- Australia’s CPI surged 0.8% in Q2 2021, while annual inflation into the quarter increased by 3.8% (YoY).

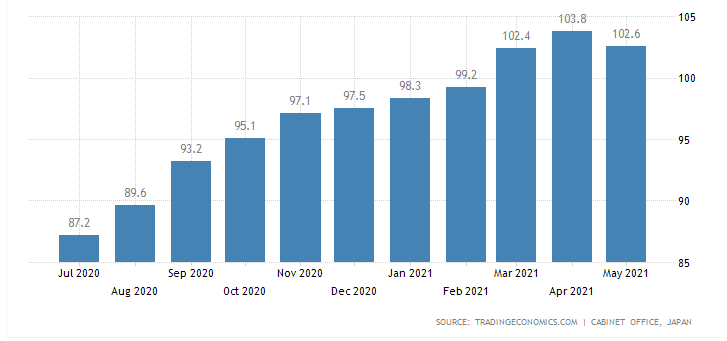

- Japan’s leading indicator index inched 1.16% down to 102.6 from an annual high of 103.8 attained in April 2021.

- Sydney has extended its lockdown by four weeks, further hurting the Australian dollar.

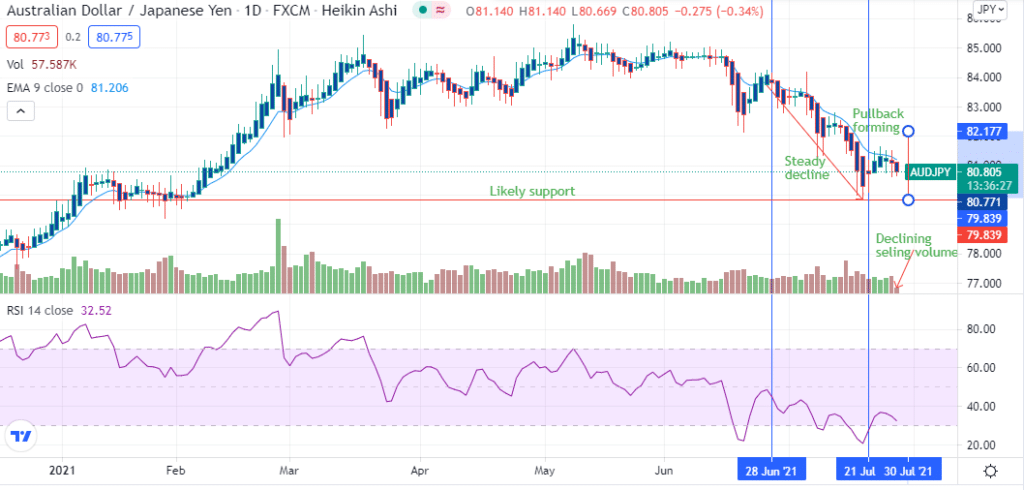

The AUDJPY pair lost 0.79% as of 3:33 pm GMT on July 27, 2021, from the previous day’s close. It traded at a high of 81.54 after opening at 80.77. Hours later, at 2:03 am GMT in the Tokyo (Asian) forex session, the pair had recouped some losses and added 0.04% to trade at 80.81.

The increase was attributed to a decline in Japan’s leading indicator index that tracks economic progress, released on July 28, 2021.

Figure 1: Leading Indicator Index for Japan

May 2021 saw the index inch 1.16% down to 102.6 from an annual high of 103.8 attained in April 2021. The decline was attributed to slow economic recovery progress efforts due to the coronavirus pandemic and the novel Delta variant infections around the country.

The International Monetary Fund (IMF) lowered its economic growth forecast for Japan to +2.8% (-0.5% points) for 2021 from the estimate it made in April 2021. Despite the ongoing Tokyo Olympics, the financial body downgraded Japan’s economic outlook owing to the slow Covid-19 vaccination exercise.

About 25.7% of the Japanese population has been fully vaccinated, representing 32.5 million people with up to 79.4 million doses administered.

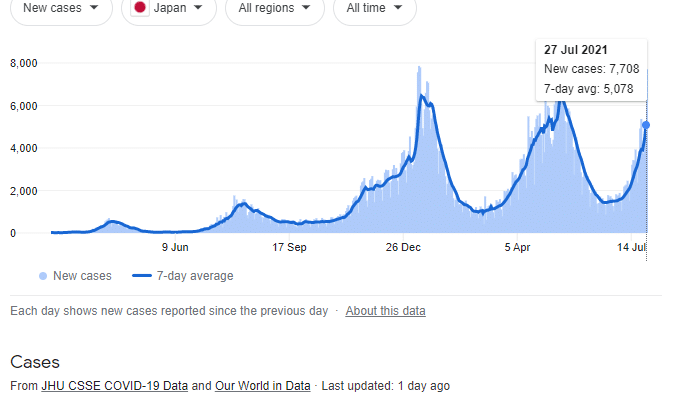

Figure 2: Daily Covid-19 infections in Japan

Since June 20, 2021, the rate of new infections has risen by more than 480%, with new infections rising to a high of 7,708 as of July 27, 2021.

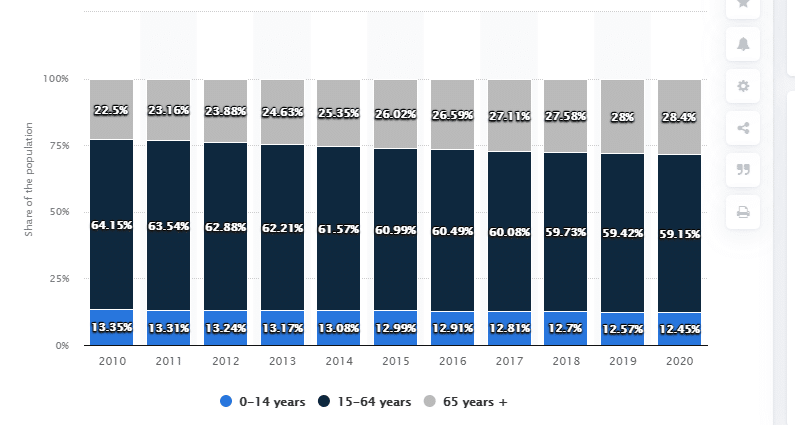

Demographic imbalance

Demographics have been cited as the leading cause of economic decline due to a high aging population that is susceptible to diseases, such as Covid-19. Demand has declined with a low population leading to deflation.

Figure 3: Population distribution in Japan

A 10-year analysis of Japan’s population distribution reveals that out of the three age groups (-14 years, 15-64 years, and +65 years), only the third group has been increasing over the years.

The population at 65 years and above began at 22.5% in 2010 before rising to 28.4% in 2020. Individuals between 15-64 years have declined from 64.14% in 2010 to 59.15%. With the aged population being the dominant now under threat of Covid-19, the Japanese economy stands to weaken.

Australia’s rising CPI

Recent data by the Australian Bureau of Statistics (ABS) shows that the CPI surged 0.8% in Q2 2021. Annual inflation into the quarter increased by 3.8% (YoY), driven by automotive fuel at +6.5%.

New Australian houses saw their prices decline 0.1% in June 2021. The government gave grants to construct houses (HomeBuilder grants) to Western Australia and Tasmania. This move helped to lower labor and material costs by 1.9%, driving demand in the sector.

State performance rankings

The State of Tasmania was ranked as the top-performing state in the Australian economy, with its dominance set to remain unchallenged for the next six months. It led to a relative population increase with its dwelling starting at a 27-year high. Queensland state that came in 7th had its jobless rate reach a 12-year low.

However, Sydney’s lockdown extension by four weeks has derailed the growth of the Aussie.

Technical analysis

The AUDJPY pair is heading to the 79.839 support. A stronger uptrend may see the pullback extend to 82.18.

There is also a decline in selling volume, with the 14-day RSI slightly above the oversold region at 32.52. However, the pair is still trading below the 9-day EMA at 81.21, indicating we could see further movement downward.

Leave a Reply