- Rising Covid-19 cases leading to new economic restrictions in Australia.

- Uncertainties in trade relations with China to influence AUD.

- The US economy plays a meaningful but slightly lesser role in influencing AUDUSD prices.

The Fed’s reluctance and good Australian inflation data combine to strengthen AUD

AUDUSD was trading at 0.74006 at 0937 GMT on Thursday, building from Wednesday’s gains to rise by 0.36%. The US Fed Chairman Jerome Powell’s announcement that the FOMC has once again decided to delay tapering sent the US dollar marginally down, as traders once again found themselves in the dark about the Fed’s likelihood to tackle rising inflation. The Fed’s latest announcement was nothing more than a reiteration that, in the Fed’s view, the current inflation is temporary.

AUD benefitted from largely encouraging inflation data from the Australian Bureau of Statistics, which showed that the nation’s second-quarter inflation met analysts’ projections. The country’s Consumer Price Index for Q2 rose by 0.8%, which was marginally above the 0.7% forecast.

At the same time, the Reserve Bank of Australia’s trimmed CPI was reported as 1.6%, which met market expectations. The inflation figures were the highest gain in 13 years and were largely driven by a rise in crude oil prices and increased government subsidies.

The next economic data out of Australia will be the Producer Price Index (PPI), to be released on Friday. However, this is unlikely to have a significant impact on AUD. Instead, the greatest concern for Australia is the spike in Covid-19 infections and the lockdowns that have followed.

New Covid-19 restrictions, trade with China and US GDP to determine AUD trajectory

In the latest development, Sydney has imposed an additional four weeks to the previous lockdown period. That means that Sydney, Australia’s most populous city, will only open on August 28th at the earliest. This comes in the wake of a new daily high in Covid-19 infections in the city, with the earlier stay-at-home order unable to control the surging numbers.

The imposition of a new lockdown in Sydney has effectively neutralized the reopening of Melbourne two days ago and will put a further strain on the Australian economy and AUD.

The other key mover for the AUDUSD pair is likely to be the release of the US Q2 GDP later in the day on Thursday. If the GDP growth matches or exceeds the 8.6% forecast, the greenback will get a fresh impetus to make further gains against major currencies after seeing its strength dissipate in recent days.

For the Australian dollar, a combined assault by a strong USD, China’s harsh new trading terms, and rising Covid-19 cases would be debilitating.

Australia’s inflation should be of concern for AUD under the current circumstances. The Reserve Bank of Australia has struggled to keep it within the 2%-3% range, and this may limit economic expansion in the medium term.

In the meantime, in my opinion, traders should focus more on the Sino-Australian trade relations and the Covid-19 cases and pay lesser attention to the US economy. Prolonged lockdowns may require new stimulus measures, which could devalue AUD. On the other hand, a prolonged showdown with China will reduce USD inflows in Australia’s economy.

Technical analysis

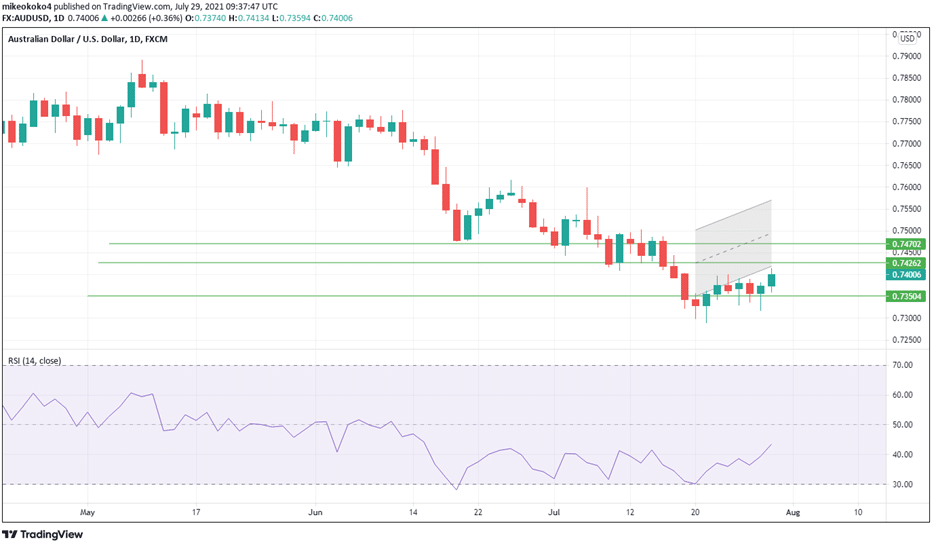

AUDUSD is currently at $0.74006. The pair’s Relative Strength Index (RSI) is on an ascending trajectory and has been steadily rising for the past two days to reach 42 at the time of writing.

If the bulls have their way, AUDUSD is likely to rise to the first resistance at $0.74262 and potentially to a second resistance level at $0.74702. A bearish market may potentially drive the price to $0.73502.

Leave a Reply