Overview

We live in a world of opposites: big and small, long and short, thin and thick, major and minor. The latter relationship applies pertinently to trading currencies. Because of the sheer size of this market, it makes sense to break things down into categories.

After major pairs, the minor or cross pairs are the second-most traded bunch of forex instruments. The average trader follows about 29 forex markets, the bulk of which consists of non-USD securities.

Yet, don’t let the wording fool you: such markets are anything but ‘minor.’ These are some of the most volatile forex instruments and provide speculators with a regular supply of unique profiting opportunities away from the major pairs.

What is a minor forex pair?

A minor or cross forex pair is any market that’s a combination of the major currencies (AUD, CAD, CHF, EUR, GBP, JPY, NZD), excluding the US dollar. Because of their disassociation away from the greenback, they can produce unique movements not typically found with major pairs.

It’s worth distinguishing that some literature suggests a minor currency as one from a so-called emerging economy. However, most analysts class those as exotic pairs instead.

Minor currency combinations are characterized by slightly wider spreads and higher volatility than their major counterparts. While their trading volume is not as high, it is still quite substantial nonetheless.

Although the US dollar mirrors the most prominent world economy, the respective countries or regions represented (e.g., the European Union, United Kingdom, and Switzerland) in the minor pairs are also quite influential in their own right.

Ultimately, despite some downsides to cross currency trading, the pros of these markets undoubtedly outweigh the cons. Therefore, regardless of your trading experience, including most or all of these pairs in your watchlist is wise.

Below is a list of the 21 minor forex pairs (in alphabetical order):

- AUDCAD

- AUDCAD

- AUDCHF

- AUDJPY

- AUDNZD

- CADCHF

- CADJPY

- CHFJPY

- EURAUD

- EURCAD

- EURCHF

- EURGBP

- EURJPY

- EURNZD

- GBPAUD

- GBPCAD

- GBPCHF

- GBPJPY

- GBPNZD

- NZDCAD

- NZDCHF

- NZDJPY

Why trade minor forex pairs at all?

Now comes the interesting part; what makes these markets different from their major opposites?

Higher volatility

This is arguably the most attractive element of crosses. Any trader will tell you that the more pips you can net in the shortest period possible, the better. Higher volatility is the key to far-reaching price movements, which tends to be the highest with GBP and JPY-based instruments particularly.

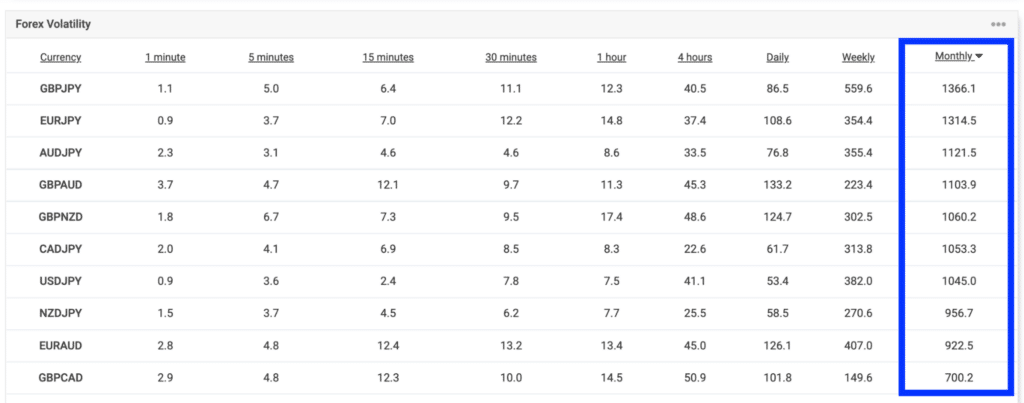

For more context, the table below shows the top 10 most volatile pairs (excluding exotic pairs). We have filtered only the monthly pips. Note that only one major (USDJPY) pair makes it to the list.

While some analysts frown upon above-average volatility, it can be your friend under the right circumstances. It’s not uncommon to see a minor pair like CHFJPY or EURAUD move in a sustained trend for several weeks or months.

Diversification

These markets offer diversified exposure away from the major pairs, which are typically driven by what’s happening in the US economy. Without cross pairs, we would only have seven pairs to trade.

However, the inclusion of all or most minors understandably increases the number of potential opportunities. So, by following an alternative market, you can shield yourself from any unwanted fundamental or economic scenario that may be present with any of the US pairs.

Pair trading

This point relates to studying correlations between major and minor pairs, which you can exploit to anticipate price movements. For instance, depending on economic traits, observing AUDJPY could provide a clue about the direction of AUDUSD.

Another example of pair trading relates to hedging, the practice of opening two opposite positions on two different markets to mitigate risk. For example, let’s assume you executed a buy order on USDCAD.

This would suggest a weakening Canadian dollar. USDCAD is sometimes considered a commodity pair because of Canada’s massive oil exports. Let’s also assume you believe the Japanese market was much weaker than Canada’s.

Therefore, a trader might take a buy position on both USDCAD and CADJPY as they would attempt to take advantage of CAD weakness and strength simultaneously.

Some downsides of trading minor forex pairs

Aside from the higher volatility, which could be off-putting for conservative or newer traders, the main downside of minors is the slightly larger spreads. With the major pairs, you shouldn’t pay above a 2-pip spread for most of the trading day with your average forex broker.

However, this can be at least five pips with most, and sometimes a lot higher with cross markets. One solution here is shopping around for brokerages providing the lowest spreads generally.

The other option is opting for a zero spread account where the spreads are lower but with the levying of a fixed commission. Scalpers, who thrive on having the thinnest spread possible, generally stay away from minor pairs.

However, trading these securities offers far more advantages than disadvantages for other traders. Some analysts also argue that following too many markets may be time-consuming or even lead to analysis paralysis.

Additionally, most forex pairs are heavily correlated and follow more or less the same direction. For instance, because of USD dominance, taking a position on any AUD minor pair often yields the same result as buying or selling AUDUSD.

So, we may view the argument of observing too many securities as another downside. Yet, there are some negatives to watching a minimal number of pairs, even if this strategy could work for others. Ultimately, it depends on a trader’s preferences, skills, and experience.

Fortunately, you don’t need to keep an eye on all 22 minor pairs. A trader may decide to stick to the GBP and JPY-based markets as these are, like we said, some of the ‘biggest movers’ in forex.

Curtain thoughts

They say that variety is the spice of life, and in forex, minor pairs offer traders precisely that: variety. If we only followed a few markets, trading would become pretty monotonous, and we wouldn’t be able to find enough opportunities for potential profit.

Thus, the inclusion of cross pairs is highly advantageous for diversification, abundance, and greater volatility.

Leave a Reply