Backtesting your Forex robot on MT4 is an excellent way to see what potential is held by your strategy before you apply it in real-time. These days, several traders use Expert Advisors (EAs) or Forex robots to conduct their trades automatically. But, it is also important to check how the robot performed until that point in time because you don’t want to leave your Forex trading up to chance.

Let us look at what backtesting really is, why you should do it, and how you can use it to test a Forex robot in MT4.

What is Backtesting?

In Forex trading, backtesting is the process when you evaluate a particular trading scheme by using archival market data. This indicates whether the strategy employed by the robot would have been successful in the past. It tells you that there is a good chance the scheme would bring success in the real-time market as well.

Most traders hold the belief that a strategy that had given good performance earlier is very likely to repeat the same in real-time. Of course, backtesting is no guarantee that your trade will be a successful one, but it certainly increases the likelihood of it happening.

Why should you perform backtesting?

You should perform backtesting because:

- It allows you to test several strategies within a short span of time. You can also come up with an effective trading plan quickly and collect a large amount of information about the strategy employed by your robot. It tells you how the strategy would react to a reversing, trending, or volatile market.

- You can recognize trading patterns with greater efficiency and know exactly what to look for. Trading openings can be easily picked up by you after doing backtesting a few times.

- It doesn’t cost you anything, and in return, you get to know whether the strategy used by the robot is suitable for you. You get to identify its drawbacks and can take suitable measures to enhance its profit potential.

- You can test the robot’s trading strategy and identify the faults in it, thus coming up with an entirely new strategy through some minor adjustments.

What are the tick data, and what is their importance?

During backtesting, tick data is one of the most vital factors you need to consider. If your robot is employing a scalping strategy, you should aim to fetch almost the entirety of the tick data. A percentage of about 90% is considered decent for other strategies.

For a robot that is not using a scalping strategy, the information retrieved from MT4’s logs normally suffices for a standard backtesting procedure. Nevertheless, when the EA uses scalping, the tiniest shift in value can mean a lot. Thus, in order to fully judge the impact, the backtesting method ought to be robust and optimized.

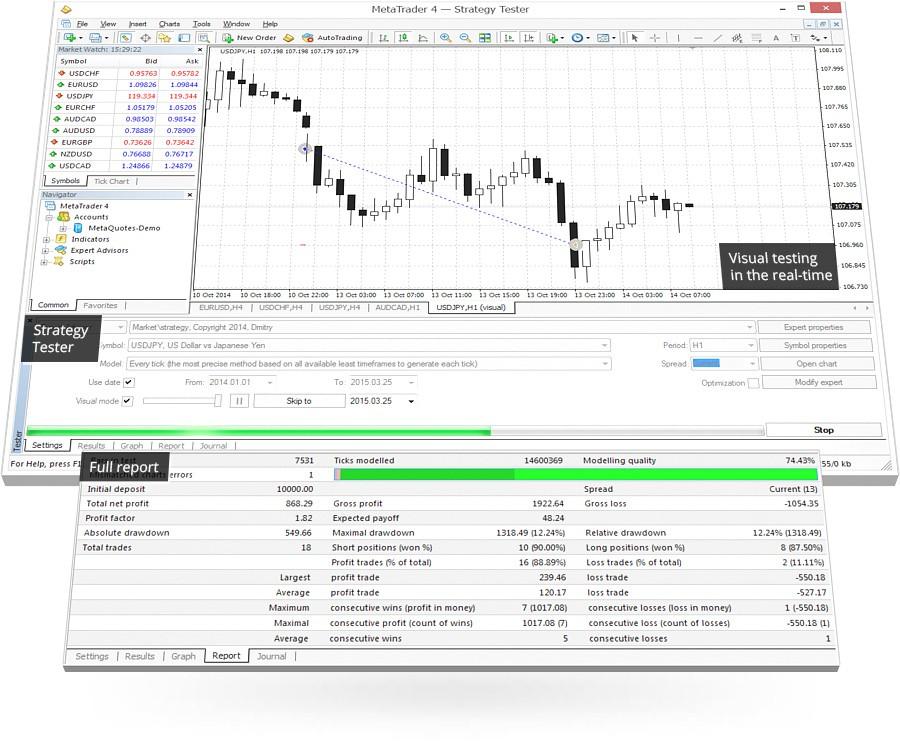

The image above shows where exactly you can see the amount of tick data you have. Using the MT4 platform, you can test the efficacy of any Forex robot. Although some sites provide a large amount of historical data, it does not come cheap, and you have no way of knowing how the robot will perform in real-time.

What is curve fitting?

While trading in the Forex market, you need to have a sound strategy in place, along with backtesting data, that helps you establish the efficacy of the former. But, you would be shocked to know that it is possible to manipulate the backtesting reports.

If you developed a Forex robot, you would surely want to showcase how it fairs in a live trading scenario or the greatest profit made by it. Of course, there are other things the developer needs to consider, like the month where most of the profits were made, for instance. It is the developer’s job to build the robot in a manner that brings out the best results.

But, of course, there is no assurance that a parameter performing well on archival data will replicate the same performance in real-time. This is known as curve fitting, i.e., showing the best possible profits by manipulating the reports.

One can also carry out curve fitting through the adjustment of parameters. Suppose a strategy performs well on every day except Tuesday, so the developer creates a plan and does the coding in such a way so as to not consider the trades done on that day. This may seem like a great strategy in appearance, but it will fail in a current trading situation.

How to backtest a Forex EA on MT4?

Prior to backtesting, you should properly organize the tester, not going for a spread that’s too low. You can start with three pips, and if you get good outcomes, then it is likely to perform better with a lower spread. Moreover, you need to ensure that the expert properties and period are appropriate.

You may take the help of the visual mode as well, which takes more time but shows you the chart at the same time. This lets you identify the points for entry and exit. In case you face any inaccuracy, you need to click on the “Journal” button, where you can fix the issue if you are knowledgeable about MQL. If you are not, the error can be corrected by your developer.

Evaluating your backtesting results

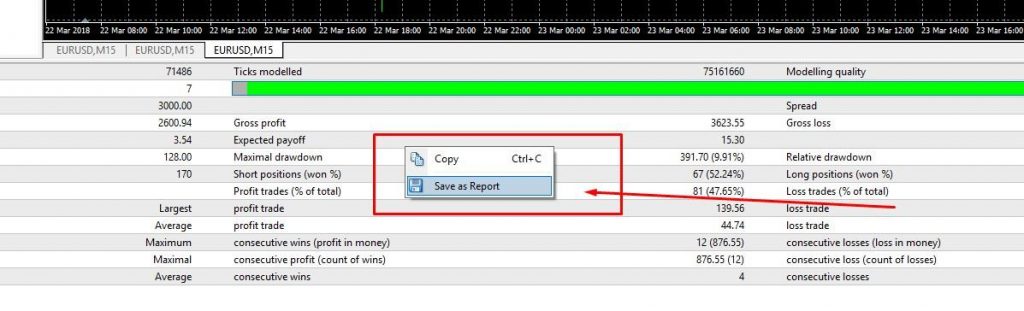

After you’re done with the backtesting, you can save the assessment in a file where you will be able to view the different trade parameters. It is advisable that you use diverse settings for the reports so that you can find out the best possible combination for your Forex robot’s strategy.

Summing up

Now you have sufficient knowledge about how to backtest a Forex robot on the MT4 platform. It allows you to find tiny faults in the robot and get them fixed. But, if you’re using a high-end EA, you should consider spending some money to get superior tick data.

Leave a Reply