Autopip EA Gold is a fully automated FX EA that assures high returns with minimal losses. It uses an aggressive and meticulous trading approach. As per the developer it is designed to safeguard your capital from sudden trend changes. This FX trades mainly on the EURUSD and the gold pairs like XAUUSD and XAUAUD. It works on the Metatrader 4 terminal.

Detailed forex robot review

Neill Thomas Campbell Forbes is the developer of this MT4 tool. He is based in the UK and is a software developer involved in developing FX EAs. The dev has created two products and 11 signals. The Mad Gold Scalper is one of his products. He published Autopip EA Gold in August 2021 and it is in version 2.7 now. While we could not find location info or phone number for the vendor, to contact the developer, you need to use the personal messaging feature of the MQL5 site or via the Telegram Channel group.

The developer reveals very little info on the features of the FX EA. Some of the features provided include the use of news filters, drawdown reduction algorithms, and indicators. This MT4 tool uses the M15 timeframe. The developer recommends the use of the default settings and making changes in the drawdown limits, trade size, SL, and the trading hours as per user preference.

Autopip EA Gold strategy tests

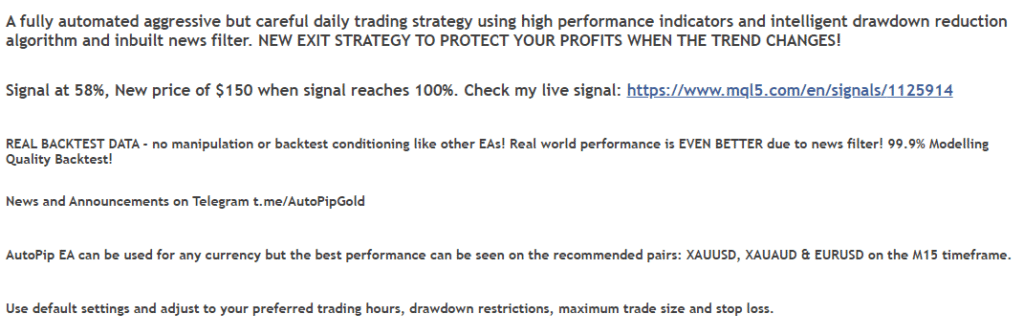

As per the developer, this FX robot uses a daily trading approach with the help of indicators and an algorithm for limiting the drawdown. It uses an exit approach that prevents losses during changes in the trend. We find the explanation vague and insufficient. A backtesting result is present on the MQL5 site. Here is a screenshot of the report.

From the strategy tester report for the XAUUSD pair, we can see a total gain of 13619 has been generated for an initial deposit of $1000. The test done on the M15 timeframe for 5 years shows a drawdown of 13.40%. Profitability of 67.86% and a profit factor of 1.49 were found for the account which was done with a modeling quality of 99.9%. While the drawdown is not high, we find the profits are poor indicating an ineffective approach. The low value of profit factor also confirms this.

Real live account trading results

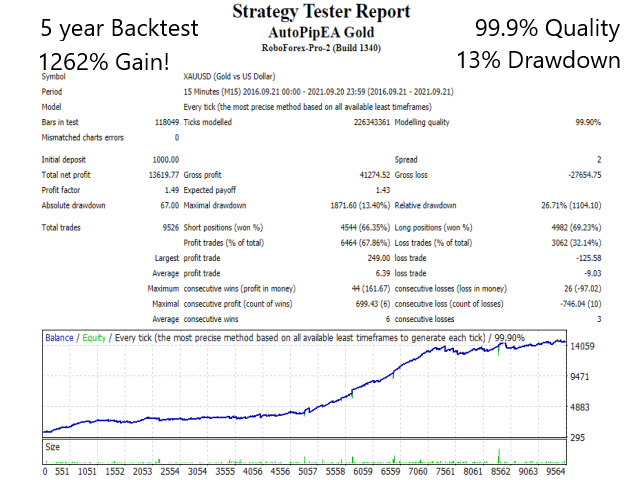

A live signal is provided by the developer on the MQL5 site. Here is a screenshot of the result.

From the trading stats, we can see the account has a growth of 58.06%. It has completed 40 trading days with 32 trades executed per week. For an initial deposit of $1000, the profit it has gained is $580.61. A maximum drawdown of 40.6% is present for the account. Profitability of 69.85 is present.

From the high drawdown percentage, it is clear that the approach is risky. Compared to the backtesting result, we can see that the profitability is similar to the backtest but the drawdown is higher. This shows that the performance from historical data cannot predict future performance. But the low profits and high drawdown are indicative of an ineffective approach.

Pricing

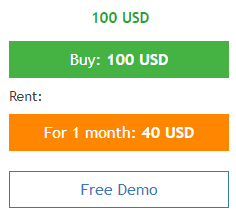

You can purchase this FX robot for $100. A rental price of $40 per month is also present. The developer also offers a free demo account. As per the official site info, the price will be raised to $150 when the signal growth reaches 100%. We could not find a money-back assurance which raises doubts regarding the reliability of the EA. When compared to other similar products in the market, the price of this MT4 tool looks affordable.

Customer reviews

We could not find user reviews for this FX EA on reputed sites like Forexpeacearmy, Trustpilot, etc. However, the MQL5 site shows a few reviews. Since the site promotes the product, the chances of the reviews being manipulated are high. We prefer reviews from third-party sites like Forex Peace Army as they are unbiased.

AutoPip EA claims to provide the best performance with high returns and low risk. Our evaluation of the strategy backtests, and the live trading results reveal a risky approach. The developer does not provide a proper explanation for the approach used.

The mention of indicators and drawdown reducing algorithm is vague and from the performance, we can see the approach is not working. Furthermore, the backtests and real trading stats confirm our suspicion that this EA uses a risky strategy. The absence of proper support and a lack of vendor transparency are other downsides that make this EA unreliable.

Leave a Reply