- CPI release fails to lift bearish sentiment around the US dollar.

- Rising commodity prices propel the Australian dollar.

- Investors keep their eyes on rising Covid-19 infections, US jobless claims, and PPI data.

The AUDUSD pair was marginally high on Thursday, as the US dollar struggled to find its footing after two days of losses. At the time of writing, AUDUSD was going for 0.7286 after gaining 0.04%. The US dollar’s struggle against the Australian dollar was mostly attributable to the underwhelming CPI data released on Wednesday.

US inflation data underlines bearish sentiment

According to the Labor Department, the consumer price index (CPI) gained 0.5% last month after gaining 0.8% in November. Meanwhile, the CPI increased by 7.0% in the 12 months leading up to December, marking the largest year-on-year increase since 1982.

The inflation data was largely in line with consensus estimates of a CPI gain of 0.4% for December and 7.0% on a year-on-year basis. Nonetheless, it was a disappointment for US dollar bulls, considering the downward pressure caused by Fed Chairman Jerome Powell’s statement on Monday.

Markets largely interpreted Powell’s statement as “less hawkish” as he hinted at possible delays in interest rate hikes. Nonetheless, the strong CPI inflation makes a strong case for the commencement of interest-rate hikes as soon as March.

Rising commodity prices stir up the Australian dollar

For the Australian dollar, surging commodity prices in the global market are welcome news. Prices of benchmark 62% Fe fines Iron ore futures inched up 1.62% on Wednesday, following a rise of 2.06% the day before. At the same time, strong demand for natural gas in China has also helped boost the aussie. The ban on coal export by Indonesia has also helped prop up coal prices over the past week.

It is worth noting that the Australian dollar has shaken off fears of rising Covid-19 infections in China, its largest export market. In addition, Australia’s domestic handling of the pandemic isn’t as restrictive as last year. However, travel restrictions remain in place, with Western Australia locking out travel into the state starting Thursday.

Potential disruptors to AUDUSD trajectory

Markets seem optimistic that the Omicron surge is unlikely to adversely affect economic recovery. Nonetheless, widespread travel restrictions and lockdowns in China and Australia could disrupt AUD’s renewed vigor against the US dollar.

In the absence of a major event in the economic calendar on Thursday, investors will turn their focus on the US Senate hearing for Fed vice-chair nominee Lael Brainard. The market will also be keen on US initial jobless claims and US Producer Price Index (PPI) data for December.

A rise in the PPI above the projected 0.4% and a rise in jobless claims will increase the pressure to raise interest rates. Even though the Fed is already hawkish, such a scenario could provide tailwinds for the US dollar.

Technical analysis

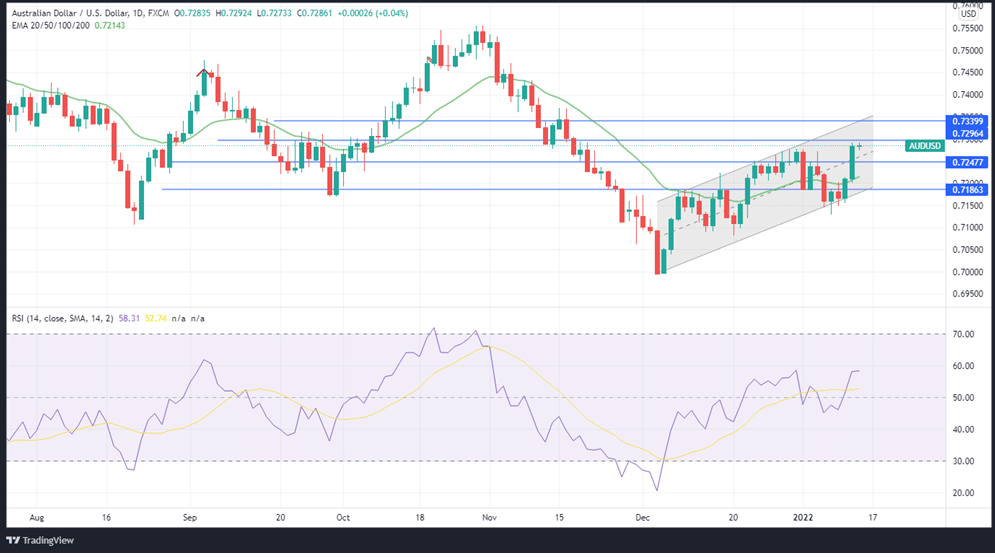

AUDUSD is in a general uptrend, as seen on the ascending channel. The market momentum is still strong, with the RSI at 57 signaling the possibility of further gains. In addition, the RSI is above the 14-day SMA and the price is above the 20-EMA, which supports the bullish assertion.

If the bulls sustain their momentum, they are likely to encounter the first resistance at 0.7296. Beyond that point, the next resistance is likely to come at 0.7339. If the pair breaches that level, the price could hit 0.7400.

On the lower end, the price action is likely to find support at 0.7247. A breach of this level will negate the bullish assertions. In that case, the next support is likely to come at 0.7186.

Leave a Reply