Passive Income in Trading: Is it Possible?

Passive income refers to regularly generated money that requires minimal effort from the recipient to maintain and earn it. Passive income includes gains on stocks, commodities, interest, capital gains and lottery wins, etc.

In the context of trading, passive income involves purchasing or creating an asset that offers value to the holder and provides them profitability, even if they do not actively partake in trading. They are mainly part-time traders.

The main difference between Active traders and part-time traders is that the former invests a considerable amount of time and effort into generating a substantial profit. They primarily focus on their trading activity. Part-time traders, on the other hand, do not spend all day trading, monitoring the market, or making trades. They make investment choices that don’t dictate their lifestyle, but rather fit around it.

What is Managed account?

Managed accounts refer to investment accounts owned by either an institutional, retail, or individual investor. It is usually overseen by a professional money manager, who is hired by the investor who owns the account. The Money manager has full discretionary authority over the account. They make active investment decisions on behalf of the investor, based on the investor’s goals, preferences, asset size, and risk tolerance.

A managed account may contain titles to property, cash, and financial assets. The money manager can buy and sell assets without taking any prior approval from the investor or client. However, they have to strictly act in accordance with the objectives of the client. A managed account involves fiduciary duty. This means that the money manager is must act in the best interests of the investor or face criminal or civil penalties. To intimate the investor about their account’s performance and holdings, the money manager sends regular reports.

There is a minimum dollar amount when one opens a managed account, with many minimums starting at $250,000. However, some managers accept accounts with minimums of $50,000 and $100,000. The Manager receives an annual fee, which is a percentage of the Asset under management or AUM. They are mostly between 1% or 2% of the AUM. Managers can also provide discounts based on the size of the client’s account assets. Larger the portfolio, the less the percentage fee becomes.

What is Automated Trading?

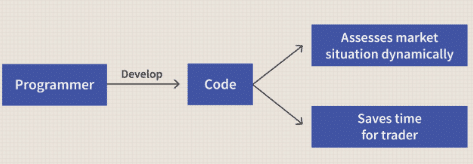

Automated trading systems allow traders to establish programmable rules for trading entries and exits. They are also called algorithmic trading, mechanical trading systems, or system trading. Once programmed, the software automatically executes trades via a computer. Several platforms have reported that automated trading accounts for 70-80% of shares on US stock exchanges.

Investors can use precise money managed, entry and exit rules to program automated trading systems that automatically monitor and execute trades. By using automated trading systems, traders can prevent negative human emotions from impacting their trading, unlike manual trading.

The exit and entry rules for trading are usually based on either simple conditions or complicated strategies. Traders need to have a comprehensive understanding of programming languages that the trading platform will use. They can also purchase automated trading software on the market from qualified developers and programmers with proven results.

Automated trading allows traders to use a multitude of strategies at the same time. They can use this to spread risk over the various instruments they hold and create a hedge against any losing positions.

Managed Accounts and Automated Trading comparison: similarities and differences

Similarities between Managed Accounts and Automated Trading

Both Managed Accounts and Automated Trading allow the clients to invest their money and reap the benefits without actively participating in any trading themselves. This is great for retired personnel or individuals who have a day job and want to earn some passive income.

Differences between Managed Accounts and Automated Trading

| Points of Difference | Managed Accounts | Automated Trading |

| Programming or Trading Knowledge | Since the client is handing over control of his/her account to an experienced money manager, they do not need any high-level trading knowledge to begin. The success of the account depends entirely on the professional skills and experience of the money manager handling the account. | In the case of automated trading, users who want to program their own trading rules into the system have to learn some special programming language to create the trading systems. In the case where a user wants to buy a product from the market, he/she must have some prior basic knowledge about different trading strategies and terms before they can make the right decision. |

| Transparency | The law requires money managers to be as transparent as possible. Since the money manager has the fiduciary duty to choose and manage investments that are in the client’s best interests, it puts the client at the utmost priority. The money managed sends regular reports to the client about how their investments are performing on a frequent basis. | If a user chooses not to make their own automated trading system and wants to purchase one over the market, he/she must proceed with caution. They must ensure that the developers behind the automated systems are legitimate and promise achievable profits. Scams usually advertise themselves as achieving unnatural numbers of profitability. If it’s too good to be true, it definitely raises a red flag. In spite of the fact that many automated trading systems provide live trading statistics and back-test results as proof, it isn’t a guarantee of their performance. |

| Initial Investment | For managed accounts, the initial investment is pretty high. Most money managed demand six-figure minimum investments starting from $250,000 even though some accept as low as $50,000. Additionally, the manager charges a compensation of 1 to 2 % of the AUM | Automated trading systems are available for much lower, depending on the type of system chosen. The minimum investment requirement is also lower at $1000 in some cases. |

Conclusion

Both automated trading systems and managed accounts are great ways for investors to earn some money, provided they make the right decisions. The success of the managed account depends on the expertise of the money manager in charge. On the other hand, the success of automated trading systems depends on the rules programmed, as well as the strategies are chosen.

Leave a Reply