AVIA is a Forex copy trade investment program. The vendor claims that the objective of this program is to minimize the investor’s exposure to risks in all market conditions. To achieve this, the team applies what it calls a technical and fundamental assessment plus market sentiment to ascertain daily directions. The company notes that it does not offer its services to residents of Iraq, Russia, and North Korea. However, they do not explain why.

Detailed Forex program review

AVIA simply trades on the behalf of investors. One part of the program (70%) is automated while the other one (30%) is discretionary. The basis of the latter element is daily trade planning, checking market responses, and defensive interventions when accounts reach certain levels of drawdown.

AVIA is offered by LEFTURN, a FinTech company that mainly focuses on Forex copy trading and managed accounts. The firm was launched in October 2017 and its objective is to become a long-term, number one trading partner.

As per vendor claims, the team is composed of highly skilled traders, advanced degree holders in physics, finance, computer science, statistics, mathematics and other quantitative disciplines. To convince us more of their credibility, the vendor should have included the names of some of its team members, their profile photos and expertise.

The features of the program are described as below:

- Trades all major currency pairs

- The recommended brokers include FBS, CedarFX, HugosWay, FIBOGroup, Fullerton, VT Markets and LMFX

- A minimum of $3k is needed to invest

- There are no lock-in periods; therefore, clients can withdraw their money whenever they want

- Uses the MT4 trading platform

The program has the following strategy requirements for trading accounts:

- Accounts with <$40k should have at least a leverage of 1:500

- Permit hedging

- Allow the firm to trade micro lots of 0.01

- Permit unlimited number of open positions

AVIA strategy tests

According to the vendor, their strategy entails monitoring the market, analyzing open positions and developing detailed plans for how to enter, exit and defend a trade. They manage risk at each early stage, whether they are preventing main risk events or hedging during times of uncertainty.

This strategy explanation is too general and does not give us any useful insight with regards to the specific data they monitor, the indicators they follow, the timeframe used, etc. Furthermore, they do not indicate the specific measures they take to minimize risks.

There are no backtests results for this program. This data would have assisted traders to see the effectiveness of the program’s strategy. It would have particularly led to realistic and detailed expectations on profitability, risks, drawdown and needed capital. Therefore, its absence disadvantages traders.

Live account trading results

These statistics are available on Myfxbook.com. We have assessed and described them as follows:

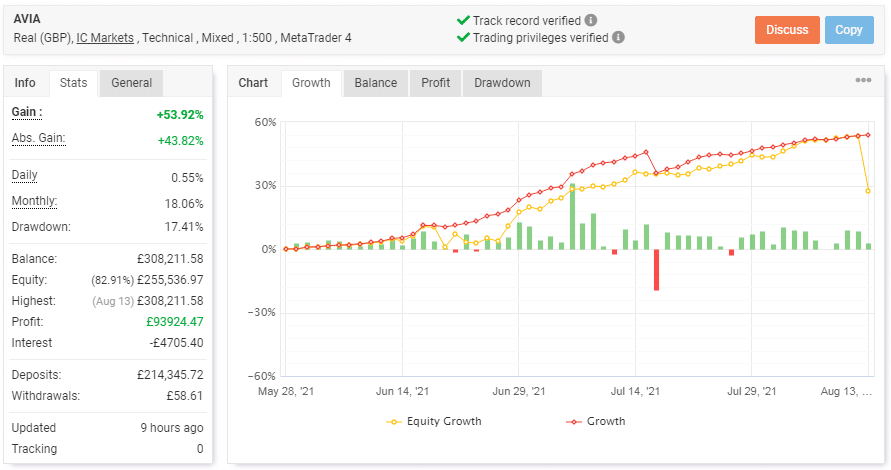

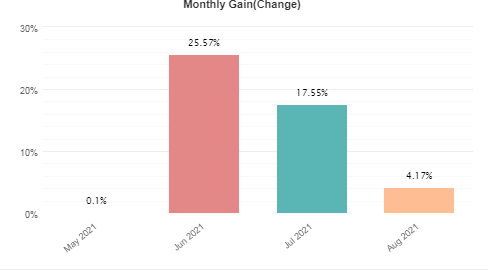

We can see here that the real GBP account was opened on May 28, 2021 and operated under IC Markets. It was deposited at £214,345.72 and generated a profit of £93,924.47 which is equivalent to the absolute gain of 43.82%. A total of £58.61 has been withdrawn so far and the balance is now £308,211.58. The daily profit is 0.55% while the monthly profit is 18.06%. Even though the drawdown (17.41%) is not that high, it can still rise and pose significant dangers to the capital.

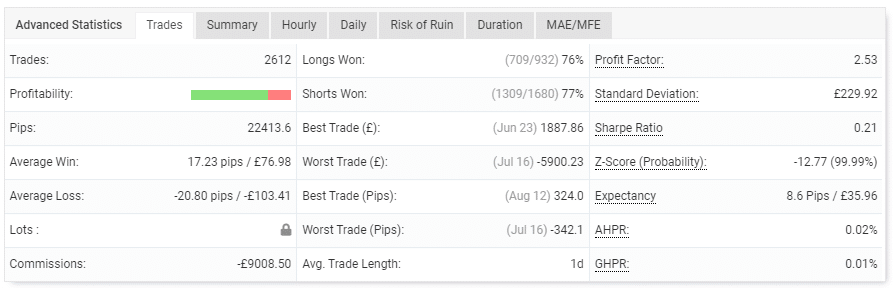

A total of 2612 trades with 22413.6 pips have been executed. The average loss which is -20.80 pips is slightly higher than the average win which is 17.23 pips. This means the account makes more losses than wins. Data on lots is locked and hence unavailable. This is very suspicious. The win rates for long trading positions are 76% and 77% for short ones. These performances are not that impressive. The profit factor is 2.53.

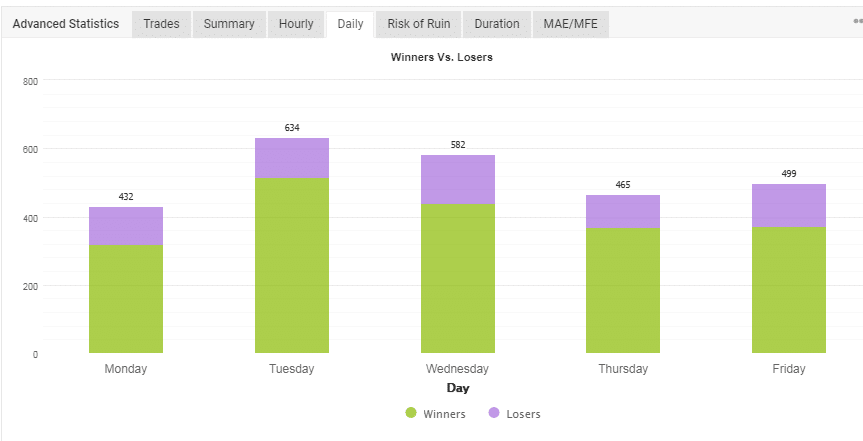

Tuesday is the day when most trades were conducted-634 trades.

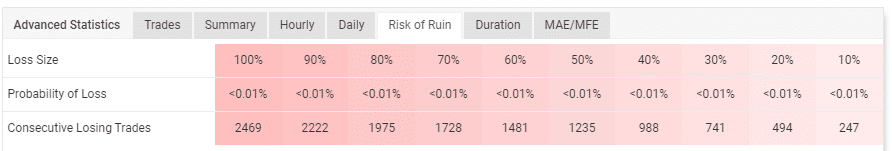

The probability of the account going under is small.

The trading history data is locked.

The monthly profits are sporadic. For this reason, it becomes hard to ascertain how the account will perform in the future.

Pricing

There are different investment options available. The highest investment amount is $250k, and you will be charged a performance fee of 32%. The required leverage for this option is 1:50 or greater. The least investment amount is $3k which requires a 36% performance fee. The leverage is 1:500 or greater. The program is definitely expensive and seems to be targeting traders with higher net-worth.

Customer reviews

There are no user testimonials for AVI on its official website. Feedback from traders is also unavailable in common FX review sites like Quora, Trustpilot and Forex Peace Army.

Rebranding

Avia showed unsatisfactory trading results and it could lead to rebranding. Now it is called Alphi. The presentation is almost entirely the same with little changes applied. The devs added another trading account, changed leverage requirements and added brokers they recommend to trade under: FBS, HugosWay, LMFX, EagleFX, and CedarFX. Long story short, all the stuff looks odd and suspicious. With no explanation provided, the managed account service is a pure scam.

We advise you to avoid AVIA. Clearly, the professionals behind it do not know what they are doing. If they did, they would have confidently provided a detailed strategy of their program.

The lack of backtest results also influenced us to conclude that their program did not perform well in the past and this is what they do not want traders to discover. They also hide the trading history, a sign that they are not confident about AVIA’s performance.

Leave a Reply