The AUDUSD price was under pressure on Monday morning as investors refocused on the upcoming interest rate decisions by the Reserve Bank of Australia (RBA) and the Federal Reserve. The pair declined to 0.7500, which was slightly below last week’s high of 0.7550.

RBA decision

The RBA started its two-day monetary policy meeting on Monday morning and is scheduled to publish its decision on Tuesday. Like most developed country central banks, economists expect that the bank will leave its interest rate unchanged at 0.10%, where it has been since November last year.

Nonetheless, the bank is expected to sound relatively more hawkish than it did in the last meeting. For one, the bank will likely tweak its outlook for when it will hike interest rates. In the last meeting, it signaled that the first-rate hike will come in 2024.

The market did not believe that as was evidenced by the performance of the bond market. Australian bond yields rose, which was a sign that the market expected a rate hike to come out sooner.

The RBA is also expected to hint that it will start to unwind its quantitative easing (QE) and yield curve control program.

The hawkish statement will be because the Australian economy has rebounded in the past few weeks. For example, the labor market has tightened and inflation has jumped to 2.1%. The inflation jump was higher than the RBA’s estimate of 1.75%. And there is a likelihood that consumer prices will keep rising since energy prices have skyrocketed.

At the same time, the RBA will need to sound hawkish as it confronts the rising housing prices. Recent data showed that the country’s home prices have jumped, with Sydney prices up by 25% year-to-date. Prices in other cities have also remained vibrant.

Rising home prices are a sign that the economy is doing well. However, the biggest challenge is that a sharp increase can lead to a market bubble, which could then put the economy at risk.

Fed decision in focus

The RBA will not be the only game in town this week. The AUDUSD will react to the latest interest rate decision by the Federal Reserve scheduled on Wednesday. Economists expect that the Federal Reserve will turn a bit hawkish during this meeting.

In a recent article, Wall Street Journal wrote that Jerome Powell, the Fed Chair, had secured a consensus among policymakers about tapering. The paper wrote that this tapering will likely see the bank slash its asset purchases by about $15 billion per month until June next year.

In addition to tapering, the Fed will likely provide more hints about interest rate hikes. In the past meeting, the bank hinted that it will start hiking rates in 2023 and implement about 7 hikes by Q4 of 2024. However, like the RBA, analysts are convinced that the bank will hike interest rates sooner than expected.

Besides, recent data showed that headline inflation has risen to the highest level in 31 years while the unemployment rate is falling.

AUDUSD forecast

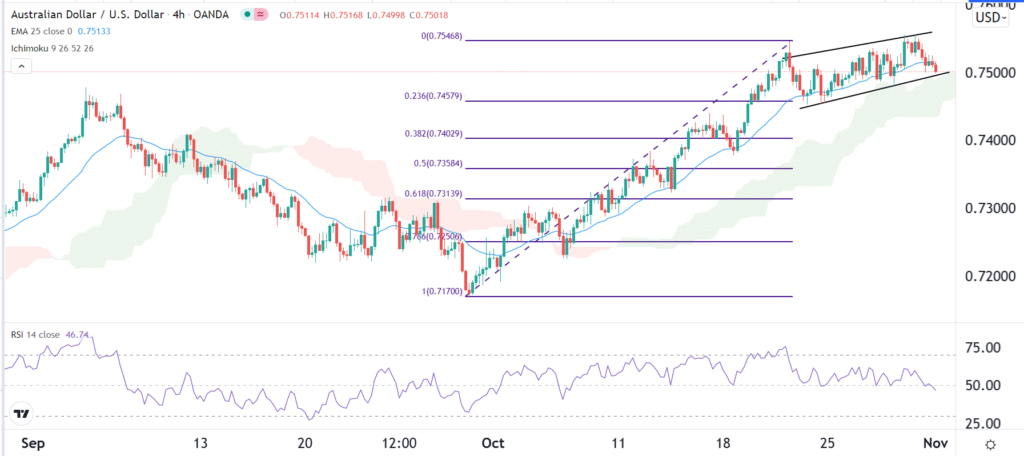

The four-hour chart shows that the AUDUSD pair has formed an ascending channel shown in black. The price is slightly above the lower side of this channel. It has also moved slightly below the 25-period moving average.

It is also above the Ichimoku cloud while the Relative Strength Index (RSI) has formed a bearish divergence pattern. Therefore, the pair is at a major risk of seeing a bigger bearish breakdown that could see it test the 38.2% Fibonacci Retracement level at 0.7400.

Leave a Reply