- USD Dollar steadies near 16-month highs

- AUDUSD bounce back stalls amid easing risk appetite

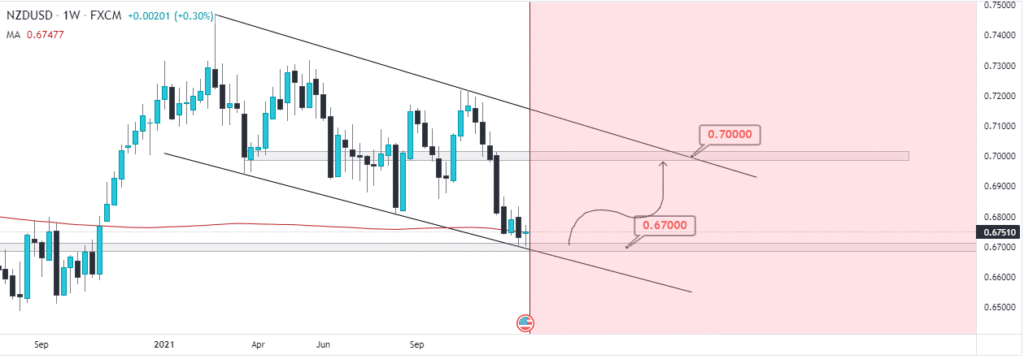

- NZDUSD under pressure near one-year lows

The US dollar is holding steady near 16-month highs supported by rising treasury yields and uncertainty being fuelled by the spread of the Omicron COVID-19 variant. The dollar index, which measures greenback strength against the majors, has already firmed near the 96.50 level.

However, dollar moves to the upside have been limited this week due to other major currencies holding steady. The European central bank and Bank of England, turning hawkish in their recent policy decisions, have continued to curtail dollar strength after strong moves over the past few months. However, that cannot be said about riskier currencies such as the Australian and New Zealand dollars.

AUDUSD technical analysis

AUDUSD is one pair under immense pressure despite the dollar struggling to register strong moves. The pair has struggled to power through the 0.7175 level, which has emerged as a crucial resistance level. Additionally, 0.7092 has emerged as a critical support level.

Going by the bearish bias, a slide followed by a close below the 0.7092 level could leave AUDUSD susceptible to further losses to the 0.6990 level. Similarly, the pair needs to rise and find support above 0.7175 to avert the risk of further downside action.

AUDUSD fundamentals

A plethora of factors has hammered Australian dollar sentiments, key among them being the spread of the Omicron variant. The variant is already threatening to disrupt the country’s economic recovery from the delta variant.

A steady increase in Covid numbers amid a 90% vaccination rate has already triggered a reaction from policymakers. Most of the policymakers are pushing for mask mandates and a booster strategy. The country’s risk plunging into stringent restriction measures to avert further spread which could significantly affect economic growth, a development that continues to hurt AUD sentiments against the majors.

Additionally, the rise in the US treasury yields could put more pressure on the AUDUSD. Rising yields often fuel dollar strength, likely to fuel further sell-off on the pair. Additionally, growing concerns about China’s economy, which is Australia’s largest trading partner, could weigh heavily on AUD sentiments in the market.

NZDUSD struggling for direction

Meanwhile, the New Zealand dollar is another major under pressure despite the dollar softness across the board. The NZDUSD is struggling for direction after a recent slide to one-year lows. A slide below the 0.6800 has left the pair susceptible to further losses as the dollar continues to hold firm near 16-month highs.

In the short term, NZDUSD bulls will have to steer a rally above the 0.6770 level to avert further downside action. The 0.6770 has emerged as a short-term resistance level. Meanwhile, 0.6705 is a critical support level, a breach of which could trigger a sell-off to multi-year lows.

Just like the AUD, the kiwi pair has been hit hard by the growing concerns of the Omicron variant triggering a new wave of restriction measures. While the fears have been subsidized recently, the pair has struggled to edge higher as the dollar remains well supported by rising treasury yields.

NZDUSD outlook

Similarly, solid economic data from New Zealand has limited the downside action. The country’s Credit Card spending improved in November to -0.1% versus -2.1% expected. Roy Morgan Consumer Confidence also improved to 97 from 98.

Looking forward, Omicron infection data will be crucial in swaying market participants on the pair. Additionally, it will be on the US Q3 data and Core Personal Consumption Expenditures likely to sway trader’s sentiments on the dollar consequently affect NZDUSD price action.

Leave a Reply