- Iron ore prices have surged during the pandemic from $75 per ton at the beginning of 2020 to more than $200 per ton in 2021.

- China reduced its tax rebates for steel in April, forcing prices to rise by 13% in July 2021.

- The AUDTRY pair is trending in the overbought zone.

The AUDTRY added 1.33% as of 4:32 am GMT on August 17, 2021, from the previous day’s close. It traded from a high of 6.2118 to a low of 6.1346, representing a sharp decline of the Australian dollar. The AUD also lost 0.73% at the time against the Swiss franc, 0.32% against the British pound, and 0.26% against the Canadian dollar.

The Aussie has been on a losing streak, with the rising number of Covid-19 cases threatening a near-shutdown economy. Of importance is the effect on the export industry, especially minerals, that contribute highly to Australia’s GDP growth.

Commodities export and trade war

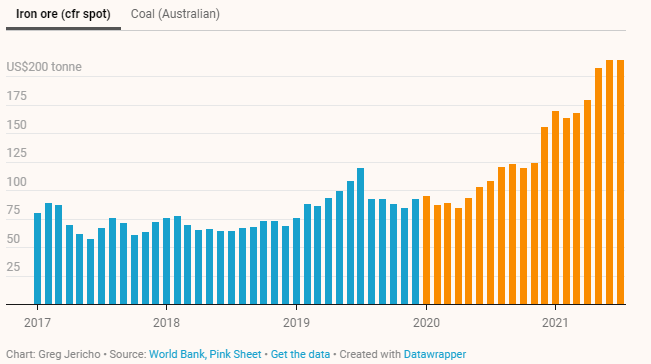

Prices of key commodities such as iron ore have surged exponentially during the pandemic, from $75 per ton at the beginning of 2020 to more than $200 per ton in 2021.

Iron ore soared to $214 (A$294) per ton due to increased industrial activity in China and Japan. Australia’s trade war with China has seen the price of the commodity plummet from highs of A$300 to A$228 in August 2021.

Analysts note that when the price of iron ore was $68 per ton, Australia’s exports to China soared. However, the increase in price coupled with China’s restrictions saw the latter lose up to $6.6 billion from June 2020 (Q2 2020)-February 2021 (Q1 2021).

On its part, coal has risen from $69.70 per ton in January 2020 to $152.00 per ton in 2021. However, restrictions in Australia are hindering movement with key states of Sydney, Melbourne, and New South Wales, among others, under lockdown.

China, which provides the third-largest source of steel to Australia, is also working on raising export taxes of the commodity. The increase in taxes will increase steel prices being imported by Australia.

China reduced its tax rebates for steel in April, forcing prices to rise by 13% in July 2021. Additionally, steel production is being lowered in the country as it is known to contribute up to 15% of total emissions of carbon. In the seven months to July 2021, steel exports have surged 31%.

Construction recovery

The recovery of the construction industry has also been hampered by the slow vaccination rate in Australia. As of August 17, 2021, the vaccination rate stood at 21.2%, with 5.37 million people fully vaccinated out of 15.3 million issued doses.

Construction costs have risen 4.5% in Perth and 4% in Sydney. Like Australia, New Zealand is also facing a relapse in its construction industry, with costs rising 4% in Auckland.

Australia is hoping to announce the wage price index for Q2 2021 (YoY) as well as the quarterly analysis on August 17, 2021.

Technical analysis

The AUDTRY pair formed a rounded top formation that began on March 19, 2021, to July 22, 2021. The pattern gave way for a short-term decline. The price may soon confirm the downward breakout at 6.1267.

A decline below this point can send the price towards 5.6780, 5.5791, and 5.2932.

There is a slight increase in volatility, as shown in the 14-day ATR at 0.0898 after August 13, 2021. Further, with the 14-day RSI now near the oversold zone at 30.11, we expect a rapid decline as selling pressure continues. On the other hand, reversal may push prices towards 6.4697.

Leave a Reply