- Australia’s 10-year yield hit 1.4% (75 basis points) higher than the rates accrued in 2019.

- US GDP grew at an annualized adjusted rate of 4.1% (0.1%) less than estimates.

- The rise in commodity prices may alter Australia’s currency levels and steer inflation targets.

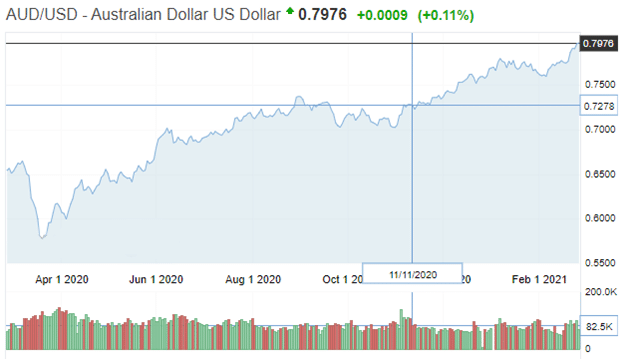

In early trade on February 25, 2021, the AUD/USD trading pair gained a three-week high of 5.32% from 0.7569 on February 2, 2021, to 0.7972. The Australian dollar received a boost from Treasurer Josh Frydenberg when he complimented the economy’s strong performance in the world. This situation is despite the country’s 3% in capital expenditures in Q4 2020. The US dollar has been unable to recover against the Australian dollar since early 2020, when the AUD/USD traded at an annual low of 0.5741 on March 19, 2020.

The US economy up but not strong enough

Q4 2020 saw the US GDP grow at an annualized & seasonally adjusted rate of 4.1% (0.1%) less than estimates. The slight increase was attributed to advanced residential investments as well as high government spending. However, consumer spending had a lower revision into 2021. This revision made the US economy contract by 3.5%.

The US unemployment rate was stagnant at 6.3%, approximately 44% higher than the pre-pandemic levels. The Fed has been skeptical about raising interest rates. The government widely believed that the 6.3% figure is an understatement and that it may be levels above 10% since some left active employment due to the pandemic.

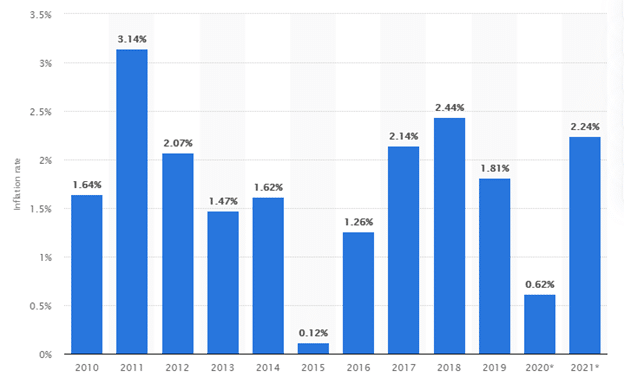

Raising interest rates with high unemployment rates may allow for higher inflation. Projection estimates show that US inflation may hit 2.21% in 2021, although it closed 2020 at a low of 0.62%

However, the economy is still stable, seeing that inflation hit its worst run in 2015 when it struck an all-time low of 0.12%. The coronavirus stimulus plan could increase the inflation rates, but only on a temporary basis seeing that the plan includes consumer and government spending at the same time.

Australia may raise rates soon

After contracting 2% in 2020, the Australian economy is set to recover before the end of 2021. At the beginning of February 2021, Central Bank head Philip Lowe was optimistic that the bank would raise interest rates in 2024, citing inflation and employment targets. The country is projected to reach A$200 billion in its bond-buying (quantitative easing) program by mid-April 2021. This effort may slow the AUD’s gain.

Australia’s 10-year yield hit 1.4% (75 basis points) higher than the rates accrued in 2019. Increased reserves made the Reserve Bank buy A$ 5 billion ($4 billion) worth of bonds to match the amount purchased in March 2020.

However, the rise in commodity prices may alter Australia’s currency levels and steer inflation targets sooner than we think. The S&P/ASX 200 has risen by 50.33% from April 2020 to February 2021.

This rise has been fueled by high commodity prices, with copper riding to the year’s high as of February 24, 2021. A pound of copper futures traded at $4.23, translating at $9,306 a ton. As of January 18, 2021, iron ore prices in Australia reached $172.6 per tonne. The 62% iron ore cost $169.97 per ton, while the iron ore itself went for $171 by mid-January 2021. China is expected to purchase more iron ore from Australia in 2021.

Technical analysis

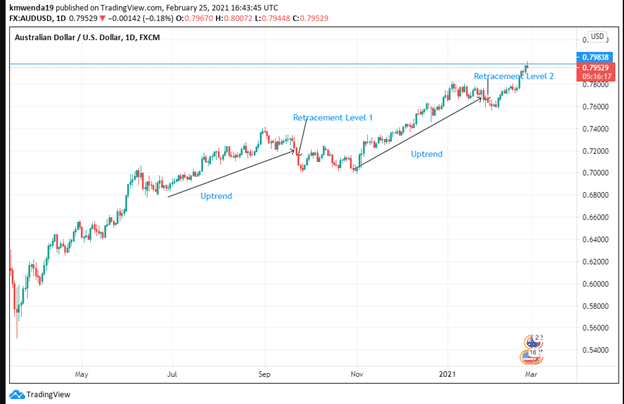

Two retracement levels have been spotted between July-October 2020 and November 2020/ February 2021. The uptrend in these two levels has not led to a reversal in the trading price. The bullish continuation is seen to reach 0.79838 as the new support level. The 50-day SMA is at 0.7942, while the EMA is at 0.7948.

Leave a Reply