Central banks are government agencies that control money flow in the economy.

These agencies have various tools to deliver their mandate, including rate cuts/raises and Open Market Operations (OMOs).

The trick is to make speculative statements and leave the interpretation of the market to the audience. As more investors react to the announcement, their actions end up maintaining the right interest rate adjustment without the central bank moving a finger.

Defining open mouth operations

Open Mouth Operations refer to central bank officials’ speeches or opinion statements to shift market behavior towards a premeditated target. If central bankers were blacksmiths, interest rate adjustments would be hand hammers, and OMOs would be sledgehammers.

But blacksmiths have other tools such as chisels for refining their crafts. Open Mouth Operations are to economic spokespersons (central bankers etc.) what chisels are to blacksmiths.

Consider Jerome Powell, the current Chairman of the US Federal Reserve System (the Central bank). Assume that, together with his colleagues in the Federal Open Market Committee (FOMC), Powell intends to shift inflation levels in the US economy. Powell and his team can start the ball rolling even without touching any of their tools.

Open mouth operations as a stand-in for open market operations

So far, we have characterized open market operations as crude tools that central banks can use to instigate interest rate adjustments. But if open mouth operations can be viewed as a stand-in (or a softer tool for interest rate adjustment), we must understand the difference between the two operations.

We have already seen what open mouth operations are and how they help Centrals banks to accomplish their aims. Open Market Operations (OMOs) are a critical element of monetary policy. It is the second most potent tool in the hands of central banks to control the money supply and the exchange rate of the domestic currency.

You should know that all tools that central banks yield affect the money supply. For example, the US Fed could buy US Treasury bills, bonds, and notes to increase the money supply. A higher supply of money allows commercial banks to increase the amount of money they can lend to consumers. The resulting credit conditions are much better, and more consumers will have more disposable income.

Notice that the Fed acts by buying US Treasury from the market, and here is where this operation differs from Open Mouth Operation. Although the effect is the same, the Fed does not act directly on the market through Open Mouth Operation. Instead, Fed officials shift sentiment in the market, and investors do the rest.

Breaking down open mouth operations

So far, our definition of Open Mouth Operations is narrow. From a broad perspective, Open Mouth Operations is the case where the central bank uses its communication policy to manipulate the slope of the yield curve in the short-term. Usually, the central bank conducts this operation by making an announcement concerning a target rate change. Senior central bank officials may hint at the news, or an official spokesperson might give a detailed account of the announcement at a press conference.

We shall look at an example but not before we understand the relationship between yield curves of bonds and interest rates. This concept is critical if you are to understand how Open Mouth Operations work.

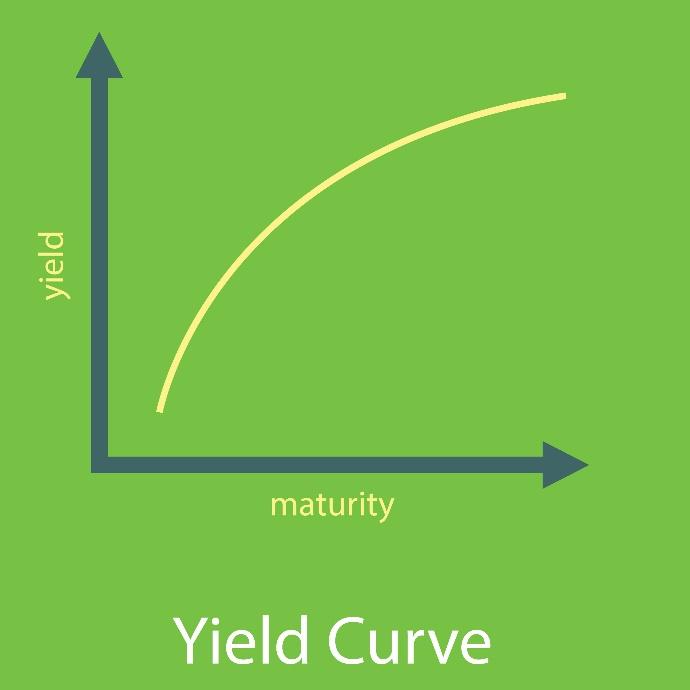

A yield curve joins the interest rates of bonds at different points in time. The bonds might have different maturity dates, but their credit quality is similar. A normal yield curve slopes upwards, meaning yield reduces as maturity draws closer.

What options does the central bank have if it desires to prevent the yield curve from flattening too soon as the bond reaches maturity? Here is where we shall see the example of Open Mouth Operations work.

In the yield curve image above, notice that yield reduces incrementally as the maturity draws closer. The central bank can delay this flattening by influencing market sentiment. How?

Let us take the US Fed and say that the FOMC would like to alter the three-month US Treasurys slope. Through an official spokesperson, the Fed might put out a statement that comments on the target rate. The communication might imply that the is eyeing a rate hike, which means future yields of bonds could be higher.

The market then responds by buying up more of the bond, resulting in increased demand. In the end, the bond’s yield curve will delay flattening, and it might remain high at the bond’s maturity date.

Central Banks Need A Clear Communication Policy

Having seen how central bank communication has far-reaching consequences, it is needless to say that the institutions need to have a clear and coordinated communication policy. This is why you do not see Fed officials taking interviews anyhow or making reckless comments at public forums.

Nonetheless, Open Mouth Operations are not effective on their own. Especially when communication from the central bank is not clear, the market might want some better guiding light, or less it descends into disarray. Largely, Open Mouth Operations shed light on possible central actions, which helps to shape market expectations.

The US Fed uses Open Mouth Operations by releasing FOMC minutes a while after the meeting ends. This expedited release of the minutes helps the Fed shape key narratives and get ahead of any misunderstanding that might develop in the market.

Conclusion

Central banks have a set of tools with which they implement the prevailing monetary policy. In some cases, the institution has to act directly, but tools such as Open Mouth Operations afford central banks an indirect influence on interest rates.

The idea is to shift market expectations about target rates. Central banks often leverage this tool when they need to alter a bond’s yield curve slope, though in the short-term. Open Mouth Operations cannot have long-term effects because market expectations easily. Usually, central banks deploy Open Mouth Operations when they want to test the waters.

Leave a Reply