- Japan’s export increased in 2021 but not as high due to lower US exports.

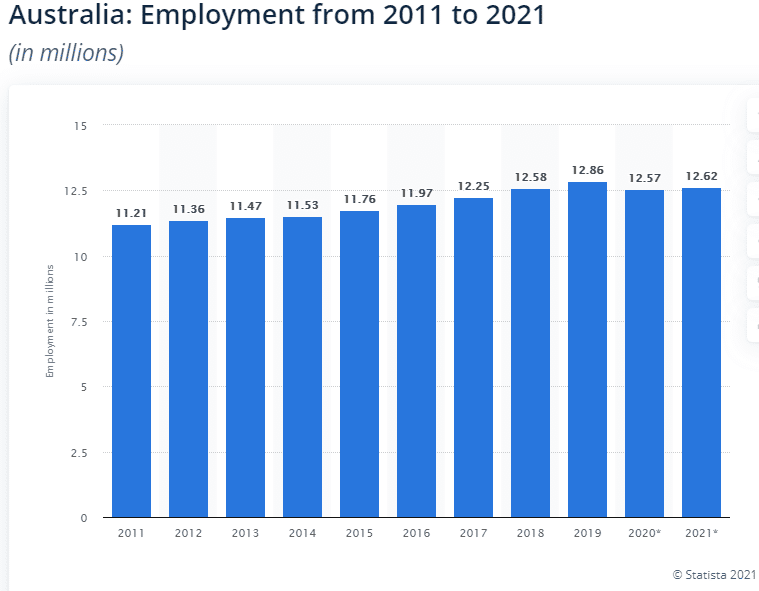

- Australia’s unemployment rate fell to 5.6% from 5.8%.

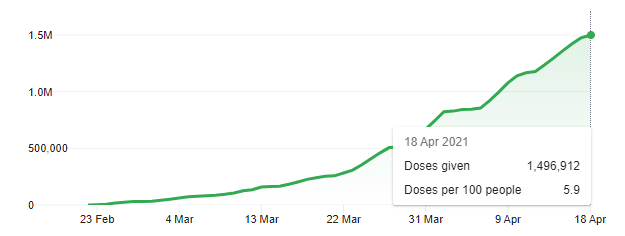

- Australia plans to increase Covid immunization as it spurs economic growth.

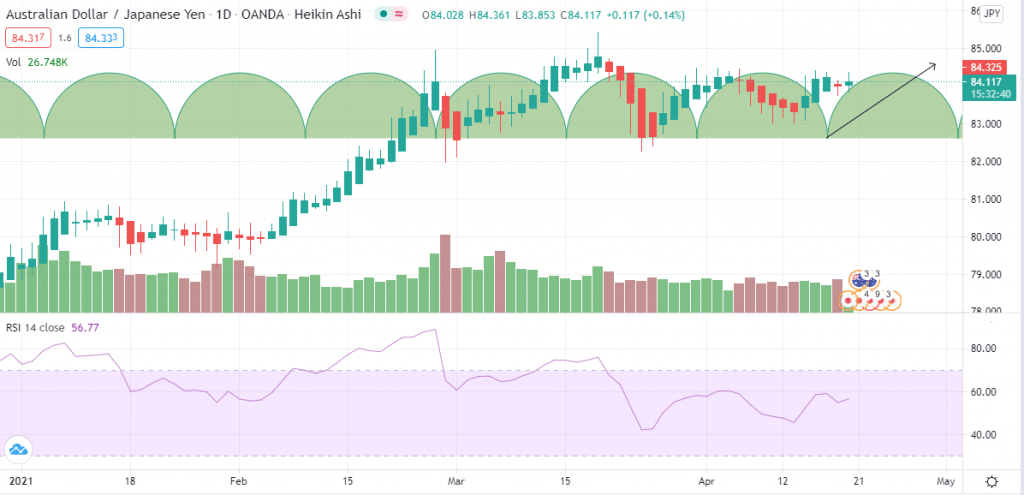

The AUD/JPY pair opened on a +0.49% price increase as of April 19, 2021, from the previous day trading. The currency was on a three-day bull run following a positive business outlook of the Australian economy by the Deloitte Access Economics group. The Deloitte report indicated that the year 2021 would see Australia post a quicker fall in unemployment levels. Commodity prices would also soar as well low-interest rates to boost the economy.

In this regard, the government was supposed to target an unemployment rate below 4.5% from the current 6%. A stronger Japanese yen pushed the Australian dollar lower as imports and exports hit remarkable levels into the new week.

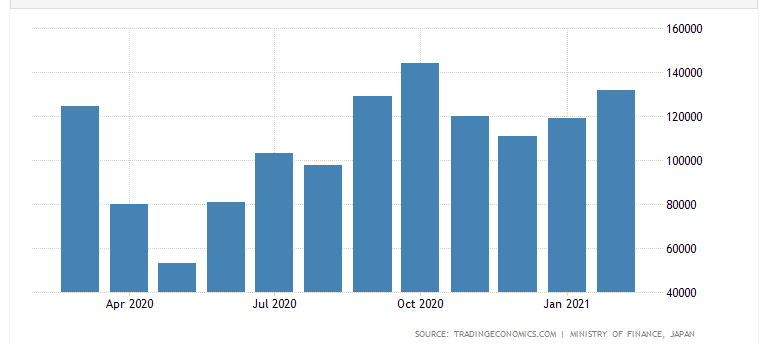

Trade balance

Japan posted a 16.1% increase in export in March 2021 compared to a -4.5% decline year-on-year. The high export figure was against a prediction of 11.6%. Imports were also reduced by a positive margin of 5.7% against a high of 11.8% YoY. The trade balance as of March 2021 had increased by 207.41% from 215 billion yen to 663.7 billion yen beating estimates by 35.45%. The AUD/JPY fell to -0.27 in the opening of April 19, 2021, citing a stronger yen against the Australian dollar.

Japan’s export to Australia from March 2020-April 2021

While Japan’s export to Australia increased into Q2 2021, Australia may likely decrease exports to Japan due to environmental concerns. Ahead of the meeting between US President Biden and Japan’s PM Yoshihide Suga, the two leaders are likely to consider decarbonization initiatives as the next trade frontiers.

Australia exports approximately $25 billion worth of thermal coal and LNG to Japan. The decarbonization program by the US may limit Japanese imports of coal and LNG from Australia. However, it may still bring into play the production of renewable energy such as offshore wind to help cover up the missing energy trade links.

There were increased Japanese exports to China into April 2021 by 16.1%, the highest rise in exports since November 2017. The data beat estimates at 11.6% after February 2021 saw exports contract 4.5%. A surge in nonferrous metals trade, as well as plastic materials in China, saw Japan’s trade increase 37.2% year on year.

There was a reduced shipment of Japanese aircraft into the US, despite robust demand for cars and construction equipment. However, the Bank of Japan (BOJ) is mulling over the downgrading of inflation figures by 0.2 percentage points (from 1.2% to 1.0%). Consumer prices are also likely to rise to 0.5% in Q2 2021.

February 2021 saw an increase in Japanese exports to Australia by 9.78%, from 119.079 billion yen to 131.981 billion yen. We may see improved relations between the US and Japan to counter the influence of China in Asia.

Employment

March 2021 saw Australia’s unemployment rate fall to 5.6% (dropping 0.2 percentage points). The increase means that up to 13.1 million Australians have joined employment in Q2 2021.

Australia’s rising covid vaccination

Australia is rushing to immunize its population close to 1.5 million doses administered.

Australia’s employment level

The number has increased by close to 0.05 million from 12.57 million in 2020 to 12.62 million in 2021. Since February 2021, more than 70,700 Australians have returned to employment as unemployment fell to 5.6%. JobKeeper payments have increased from A$1000 per week in January 2021 to A$1500 per fortnight (a rise of +50%).

Technical analysis

AUD/JPY trading chart

The AUD/JPY forex pair is trending on a positive time cycle, indicating it could find support at 84.5000. The 14-day relative strength index (RSI) was 56.77 showing increased buying activity among traders. Employment rates are pushing prices, creating impulsive movements as compared to corrective motions.

Leave a Reply