- The Australian dollar is struggling to hold the lead against the kiwi.

- The high under-employment numbers in Australia are outshining the rising employment numbers indicating low domestic trade.

- New Zealand has capitalized on Australia’s spat with China by signing a free-trade agreement.

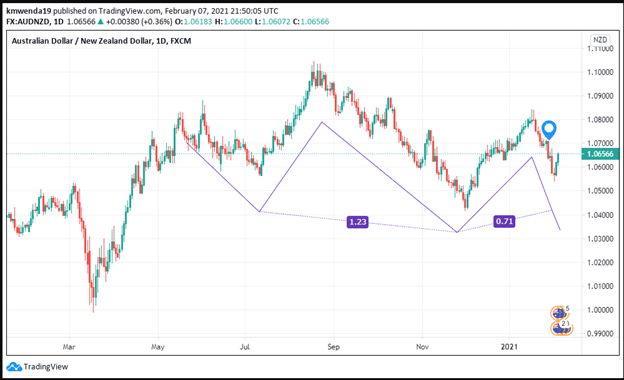

The AUD/NZD trading pair bounced off from the monthly lows of 1.0544 on February 3, 2021, to close the week at 1.0666 on February 5, 2021 (+1.16%). The Australian dollar experienced slight volatility after rising cases of unemployment hit the economy into 2021. Retail sales are yet to recover, with commodity prices expected to rise with global reflation.

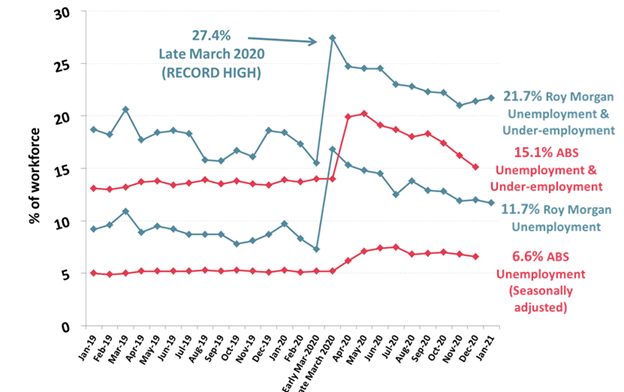

Change in employment

The month of January 2021 saw more than 12.6 million citizens in Australia gain employment, the highest since March 2021, up 0.21% since December 2020. This acceleration was due to the rise in full-time employment numbers. However, unemployment still fell to 11.7% into 2021 from a projection of 6.6%.

Approximately 10% of the workforce was under-employed with figures standing at 1.44 million. A total of 3.12 million Australians remained unemployed or underemployed, coinciding with 21.7% of the labor force.

High underemployment means that there is slowing domestic demand for goods within Australia. The slight gain of the Australian dollar against the New Zealand dollar (kiwi) may be outlived as we head into the second quarter of 2021.

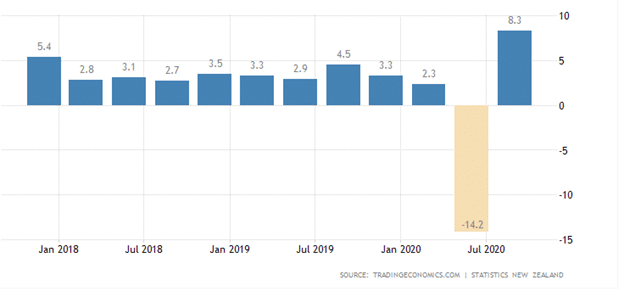

The unemployment rate in New Zealand (nationally) declined below 5% in December 2020 from 5.3% in September 2020. The unemployment rate was 4.9%, up from 4.1% (YoY). Indications show that this trend will strengthen into 2021 as the country supported local businesses through wage subsidies during the peak of the coronavirus pandemic.

The property market received a major boost in 2020 with low-interest rates that also translated to low mortgage rates. The Central Bank of New Zealand (RBNZ) removed the loan-to-value ratio (LVR) that will continue to spur housing demand into 2021. There may be no need for the Reserve Bank to cut rates from the 0.25% threshold.

The third quarter of 2020 also saw retail sales in New Zealand rise 8.3% YoY from -14.2% in the second quarter.

Australia is set to revamp its mining industry so as to increase employment levels and make up for the rising levels of underemployment. The country’s diplomatic spat with China did not decrease the export of iron ore that accelerated by 20% to record highs of $116 billion in 2020. However, since China is the main consumer of iron ore, increased tensions between the two countries are likely to lower export values from Australia.

On its part, New Zealand signed a free-trade agreement with China in February 2021. Up to 98% of tariffs will be brushed off with this deal that will make China New Zealand’s strongest trading partner. Products of wood and paper valuing at NZ$ 23 billion ($8.3 billion) will be exported into China devoid of tariffs.

The trade surplus between New Zealand and China stands at NZ$ 6.4 billion (exports at NZ$ 19.4 billion and imports at $NZ billion). The kiwi may take advantage of the declining relationship between Australia and China.

Technical analysis

The three-drives-pattern supports a short-term bullish position in favor of the AUD but a long-term bearish position of the AUD/NZD trading pair. The stochastic RSI is 26.890 showing increased selling activity among investors. The psychological support for the currency pair is 1.0516. It is possible that it will find resistance below this point.

Leave a Reply