- US dollar strengthens amid interest rate hike bets

- AUDUSD drops below 0.7400 amid dollar strength

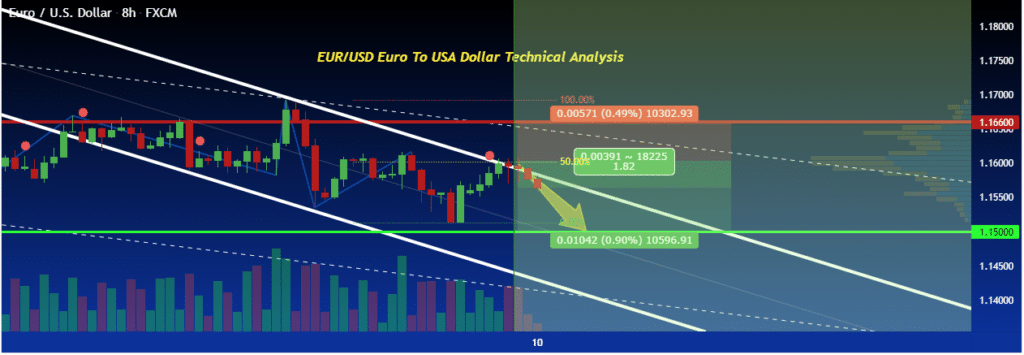

- EURUSD struggling for a direction below 1.1600

The US dollar was on the front foot on Wednesday morning after a three-day losing streak triggered by a slide in Treasury yields. The dollar index, which measures the greenback strength against the majors, powered through the 94.00 handle, affirming the upward momentum.

The bounce back in the greenback comes ahead of the release of crucial inflation data later in the day. A better than expected print is likely to trigger the charter of the Federal Reserve moving to hike interest rates much earlier. The market is already pricing in two interest rate hikes next year as one of the measures to counter the runaway inflation.

AUDUSD technical analysis

The Australian dollar is the biggest casualty amid renewed dollar strength. The AUDUSD has since plunged below the 0.7400 level as the bears continue to pile pressure. The pair remained on the back foot for the second day running on the heels of growing concerns about China’s economy.

AUDUSD has extended its downbeat performance with bears likely to fuel a sell-off back to the 0.7320 mark, the next substantial support level. A downside break of the support level would leave the pair susceptible to plunging below the 0.7300 handle.

On the flip side, a bounce-back above the 0.7385 level could pave the door for the pair to make a run for the 0.7400 psychological levels. The Australian dollar remains under pressure against the dollar, all but fuelling prospects of the pair edging lower.

AUDUSD fundamental analysis

The market has already shrugged off China CPI and PPI data. The headline Consumer Price Index rose 1.4% against 0.7% expected. The Producer Price Index, on the other hand, rose 13.5% compared to 12.4% expected and 10.7% prior.

The Australian dollar is always susceptible to concerns about the Chinese economy in part because it is its biggest trading partner. The Australian dollar sentiments have taken a significant hit in the aftermath of a 50% slump in shares of China real estate player Fantasia Group. The slump has once again triggered concerns that the Chinese real estate sector could trigger a financial crisis whose effects could be felt in Australia.

In addition, AUDUSD has turned bearish in recent days amid growing concerns that runaway inflation in the US could force the FED’s hands into hiking interest rates. Compounded by a rise in US treasury yields, the greenback has strengthened all but sending the AUDUSD pair lower.

Looking forward, the focus is on the release of the US CPI and PPI data which could paint an accurate picture of inflation levels. Additionally, the focus is on US stimulus and China real estate developments likely to influence AUD sentiments in the market.

EURUSD under pressure

Meanwhile, the EURUSD is struggling for a direction below the 1.1600 level. While the pair has been on a three-day winning streak, it has struggled to power and find support above the critical psychological level.

Renewed dollar strength is the latest headwind that increases the prospects of the pair edging lower on a close below the 1.1570 level. The pair faces strong support near the 1.1523 level below which the sell-off could accelerate.

The euro sentiments have taken a hit in the aftermath of the European Central Bank turning dovish and failing to provide a clear path to rate hikes. Additionally, fears about the Chinese real estate sector continue to fuel concerns in the market, triggering a rush to safe havens such as the dollar at the expense of riskier bets such as the euro.

Leave a Reply