profit is deducted from the service fee.

Deposit and withdrawal

The platform can be used with no deposits and doesn’t need a trial period to work.

| Pros | Cons |

| There is a guaranteed 12% profit every month. | Professional traders must meet high standards to upload their account data. |

| It offers several subscription options to choose from. | Data entry is supported only by MT4 and MT5. |

| A trader or individual can earn an income without lifting a finger. | High fees for Green Annual plans. |

Best for

Trading from MT4 or MT5 is a good option for forex experts who want to earn more income from their trades. TechBerry is good for professionals because they don’t have to put anything on the platform or undergo a testing period.

2. eToro

eToro UK clients can access its services through a unit regulated by the Financial Conduct Authority (FCA). In contrast, Australian clients can access them through the Australian Securities and Investment Commission (ASIC). The rest of their customers are served by our Cyprus office, which is regulated by the Cyprus Securities and Exchange Commission (CySEC).

Fees

Forex and CFD trading fees at eToro are low, while stock and ETF trading is free. A negative aspect of the platform is the high nontrading fees, including a $5 withdrawal fee. A benchmark fee of $7.8 is charged for EURUSD.

Deposit and withdrawal

Depending on where you live and how you set up your account, you may need to make a minimum deposit before using it. Deposit and withdrawal options are easy and have lower comparative withdrawal fees than other brokers.

| Pros | Cons |

| Invest for free in stocks and ETFs. | The high cost of nontrading fees |

| Open a new account quickly | Only one currency is available per account. |

| The social trading system | A better customer support system is needed. |

Best for

It is ideal for traders looking to copy other traders’ trades and trade without commissions.

3. ZuluTrade

In terms of copy trading platforms, ZuluTrade is one of the leaders. The platform lets you connect to more than 30 different brokers and has a wide range of copy trading tools.

Fees

Fees include a $30 monthly fee that pays for the trading signals you get and a 25% cut of any profits made by traders you follow.

Deposit and withdrawal

Depending upon your broker choice, you will also have access to different deposit and withdrawal methods, including wire transfers, credit/debit cards, and various eWallets such as Skrill, Neteller, and PayPal.

| Pros | Cons |

| Several features are at your disposal to assist you. | Assets are subject to the broker’s control, not ZuluTrade. |

| Traders can engage in social exchanges in a social area. | There are only a few features offered. |

| Cryptocopy trading has its own section. | ZuluTrade is not responsible for brokers’ assets. |

Best for

ZuluTrade offers an excellent crypto copy trading service, one of the few currently offering it.

4. Pepperstone

=

Pepperstone offers CFDs and forex services. Founded in 2010, it opened a London office in 2015 as a means of better serving clients in Europe.

Fees

Pepperstone charges low foreign exchange and nontrading fees and no account fees for inactivity or inactivity. A few assets, however, have high CFD financing rates.

Deposit and withdrawal

Pepperstone offers many account base currencies and many ways to deposit and withdraw money. The fee for withdrawing from a bank outside the EU and Australia is high, at $20.

| Pros | Cons |

| Opening a digital account is fast and easy. | Most of the trading is in CFDs. |

| Customer service is excellent. | Platforms such as MetaTrader are basic. |

| Withdrawals and deposits are seamless. | Only a few assets available to trade |

Best for

Pepperstone is a great option for forex traders looking for the best account opening experience and customer service.

5. NAGA Trader

According to expert reviews, NAGA is a reliable, low-risk broker with many trading tools and a competitive social trading environment.

Fees

NAGA spreads start at 1.0 pips and does not charge any commissions. NAGA doesn’t charge any account fees.

Deposit and withdrawal

The first deposit you make to NAGA doesn’t have to be a certain amount, but it’s recommended that you put in at least $200. This gives traders access to almost any market. Payment methods may have a minimum transfer requirement as well.

| Pros | Cons |

| Fund Compensation for Investors (ICF) | No clients in the United States. |

| Provide personal trading assistance to traders. | Nonprofessional clients have limited leverage. |

| Various educational tools | The option of having only one account for everything |

Best for

The best choice for traders who want to invest, trade, store, and access financial markets and cryptocurrencies.

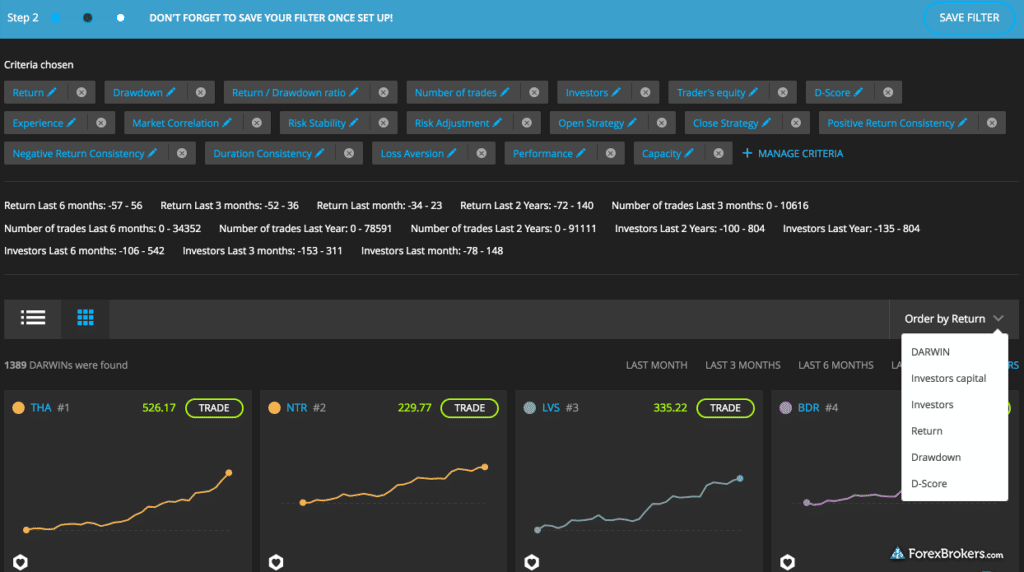

6. Darwinex

Darwinex platform

With Darwinex, forex traders can buy and sell strategies developed by other traders in a unique social trading community. Even though Darwinex offers the whole MetaTrader suite and copy trading, it is just an average provider.

Fees

When you make money with a Darwin investment, you pay a 20% performance fee plus a 1.2% commission on invested equity. Providers earn 15% of the performance fee, and Darwinex gets 5%.

Deposit and withdrawal

Funding accounts in EUR, USD, or GBP can be completed via bank transfer, bank card, or e-payment services like Skrill and Trustly. There is a minimum deposit requirement of 100 currency units after the initial 500.

| Pros | Cons |

| Darwinex is a well-regulated broker with a high-quality trading platform. | On the negative side, beginners aren’t provided with deep education. |

| A wide variety of trading instruments are available. | Customer support is weak. |

| Fast execution and good technology are available at the broker. | It is an average signal provider. |

Best for

They aim to assist traders in developing their skills and facilitate an exchange of information between them and potential investors.

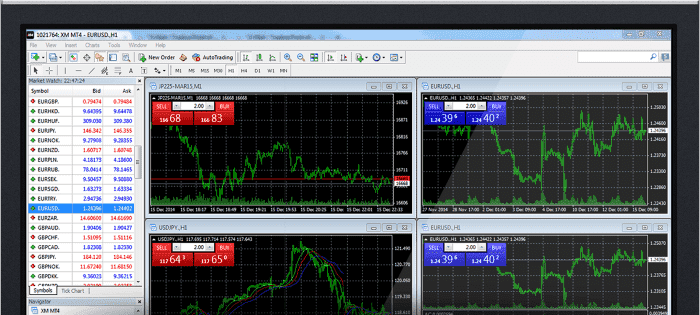

7. XM

Trading Point Holding, a global CFD and FX company founded in 2009, owns XM, a global broker for CFDs and FX.

Fees

There is no withdrawal fee at XM for CFD trading. However, Forex and stock index fees are only above average, and inactivity fees apply.

Deposit and withdrawal

With XM, making deposits and withdrawals is easy and cheap, and you have many options. XM offers 11 base currencies and does not charge a deposit fee.

| Pros | Cons |

| Low withdrawal and CFD fees on stocks | A limited range of products |

| Account opening is quick and easy. | CFD fees on Forex and stock indexes on average. |

| Tools that are great for education | Non-EU clients do not have investor protection. |

Best for

A good option for those who use MetaTrader platforms and want a seamless account opening experience.

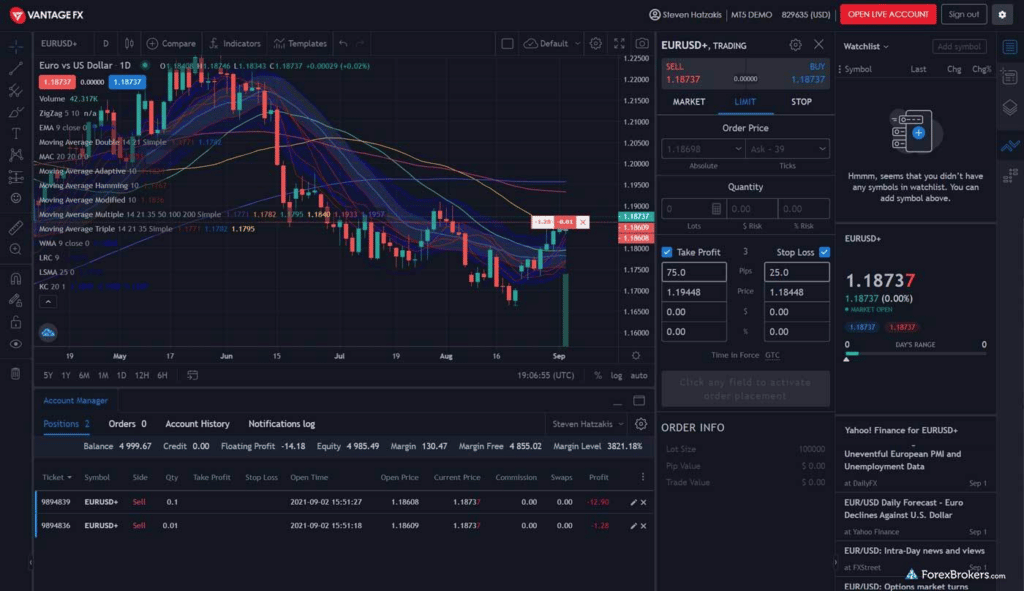

8. Vantage

It is a global broker of Forex and CFDs based in Australia. Based in Vanuatu, the Vanuatu Financial Services Commission was founded in 2009 and is regulated by the Australian Securities and Investment Commission (ASIC), the Financial Conduct Authority (FCA), and the Vanuatu Financial Services Commission (VFSC).

Fees

The brokerage has low forex trading fees, no inactivity fees, and low nontrading fees. Share CFDs have relatively high financing rates and fees compared to other financial instruments.

Deposit and withdrawal

It has several easy, fast, and cheap ways of depositing and withdrawing money. However, you will be charged high fees if you make international withdrawals more than once a month.

| Pros | Cons |

| Exceptionally low fees | A limited range of products |

| Opening an account is super fast and easy. | There is room for improvement in customer service. |

| Withdrawal and deposits are seamless. | The UK is the only country that offers investor protection. |

Best for

This course is recommended for traders using the Metatrader platform to trade Forex or CFDs.

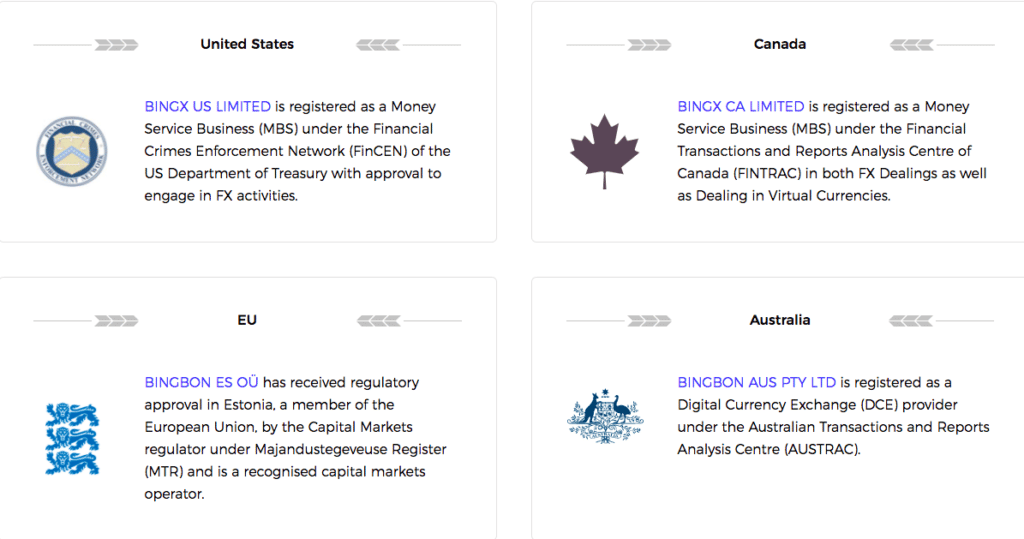

9. BingX

Bingx is a unique and innovative platform that allows you to connect with elite traders and get the most for your investments.

Fees

The trading fee rate is 0.075% (The current fee rate is discounted as 0.045%). The copy trading fee rate is 0.075% (The current copy trading fee rate is discounted as 0.0375%)

Deposit and withdrawal

Funds are deposited and withdrawn from the exchange without hindrance. The time depends on the network load. For security purposes, each withdrawal is checked by the security service of the exchange. The verification takes about an hour, in some rare cases, a little longer.

| Pros | Cons |

| Support is available 24 hours a day in ten languages, including Dutch. | Trading does not require KYC. |

| It is among the largest platforms for copy-trading. | Only applicable to a limited number of cryptocurrency pairs and transfers. |

| You earn between 8% and 12% crypto if someone successfully copies your trades. | Trading fees are variable and change from time to time. |

Best for

It is surely a great way to boost your profits while trading since it allows experienced traders to earn a profit from their followers’ earnings.

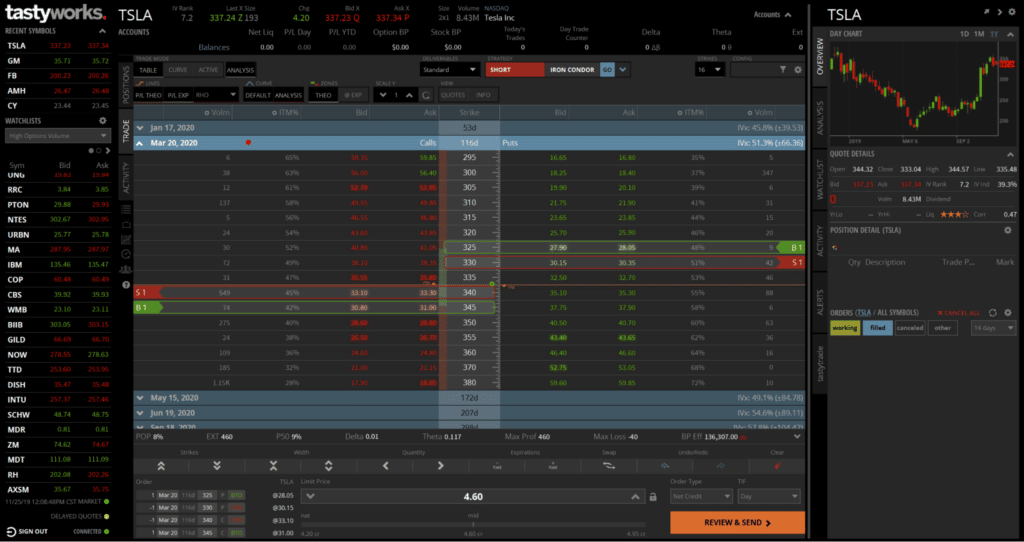

10. TastyWorks

Tastyworks is a young, upcoming US broker that focuses on options trading. The Australian Securities and Investments Commission (ASIC), the Financial Industry Regulatory Authority (FINRA), and the Securities and Exchange Commission (SEC) all keep an eye on what clients do in Australia.

Fees

Inactivity fees are not charged by Tastyworks. Meanwhile, you are charged a high withdrawal fee for wire transfers, and margin rates are quite high.

Deposit and withdrawal

Tastyworks makes it easy to deposit and withdraw money compared to other online casinos, but withdrawal fees can be high, especially for players from outside the US.

| Pros | Cons |

| Fees are low when trading. | Product selection is limited. |

| A great educational resource. | Deposits and withdrawals are limited. |

| Many tools are available for conducting research. | A demo account is not available. |

Best for

Traders who focus on US markets and options should consider this broker, which is best for experienced traders.

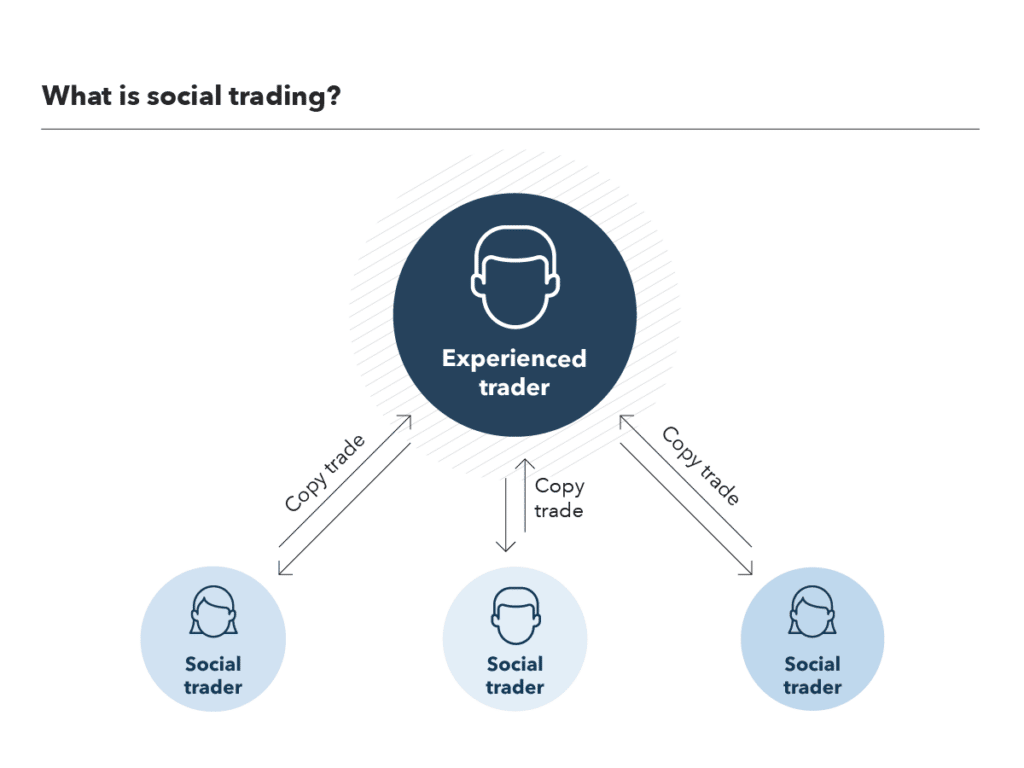

What is social trading?

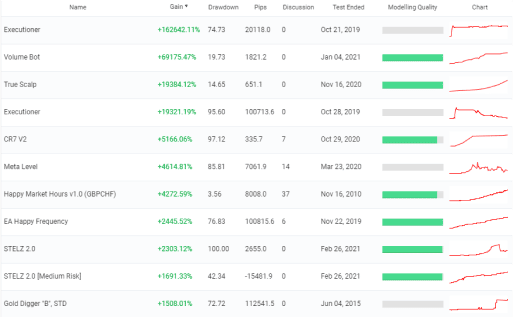

Social trading is a way to trade that lets investors and traders copy the strategies of their peers or counterparts who have more experience. Even though most traders analyze fundamentally and technically themselves, some traders prefer to observe or replicate the analyses of others.

Social trading mechanisms

Social trading works like an efficient machine operated by traders, platforms, brokers, and experts. It is similar to a typical social network, such as the ability to post information, comment on others’ posts, and send messages.

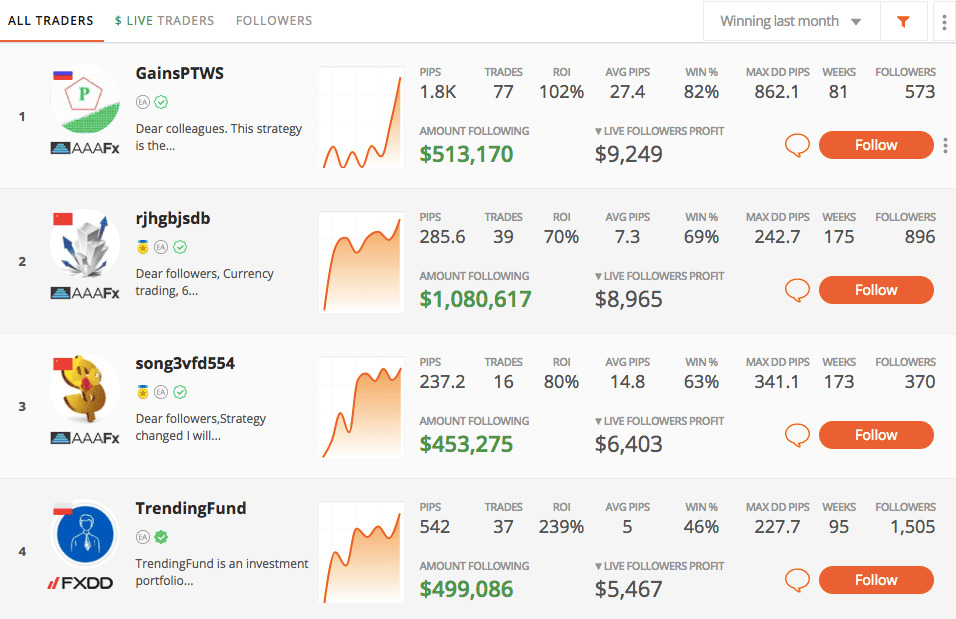

Subscribing to other traders

A copy trading platform lets users subscribe to other traders and buy and sell trading signals. A broker platform on which they can automate copy trading can also be connected. Professional traders are assigned roles as signal providers. They allow novice traders to emulate their moves by trading on their accounts. Some even keep a blog that shares their professional opinions.

News feed and comments

Your news feed combines elements of social media and online trading. It allows you to follow the financial instruments and traders you like, interact with fellow eToro members, and hold discussions.

Investor sentiment

Market sentiment is one of the most common ways to figure out trends and what other traders are likely to do. Sentiment about the market is primarily a reflection of the mood of participants in the market. But it can also offer insights into what’s being traded.

Copy trading

The term “copy trading” refers to trading in which users mimic the trades of others. Copy trading is typically hands-off, unlike social trading. Many platforms display a list of top traders and their risk and return history. Choosing a few traders to copy and leaving the rest to them could be possible.

Which markets does social trading support?

There are millions of Forex participants that have benefited from social trading platforms. Formerly, only professionals with years of experience and study could earn a profit on the forex market, but now even novice traders can do so.

Social trading. Is it legit?

In most cases, social trading on Forex with the world’s top brokers is safe, and the biggest risks stem from the trade itself. Due to how popular copy trading has become, scam brokers may offer it. Scam brokers are usually not regulated, don’t explain the risks, and overstate the money they could make.

Social trading vs. copy trading: What is the difference?

Copy trading is, however, better than both in the end. By copying the trades of other traders, you can save time and effort from studying charts, analyzing your next move, monitoring economic news, and trading manually.

With automated trading via copy trading, you will likely gain more profits when calculating the return on investment for the money, energy, and time invested in trading.

What are the benefits of social trading?

Social trading provides the advantage of making money and becoming successful by following others, thus increasing your capital faster. This way, you can get all the information you need about market movements while immersing yourself in the market. You can then devote your time to other activities. Putting things in your portfolio that you wouldn’t normally invest in can help you make more money.

Fair fees

Social trading gets even better regarding fees because platforms like eToro do not charge commissions.

In addition to avoiding commissions on purchases, sales, and trades, you’ll also experience increased profits when using the Copy Trading feature. When making payments, eToro accepts various payment methods, including debit and credit cards, e-wallets, and bank transfers. There are no deposit fees if you use a USD payment method and are an American. However, there will be a small FX fee of 0.5%.

Low deposit requirement

Several social trading platforms offer $100 minimum deposits, so you can start copying top traders immediately. This significantly increases the accessibility of copy trading.

Good safety score.

By asking for help and getting input from others, you can grow your capital safely while learning about it. Investing in several strategies can also help you spread your risk, making you less likely to lose money on a bad investment. Because most of the social trading platforms we will discuss below have a safety rate of over 90%, you can be confident in investing in these platforms.

Emotion-free decisions

Investing decisions should be made with your head, not your heart, and trading can sometimes force you to make decisions quickly, leading to bad investments.

Copy and mirror trading can eliminate the emotional component of trading. Theoretically, algorithms could make trading decisions instead of traders by automating the process based on their needs.

Opportunity to learn from other traders

The ability to see real-time news from other traders is a key benefit of social trading.

A new investor can observe what other traders are doing, learn from them, and make these trades themselves. This is one of the benefits of social trading: the ability to learn while doing.

Getting market information

This type of trading also offers the advantage of getting market information, as it allows a better understanding of the markets while returning a return on your investment, allowing you to accumulate your own following if that is something of interest to you;

Diversified strategies

An outlet for a group of traders is social trading, which allows them to discuss investing and trading strategies. Through this process, you can gain insight and boost your understanding, which can help diversify your strategy.

Staying informed

Several factors, such as performance, are considered when ranking investors on social trading platforms. Most metrics are configurable, so the user can search based on the factors most important to them.

Before copying a trader’s trades, other users can check to see if they have the right credentials. This adds a level of security. This way, you’re informed at all times.

Automated trading

An automated trading solution, or social trading, as it is also known, enables a small business or a new trader to place their trading orders by watching what others on the same platform are doing. Smaller and newer traders typically look to expert and experienced traders on platforms as benchmarks for their own trading and try to mirror their moves by replicating them.

Creating a trading community

Social trading enables people to become part of a trading community. It can also act as an exchange of ideas, insight, leads, strategies, trading tools, and a support system for traders. Even though you have to keep learning, social trading lets you talk to a community of investors, learn from them, and improve your investing skills.

Risks of social trading

There are many risks associated with social trading. In this article, we’ll talk about the four most important risks you should know about before you start trading with this method.

Non-independent opinions

There is no guarantee that expert opinions are unbiased, which is a big risk for traders with less experience who may take high risks based on what others say.

Unrealistic expectations

Most people find social trading attractive because it offers a chance to make large gains with very little investment.

The people have set their expectations based on these exceptional results. They don’t realize, though, that if their potential gains are increased, so are their potential losses.

No diversification

Less experienced traders tend to place all their investment funds with a single trader or signal provider. With a network, you can follow and copy several traders, so spreading your investment over several traders will reduce your overall risk.

Verdict and summary

Recognize that some of these social trading platforms carry risks. Check the social trading platform’s free trial and demo account before deciding whether to use it. You can look at some automatic trading strategies and developers before deciding.

You can see historical success on many social trading platforms, determining the chances of profiting when you copy someone else’s signals. Keep an eye out for fees as well, since you might have to pay copy fees, auto trading fees, and subscription fees, plus regular trading commissions.