Investing in cryptocurrencies has grown in popularity in recent years as a way to acquire access to a big profit through successful trading. Traders, investors, and businesses are always looking for new ways to boost their earnings, so they take advantage of any opportunity that presents itself. There has been a boom in demand for cryptocurrency trading apps that allow users to leverage their funds through margin, derivatives, and futures markets. Some of these apps provide ridiculously high leverage ratios, and others just enough. We’ll look at the most popular apps.

What is leverage trading?

It refers to trading cryptos or other financial instruments with borrowed funds. It boosts your buying or selling power, allowing you to trade with more money than you have on hand. Depending on the crypto exchange you use, you could borrow up to 100 times your account balance.

In order to borrow cash, a trader must first make an initial deposit. For example, if you wanted to put $5,000 in a leveraged trade with a 1:10 leverage ratio, you’d only need to invest $500 to get started. Traders must, however, maintain sufficient funds in their accounts as collateral for the lending platform.

There are two types of open positions: long and short. Traders will enter long positions if they believe the price of digital assets will rise; traders will open short positions if they believe the price of digital assets will fall. You borrow crypto instead of cash when you go short. So, if the price drops, you buy the identical crypto at a lower price and repay the lenders’ assets while keeping the profit.

If you open a long position and it is successful, the lender will release your initial cash deposit and your earnings. The broker will liquidate your position and keep your money if the trade ends up at a loss. By employing less leverage, you can reduce your risk of liquidation.

PrimeXBT

PrimeXBT was founded in 2018 and is based in Seychelles. It allows users to trade the market’s major cryptos by market cap. Bitcoin (BTC), EOS (“EOS”), Ethereum (“ETH”), Litecoin (“LTC”), and Ripple’s XRP (“XRP”) are just a few examples. It also allows you to trade crypto-BTC pairs in addition to crypto-USD pairs. EOS/BTC, ETH/BTC, LTC/BTC, and XRP/BTC are among them.

PrimeXBT enables long and short positions with leverage up to 100 times your initial investment. It also has aggregated liquidity, which allows it to deliver the best pricing from 12 distinct, prominent liquidity sources in real-time, with immediate order execution. It also supports advanced order types, including stop-loss orders, which help to mitigate leverage risks. Its fees, standing at 0.05%, are among the lowest in the market.

BitMEX

BitMEX is a Bitcoin-only trading platform that gives investors access to global financial markets. BitMEX was created by a team of finance professionals with over 40 years of combined expertise, and it features a robust API and accompanying tools.

It offers leverage on all of its products. The amount of leverage varies from product to product. The Initial Margin and Maintenance Margin levels determine leverage. To enter and maintain positions, you must have a certain amount of equity in your account. It has a minimum equity requirement rather than a constant multiplier.

On its Perpetual Bitcoin / USD Perpetual Contract, it gives the maximum leverage of up to 100x. Advanced order types, such as stop-loss, are also available. Fees are only 0.075 % for XBT and 0.25 % for all other assets.

OKEx

OKX is a cryptocurrency startup based in Seychelles. It provides a cryptocurrency exchange as well as a number of other services. Users all over the world can use it; however, it is not available in the United States. It does an excellent job of supporting a wide range of currencies and services. It accepts approximately 300 different cryptocurrencies.

You can use leverage on the OKEx app and trade with three times your initial capital. As a result, your potential profit is maximized, just as your potential loss. Advanced order types, such as stop-loss, are available. It has a high liquidity level, with fees ranging from 0.015 % to 0.075 %.

Kraken

The Kraken exchange is one of the US-regulated trading platforms that allow US traders to participate in the developing crypto market. It is a registered entity situated in San Francisco, California. It is one of the few exchanges that allows investors to trade on margin and offers up to 5x leverage.

On Kraken’s margin trading platform, you may currently trade BTC, BCH, ETH, ETC, XMR, XRP, and REP against BTC, ETH, USD, and EUR to place a long/short position on any of these pairings at any price with the order types required to make winning crypto trades. Advanced order types, such as stop-loss, are available. Its fees range from 0-0.26% plus a 0.01–0.02% extra margin fee.

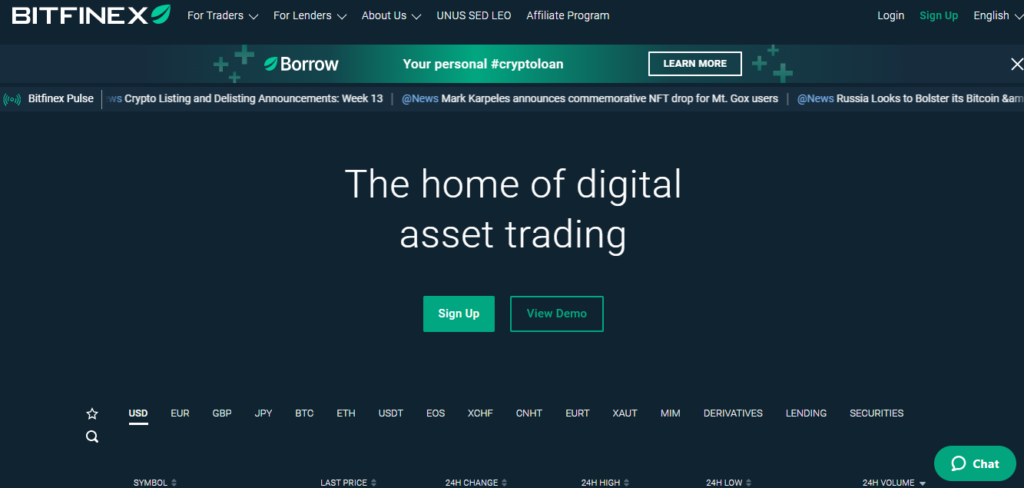

Bitfinex

Bitfinex is a digital asset trading platform that provides digital currency traders and global liquidity providers cutting-edge services. Traders benefit from simple and complex order types, margin trading, and additional features to preserve your market edge.

Bitfinex allows up to 10x leverage trading by providing traders with access to the peer-to-peer funding market. Traders can place an order to borrow a certain amount of money at a specific rate and for a particular length of time, or they can just establish a position, and Bitfinex will take out funding for them at the best available rate at the time. It accepts Bitcoin, major cryptocurrencies, and fiat currency. Fees range from 0.1% to 0.2%. However, it has a lengthy KYC procedure, requiring 6–8 weeks to authenticate an account.

Summary

Bearish and sideways patterns have characterized the crypto markets in recent years. To survive the crypto winter and continue to earn under these conditions, the capacity to use large leverage and enter short positions is critical. A long position can also be used when the market is bullish. Using the right app is crucial, and the top apps include PrimeXBT, BitMEX, OKEx, Kraken, and Bitfinex.

Leave a Reply