Are you confused about the best method for taking profits? This article will cover five of the most popular techniques in this regard.

So, you’ve done all the necessary homework, entered a position with a stop loss, and fortunately, it begins to show some promise towards your desired profit target; now what? Taking profits in forex is the ‘fun part’ in trading.

Despite seeming like the easiest decision, it’s surprising many traders struggle with this concept and fail to take logical action. Most tend to spend too much time on the entry process with little regard for trade management.

Understandably so, knowing when to exit with a profit of any magnitude is not so simple. For starters, no one knows precisely how far the market may go in their favor before the dreaded retracement, which is hard to predict its extent accurately.

Any profitable trader attempts to eliminate any guesswork by forming a set of logical rules when taking profits. It’s still important to appreciate the impossibility of taking profit at the exact top or bottom of a market.

There will be plenty of scenarios where a trader will exit too soon or too late. So, the plan of action one employs aims to eradicate these situations as much as possible to maximize their gains.

Hence, this article covers the five most popular technical methods of taking profits in forex, along with the pros and cons to note.

1. Fixed risk to reward

This technique is one of the simplest to implement and works with all trading styles. One employs a fixed risk-to-reward ratio by simply comparing the distance of their stop loss against the length of their take profit level.

Let’s consider the chart below.

The chart above shows an imaginary 1:3 sell trade, meaning the stop was 30 pips while the profit target was 90 pips. Despite seeming like the simplest technique, being fixed is also a disadvantage, especially when traders lack adaptability and cannot accurately discern volatility.

If we look at the chart again, we see the market fell close to 100 pips more. Thus, traders using this technique can often leave some money on the table. Traders also need to have some idea over the likelihood of a position moving towards their target and perhaps lock in profits at predetermined logical levels or use breakeven stops.

So, a fixed risk to reward shouldn’t be rigid, and traders need to adjust their expectations according to their trading plan based on what price is doing and how long they’ve been in the position.

2. Trailing stops

A trailing stop is a special form of stop placed before executing a position to protect its profits. The trader sets the trailing stop to ‘trail’ along with the price according to a specified number of pips.

For instance, if the price moved 50 pips in someone’s favor, one can decide to trail their take profit every 20 pips starting from their entry point. Essentially, it’s an autonomous way of locking in gains.

On most trading platforms, one should have the luxury of adjusting the extent to which the trailing stop moves. Some traders may consider trailing stops when the price is moving with high momentum.

Many investors commit the mistake of using such stops in all scenarios, meaning they tend to exit their positions far too early because of the fluctuations. As with any other method, it’s virtually impossible to catch the absolute top or bottom of the move, especially when the stop is trailed too close to the price.

Therefore, a trader would need to define the distance they feel is suitable for the stop. Alternatively, many will instead trail their stop manually, but even this technique is victim to similar challenges.

3. Support and resistance levels

Traders using this approach may have a fixed risk to reward in mind or target particular support and resistance. The chart below shows an example of how the average trade would plot out these zones:

This method provides the benefit of flexibility as traders can potentially make more than expected, especially in strong-trending markets.

The disadvantage is knowing which levels to target and how weak or strong they are. Short-term traders will typically eyeball zones in lower time-frames and generally don’t need to wait for long for the price to reach these.

Conversely, swing traders, for instance, would use higher time-frames and target the most obvious support and resistance areas there. The drawback is price will often take very long to reach such points.

Like with the previous method, it comes down to experience and following a trading plan that would advise where traders should lock in profits, perhaps scale out of a position, use trailing stops, and so on.

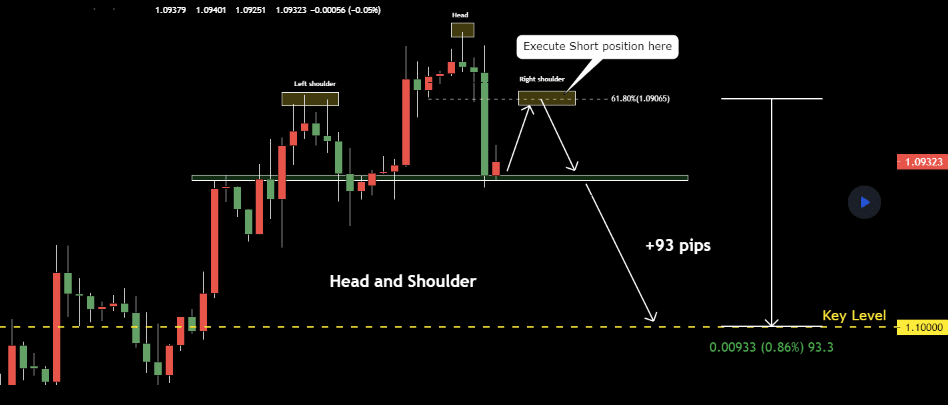

4. Pattern projection

This procedure applies exclusively to traders who trade patterns with defined profit targets that have been the standard over time. For instance, the classic rule for the head and shoulders is setting the profit level twice or three times the distance from the right or left ‘shoulder’ and the ‘neckline’ as in the chart below:

Harmonic patterns are also patterns with very specific profit points. The advantage of these tactics is providing set rules to know the most optimal places for traders to exit. On the downside, such a technique doesn’t provide much flexibility, and the profit potential may or may not be favorable to someone’s trading plan and risk-to-reward parameters.

5. Time-based approaches

A time-based approach is a discretionary way of taking profits in forex. Here, a trader will essentially decide a preferable time to exit a profitable position based on an estimated time.

For instance, a day trader might decide to close their trades before the next trading day, while a swing trader might exit before the close on a set Friday. While these ways are one the most flexible, traders need to have bulletproof rules in place and ensure not to leave too much money on the table.

Final word

Most things in currency trading are art rather than science. There is no one size fits all tactic as it will depend on a plethora of variables such as skill, experience, and trading style. Taking profits is more about individual trade management and can incorporate a mix of the techniques discussed here.

The common thread with all these approaches is the grey area of locking in profits, which is the hardest part to implement consistently.

This article only provides the framework. Traders will need to complete the puzzle to see what works best for them and formulate a set of rules on precisely what to do, why, and when after their trades go into profit with little room for subjectivity.

Leave a Reply