The Oxford dictionary defines the term ‘exotic’ as (to paraphrase) something originating from a foreign country. Since we are dealing with foreign exchange, you may be wondering, aren’t all pairs exotic then?

Some currency markets are ‘closer to home’ since they consist of developed economies and are traded by a large segment of the global populace. Exotic pairs are indeed quite foreign from the major (all currencies paired with the US dollar) and minor pairs (the seven major currencies paired against each other).

Therefore, they are the third most traded currency markets, and for several reasons. This article will explore what exotic pairs are, plus their benefits and drawbacks.

What is an exotic pair?

An exotic pair in forex is a market consisting of a popularly traded currency (namely USD, EUR, GBP, CAD, JPY, AUD, or CHF) coupled with a thinly traded currency. The latter commonly include the South African rand (ZAR), Turkish lira (TRY), Chinese yuan (CNY), Singapore dollar (SGD), Mexican peso (MXN), and several others.

Therefore, examples of such pairs are USDZAR, EURMXN, GBPCNY, and many other interesting combinations. Such markets are distinct from your typical currencies. Exotic pairs are not broadly used in global financial transactions.

Hence, they trade at volumes and lack market depth, making them illiquid and far more volatile than their counterparts. Exotic pairs are also synonymous with emerging economies in forex.

In most cases, such currencies come from so-called developing regions with some mainstream appeal but not to the level of the likes of America, the United Kingdom, and the European Union.

Because we’re dealing with growing economies, exotic pairs can be distinctly sensitive to fundamental events that could make their currency depreciate or appreciate faster than their established counterparts.

Due to the lack of liquidity, trading exotic currencies is more expensive because of the higher spreads.

Why trade exotic pairs at all?

The consensus among many forex traders is to stay away from exotic pairs, and for good reasons. The high spreads alone are a ‘turn-off’ for most speculators, especially scalpers and day traders.

Therefore, analyzing such markets should be reserved for more seasoned or long-term chartists like swing and position traders who can easily cover the transaction costs with large profits.

However, a few exotic pairs like GBPSGD, EURSGD, and USDCNY have reasonably affordable spreads, which are only marginally higher than some minor pairs. Countries like China and Singapore aren’t necessarily developing countries, meaning their respective currencies should become cheaper to trade over time.

Alternatively, if you opt for a zero spread, you can certainly narrow the gap even further. Regardless, let’s explore the benefits of exotic pairs.

Higher volatility

We should preface by saying high volatility isn’t always a good thing. However, exotic pairs may be worth exploring if you love a challenge. Such markets are more volatile since they have lower trading volumes than other instruments.

It all boils down to the order book. With fewer orders than usual, a seemingly large position can drastically affect the pair’s price, which wouldn’t be the case with a more traded pair like EURUSD.

Additionally, most exotic currencies are fragile by nature due to their less prosperous economies; this is another factor contributing to the higher volatility. It also has to do with how exotic pairs are priced.

Usually, the price of a market like the euro will be closer to 1, while an exotic instrument can be worth 5, 10, or even more units (which reflects the weakness against the more valuable currencies).

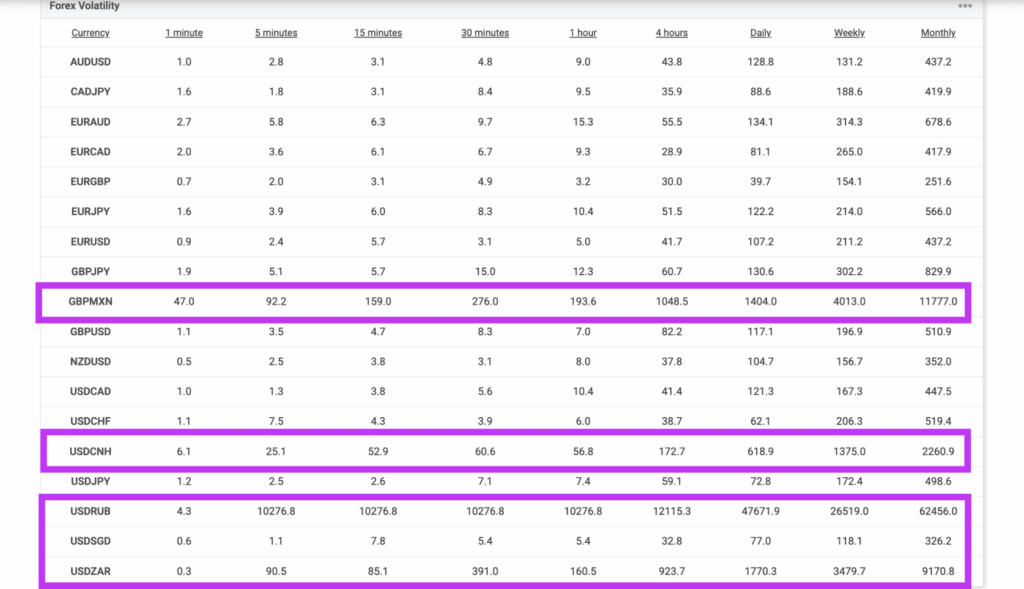

The table below is from Myfxbook, showing the pip range across multiple time frames between popular forex markets and exotic pairs like USDZAR, USDCNH, and USDSGD. Note the stark differences.

Diversification away from popular markets

If you only trade major or minor pairs, your position is still somewhat correlated to a few prominent economies, most notably the US dollar. However, many exotic pairs are less affected by developments in America and can move independently from the greenback (unless, of course, they are paired with USD).

Therefore, this offers traders some diversification and the ability to find unique opportunities should none be found on the popular options.

Potential to earn interest

Any supposed emergent nation will provide higher interest rates to attract foreign investors. The same concept applies to several exotic pairs through the carry trade strategy. Here, one sells a currency with a low-yielding interest rate for a currency with a high-yielding interest to profit from the differential.

This comes in the form of swaps that you’d earn for holding a position overnight. Historically, the so-called major countries have kept their rates pretty low, while other nations offer greater numbers.

Some downsides of trading exotic pairs

Unsurprisingly, trading exotics does come with notable drawbacks. Such pairs tend to be quite erratic or ‘choppy’ in their movements due to, again, the higher volatility. It’s not uncommon to see strange-looking candle formations in many of these markets, particularly on lower time frames.

Also, the higher spreads mean that, even if your entries are performed at the most favorable turning point, your positions will take a lengthy period to move away from a loss.

If you’re a short-term trader with smaller profit points, the price will take far longer to reach your targets. Something else worth mentioning is the instability of the countries represented in exotic pairs.

As we’ve seen with the Turkish lira, these currencies are more susceptible to rising inflation, debt crises, political pressures, and other devaluation risks (since they are less developed). Although such fundamental events provide you with unique opportunities, you should always be aware of them to limit your losses.

Curtain thoughts

Compared to other forex markets, exotic pairs are indeed a different beast altogether! As previously mentioned, such instruments could have their place on the watchlist of more experienced and skilled traders who are well-versed with the behavior and risks of these markets.

If you’re only concerned about short-term movements, you won’t miss much excluding exotics from your portfolio due to the higher spreads and volatility.

Leave a Reply