ATC Brokers has been operating in the international market since 2005. Registered fx broker in the United States of America. The site is made only in English, without any translation. Therefore, the company initially focuses only on the market of American, Canadian and partly European traders.

| Availability of a regulator | Yes, FCA UK, NFA, CFTC |

| Trading terminals | MT4, Trade Copier |

| Recommended deposit | from $2000 |

| Minimum order rate | 0.01 lot |

| Leverage | up to 1: 200 |

The company is focused not only on providing access to trading currency pairs and CFDs. Additionally, you can open PAMM accounts and transfer money to managers for trust management.

Account opening and login

As with all brokerage companies with US registration, opening an account requires filling out numerous questionnaires. Indicated in the questionnaire name, phone number, and e-mail, address. The person must be confirmed via the personal account by several means of verification (sending scan-copies of a passport or driver’s license). Immediately after the moderation account can be replenished. But note that the documents are submitted only in English or with an official translation (confirmed by a notary). This creates certain bureaucratic difficulties for clients from the CIS, Europe, and Asian countries.

To test the skills of customers open access to a free demo account. To open an account with a real deposit can be only one type – ECN. This means that transactions are displayed in the interbank market. Therefore, trading is independent, just like quotes. No broker influence. Its’ function is only to process the client’s deposit, to ensure the withdrawal and replenishment of the account.

The trading platform Features

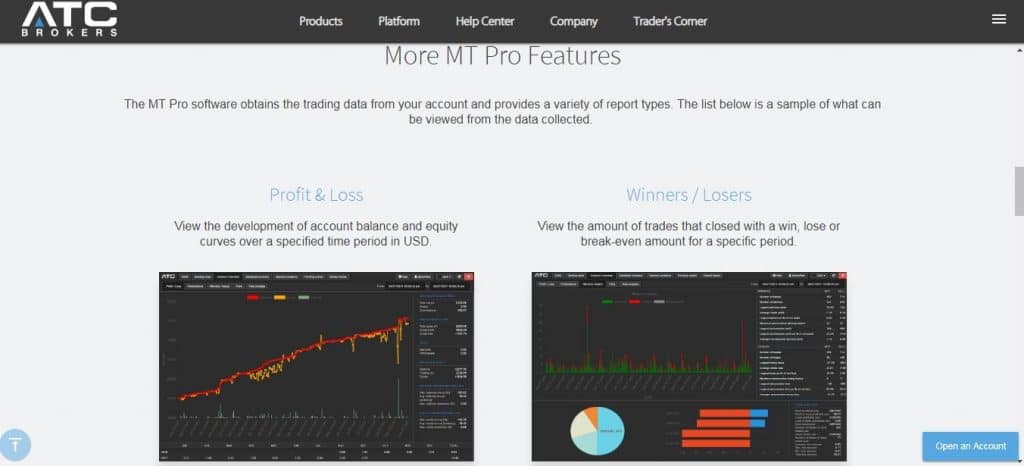

The company offers its customers an advanced MT Pro trading platform, which is available in a browser-based format. It is integrated into all services of the company. In particular, in the PAMM-investment program. Of course, automated advisors cannot be used. But here you can use paid trading signals and use any tools for forecasting without restrictions.

The platform opens freely on various devices, including different smartphones, tablets or laptops, computers. The execution of all transactions through the terminal is instant (up to 1 second).

List of financial instruments for trading and the size of the accrued commission

Categories of assets that can be traded through ATC Brokers:

- Currency pairs;

- CFD;

- Commodity assets and precious metals.

The list of tools is limited. Cryptocurrency for trading is not available.

A nice bonus will be a small spreads number for all groups of financial instruments. For example, for metals, the spread does not exceed 0.1 – 0.2 points. For currency pairs, the value is slightly higher – from 0.4 points.

ATC Brokers support service

Broker activity should be evaluated, in particular, by the quality of the support service. At ATC Brokers broker you can contact managers in the following ways:

- By contact phone number (+44 20 3318 1399);

- By email ([email protected]);

- Via online chat (the widget is located in the “header” of the official site).

The response rate of managers varies, depending on the chosen method. Managers speak only English, there is no integration into other European languages.

ATC Brokers Regulation

The American company ATC Brokers has an official regulator in the person of the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These are independent organizations that guarantee the availability of an insurance fund and the protection of the rights of investors/traders with accounts in the company. If necessary, you can issue a claim on the website of the regulator with the provision of evidence. This will entail the responsibility of the forex broker.

Analytics and training

ATC Brokers does not spend significant efforts on providing analytical and training materials for its customers. The site contains only a small section “Learn” with terminology. There is information about what trading is, what financial instruments are, how to open an account and trade through a trading platform.

There is no economic calendar, technical analysis, forecasts, webinars/seminars on the site.

The company differs from its competitors only in that it provides free access to the interbank market without significant bureaucratic obstacles. But the company is relevant only to those who are fluent in English, and his/her personal documents are also drawn up in English.

A limited list of financial instruments and a large initial deposit of $ 2000 reduce the interest of traders from the CIS, Europe, and Asia to this broker.

Leave a Reply