- In the week ending July 10, 2021, the initial US unemployment claims fell 6.74%, from 386,000 to 360,000.

- The pandemic has increased productivity from 1.4% in 2020 to 3.1% in 2021.

- Australia’s economic growth projection may fall from the 2.6% anticipated by the RBA by the first half of 2021.

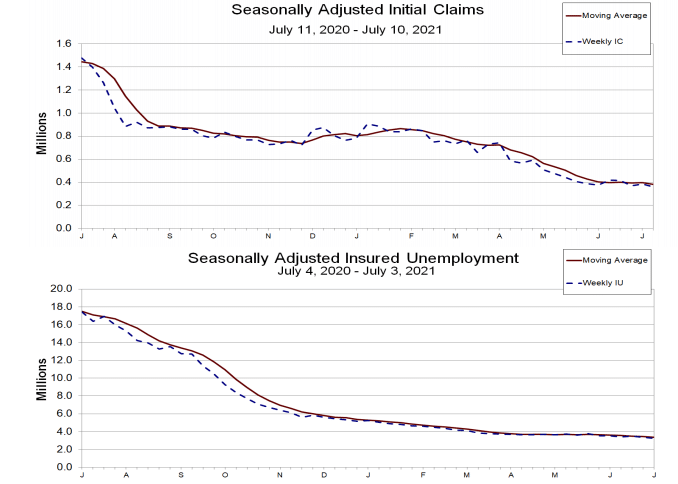

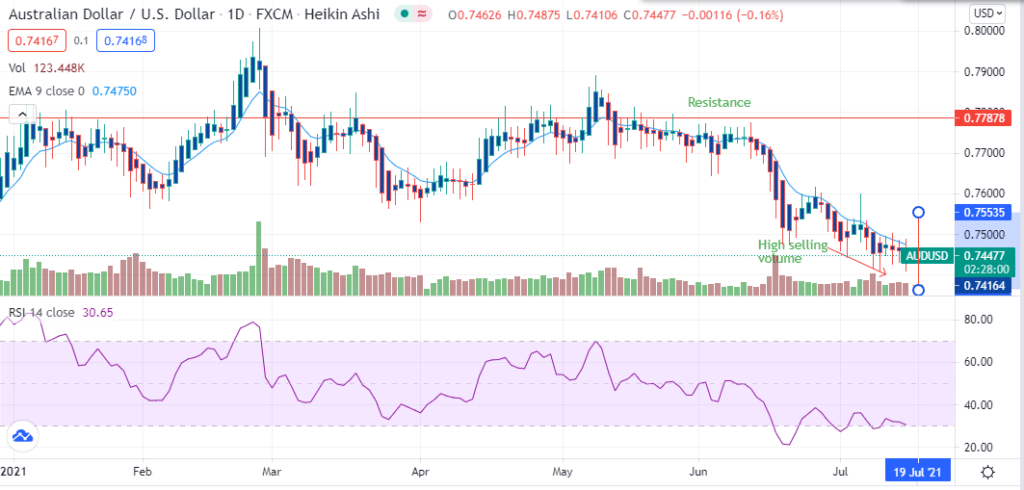

The AUDUSD pair lost 0.84% as of 01:39 pm GMT on July 15, 2021, from the previous day’s close. It opened trading at 0.7478 before hitting a low of 0.7434. As of this writing, it was trading at 0.7442, having lost 0.0038 points. The US dollar was boosted by the continuing jobless claims data (Seasonally adjusted) for the week ending on July 3, 2021. The number of uninsured unemployed population fell 3.74% to 3,241,000 (-126,000).

Initial and Continuing unemployment weekly claims

In the week ending July 10, 2021, the initial unemployment claims fell 6.74% from 386,000 to 360,000 (a decline of 26,000). It registered a low 4-week Moving Average of 382,500 (the lowest since March 14, 2020, when it stood at 225,500).

Workplace productivity

Covid-19 pandemic has fueled annualized growth in workplace productivity, with the hourly output rising 3.1% as of July 2021. According to Goldman Sachs, the pandemic has increased productivity from 1.4% (realized in the pre-pandemic times) to 3.1% in 2021. Working-from-home has reduced commuting time and lifted productivity by 5% into Q2 2021.

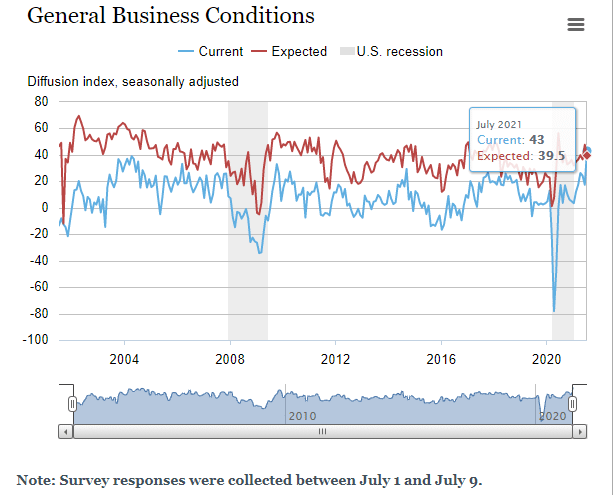

The manufacturing survey conducted by the New York Federal Reserve Bank indicated that the business activity surged to 43.00 in July 2021 (MoM) from 17.40 in June 2021.

NY Manufacturing Survey

A sharp increase in new orders and manufactured shipments increased the business activity index by 26 points to 43.00. The index beat consensus estimates by more than 138% at 18.00 points.

Despite the increase in inflation, wages in America have continued to rise. Average earnings per hour recorded in June 2021 (YoY) rose 3.6%, with the hospitality sector surging 5.7%. CPI figures shot to a high of 5.4%, but the Fed maintained that the rate was still transitory.

Approximately 12.5 million people need to be incorporated into the US labor force for inflation to force an increase in interest rates. With the Fed expected to meet on July 28, 2021, interest rates will likely remain at 0.00-0.25% until FY 2022/23.

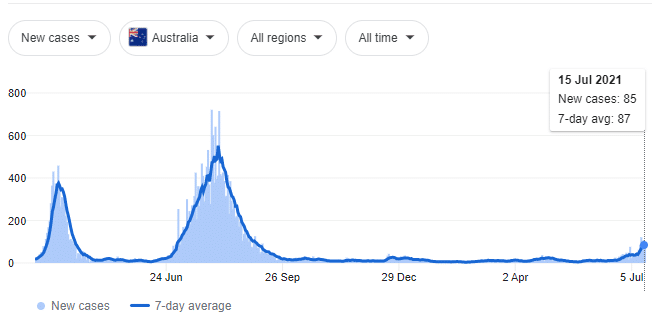

Sydney and Victoria lockdowns

The Australian state of Victoria announced a 5-day lockdown just days after Sydney proclaimed the same before mid-July 2021 over Covid-19. An excess of 6,500 Victoria citizens was in isolation, with up to 85 cases contracting the virus as of July 15, 2021.

Australia Covid19 cases

Before the new lockdowns, Australia’s GDP was sailing at A$2 trillion ($1.5 trillion). It was larger than the pre-pandemic highs lifted by high employment numbers, growing house prices, and solid consumer spending. The Reserve Bank of Australia had estimated that the country’s economy would grow at 2.6% in the first half of 2021.

However, it is expected that the lockdowns will cause contractions into 2022. Approximately A$1 billion per week is lost in Sydney alone as a result of the restrictions. Up to 5 million Australians live in Sydney and have been ordered to stay at home. Analysts estimate that the economy will have contracted 0.7% by September 2021 if the lockdowns persist due to the Delta variant.

Technical analysis

The AUDUSD pair hit resistance at 0.7788 and has been on a steady downtrend until it reached 0.7417. We expect a further decrease in prices towards 0.7361.

The pair is trading below the 9-day EMA at 0.7475. There is also a high selling volume with the 14-day RSI at the oversold region of 30.65. At the moment, the trading range is between 0.7416-0.7553.

Leave a Reply